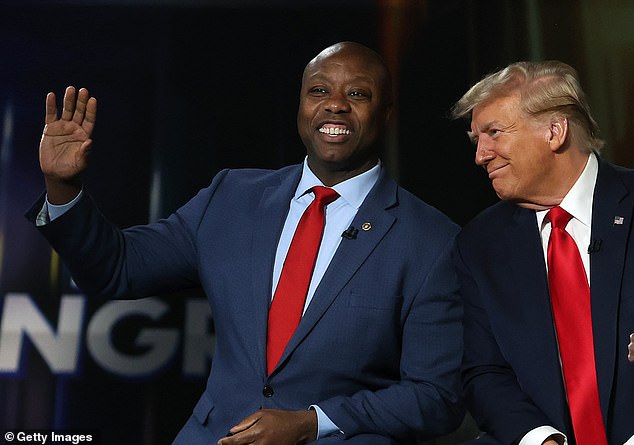

The committee tasked with developing New York’s slavery reparations plans is under fire after it was revealed its members attacked black senator Tim Scott, blamed white people for climate change and criticized Israel a few days after October 7.

Gov. Kathy Hochul urged New Yorkers “not to excuse” the state’s role in slavery when she established the task force late last year.

But she faces calls to fire panelist Ron Daniels after he referred to Scott as “Uncle Tim” and called him a white supremacist leader.

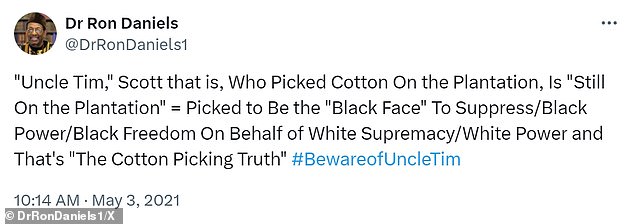

“Uncle Tim” Scott, who picked cotton on the plantation, is “still on the plantation,” Daniels described the Black Republican in a 2021 tweet.

“Chosen to be the “black face” to suppress/black power/black freedom in the name of white supremacy/white power and it’s “the truth about cotton picking” #BewareofUncleTim. »

Panel member Ron Daniels, founder and president of the 21st Century Black World Institute, sparked fury for his comments on Israel, climate change and black Republicans.

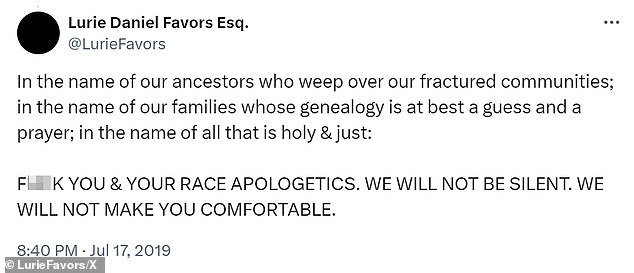

Panel member Lurie Daniel Favors is a strong supporter of efforts to defund the police.

New York Gov. Kathy Hochul signed a bill in December making the state the third state in the nation to establish a formal reparations commission.

Daniels, founder and president of the 21st Century Black World Institute, was one of three panel members appointed by State Assembly Speaker Carl Heastie.

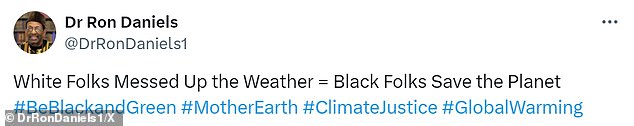

“White people ruined time = Black people are saving the planet,” Daniels tweeted three years ago.

“Silence breeds complacency. No homeland. No peace. No justice, no peace in Israel,” he tweeted in October last year above a photo of a large Palestinian flag.

“There will never be peace in Israel until the Palestinians have a home. Military force will quench the Palestinian people’s thirst for justice. No homeland, no peace! »

Lurie Daniel Favors, another of Heastie’s appointees, has been vocal in his calls to defund the police, tweeting in 2019: “Police across the country are literally proving *daily* why #DefundThePolice is necessary.”

“I’m old enough to remember that you all said that the activists were going too far,” added the executive director of the Center for Law and Social Justice at the City University of New York.

“The reparations commission was ridiculous from the start. This proves it,” said the president of the state Conservative Party, Gérard Kassar, at New York Post.

“It sounds like people have preconceived notions about what they consider white privilege. Amazing. It is not possible for these appointees to be part of the commission given their comments.

New York became only the third state to establish a panel to review paying reparations to descendants of African Americans held in slavery when appointments were made in December.

Daniels tweeted his support for Palestine days after the October 7 attack on Israel.

A 2021 tweet accused “white people” of being responsible for global warming

A 2021 tweet about Sen. Tim Scott accused the South Carolina Republican of being “Uncle Tim,” a white supremacist leader.

Attorney Lurie Daniel Favors hosts his own radio show and directs the Center for Law and Social Justice at the City University of New York.

Daniels and Daniel Favors were both named members of the nine-man panel by New York State Assembly Speaker Carl Heastie.

The controversial issue was brought to the forefront following the death of George Floyd at the hands of a white police officer in 2020, but has suffered a series of setbacks in recent months.

Black lawmakers in Washington are demanding at least $14 trillion for a federal plan to “eliminate the racial wealth gap” between black and white Americans.

But California’s black lawmakers last month unveiled a package of reparations bills for black residents that made no mention of the $1.2 million they were promised earlier.

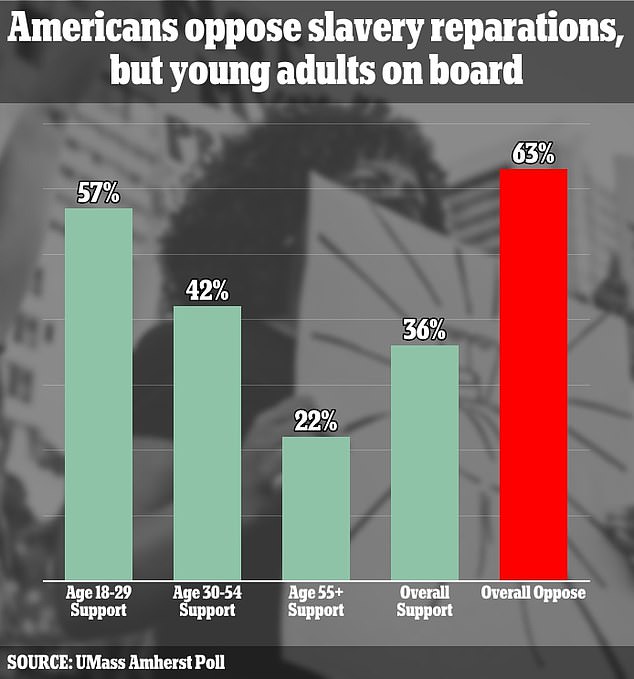

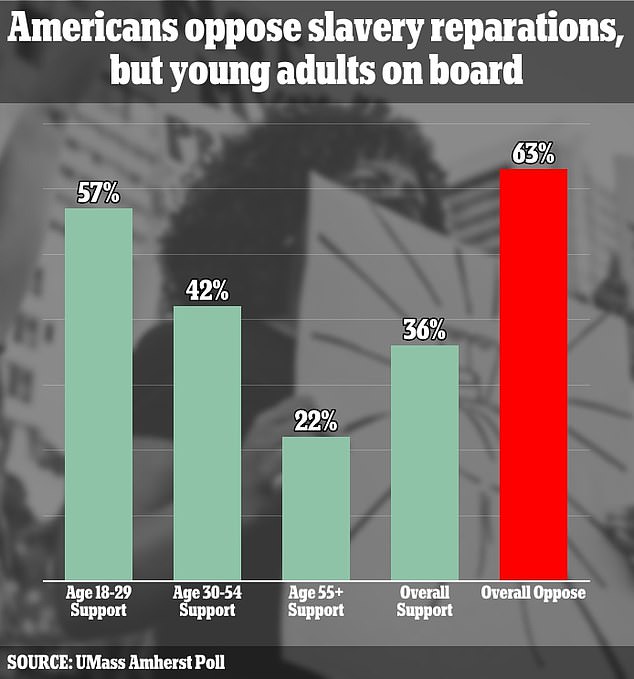

A survey last year of 6,000 registered California voters found that only 23 percent favored cash reparations, while 59 percent opposed them.

And although black Californians would like to receive compensation, very few of them believe they will ever achieve it.

A Washington Post-Ipsos poll last year found that three-quarters of blacks believed descendants of slaves should receive compensation from the government.

But only 14% expected to see them in their lifetime.

Chicago activists are now focusing their efforts on black-only exclusions on the $6,000-a-year property taxes typical of the Illinois city.

Billboards have been deployed in Chicago in an attempt to exempt struggling black households from property taxes.

Six in ten respondents oppose providing compensation to descendants of slaves, while four in ten say the federal government should “absolutely not pursue” such a policy.

“We have a problem: Our black citizens in Chicago are being evicted or forced to leave Chicago, and they’re moving to southern states to live comfortably,” said Howard Ray Jr., of the city’s Reconstruction Era Reparations Act Now group.

The cost of just setting up the New York panel is expected to be between $5 million and $10 million before a figure for repairs is proposed.

“Slavery reparations were paid for with the blood and lives of hundreds of thousands of Americans who fought to end slavery during the Civil War,” the Republican Senate minority leader said of State, Robert Ortt.

“This commission will further fuel divisions in New York and waste millions of taxpayer dollars that could be spent educating the public about our history and improving communities.”