Table of Contents

Barclays and TSB have cut mortgage rates again as home loan prices continue to fall.

The two major banks made the announcements after yesterday’s Nationwide mortgage cuts, which saw the lowest five-year fixing agreement fall below 4 per cent for the first time since February.

Barclays, which already cut rates earlier this month, is reducing selected fixed offers by up to 0.36 percentage points, which will include some new best buys.

Meanwhile, the TSB, which also cut rates last week, is back in action with cuts of up to 0.2 percentage points.

The lower rates offered by both lenders appear to benefit homeowners, customers refinancing their mortgages and first-time buyers.

Rate cuts: Barclays and TSB are the latest in a long list of lenders to cut rates

Nicholas Mendes, mortgage technical manager at broker John Charcol, said: ‘The latest mortgage rate cuts from Barclays and TSB are great news for borrowers.

The cuts, which mostly range from 0.1 percent to 0.2 percent, reflect strong competition in the market as the planned reduction in the base interest rate approaches.

‘These reductions will provide significant savings for those looking to obtain a mortgage or refinance, making it an opportune time to consider locking in a fixed rate.’

Andrew Montlake, chief executive of mortgage brokerage Coreco, told Newspage: “The mortgage market is undergoing a thousand cuts. It’s rare that a day goes by without a number of lenders cutting their rates further.”

‘The fact that the rate fell below 4 percent nationwide this week was a symbolic moment and more lenders are likely to follow suit.

‘Lenders appear to be pricing in the fact that a cut in the base interest rate is coming very soon.’

Are there new best buy mortgage offers?

Starting tomorrow, Barclays will offer the lowest two-year fixed rate on the market.

Its 4.42 per cent deal comes with a £899 fee and is available to those buying a home with a 40 per cent deposit or equity.

It narrowly beats Halifax and Nationwide, which have two-year fixed rates as low as 4.46 per cent.

Someone taking out a £200,000 two-year mortgage with Barclays and paying it off over 25 years can expect to pay £1,103 a month.

Barclays will also be cutting mortgage refinancing rates, with the lowest five-year fixed rate going from 4.36 percent to 4.26 percent starting tomorrow. This will also be a new Best Buy.

It’s worth noting that this is also reserved for homeowners with the most equity in their home: those who require the mortgage to cover no more than 60 percent of the property’s value.

Those refinancing their mortgage to a two-year fixed term with large amounts of capital will also have access to a new best buy, with Barclays charging 4.6 per cent from tomorrow on a £999 fee.

What will happen to mortgage rates?

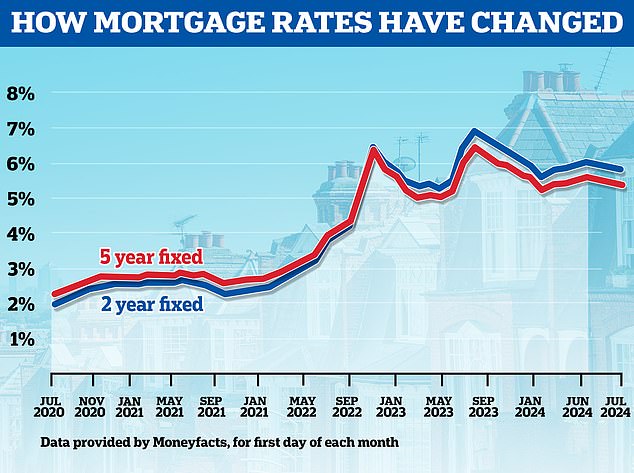

Mortgage rates have been falling in part due to competition among lenders.

But they have also been falling in recent weeks as a result of the money markets, government bond yields and expectations that the Bank of England will cut interest rates.

For almost two years, the Bank of England attempted to combat rising inflation by continually raising the base interest rate.

Since August last year, it has kept the base rate at 5.25 percent as inflation slowly returned to its 2 percent target.

The central bank is now keeping a close eye on disinflationary factors, such as any spike in unemployment and stagnant economic growth.

Markets are expecting a rate cut in late summer or early fall and then, potentially, another move lower this year.

Back down: In recent weeks, mortgage lenders have been cutting rates

In terms of what this means for mortgage rates, brokers are confident that deals will only improve in the short term.

Nicholas Mendes added: ‘While government bond yields and swap rates have fallen in recent weeks, the fall in fixed mortgage rates has been greater.

‘This is partly due to strong competition among lenders, but it also suggests that lenders expect government bond yields to continue to fall as we approach the first base rate cut of this cycle.

‘While we saw rates below 4 percent earlier this year, the situation now is very different from what it was six months ago.

‘The main difference is that inflation has now reached the Bank’s target level.

“I therefore expect the downward trend in fixed rate costs to continue next year, with further cuts in base interest rates expected. A five-year fixed rate of 3.5 percent could be on the horizon early next year.”

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.