- Have you been affected by the closure of your local bank branch? Email us at money@dailymail.com

- Scroll down for a searchable table with addresses for all closures this year.

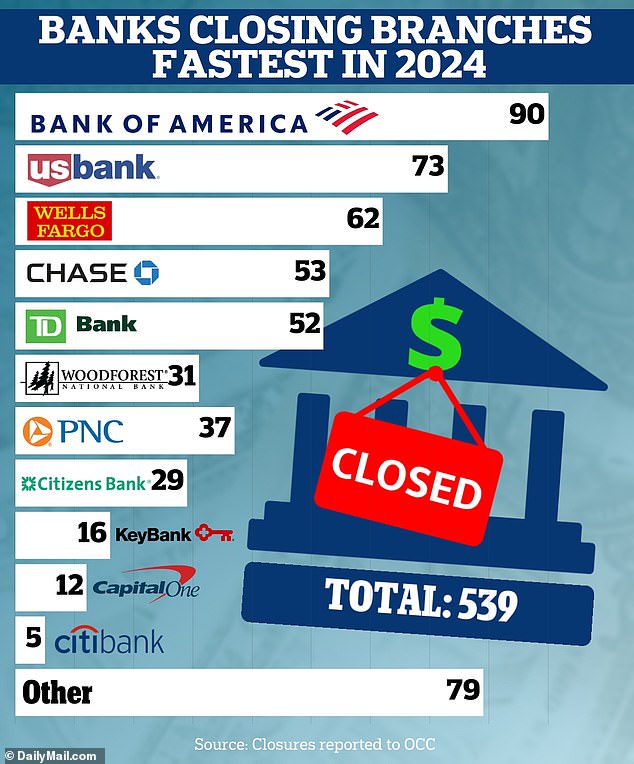

Banks closed 539 local branches nationwide in the first half of the year, leaving more and more Americans without access to basic financial services.

If the pace continues for the rest of 2024, it will mean that more than 1,000 branches will disappear from shopping centres and city centres.

Bank of America closed the largest number of branches, a total of 90 in just six months.

US Bank also made significant closures, closing 73 branches in the same period. Wells Fargo closed 62, Chase 53 and TD Bank 52. Scroll down to see the full search list with addresses.

The closures, which banks must report to the federal regulator, represent a trend as major banks move away from costly physical branches in favor of online services.

US banks closed 539 branches in the first six months of the year

“Most Americans, from Gen Z to baby boomers, have less need for a traditional bank, which may explain the increasing number of brick-and-mortar branches that have been closing over the past year,” Andrew Murray, principal data researcher at GOBankingRates, told DailyMail.com.

TO Recent GOBankingRates Survey They found that even retirees prefer online banking to in-branch services.

Overall, 78 percent of Americans prefer to use mobile and online banking and nearly one in four did not visit their bank in the past year.

“Our survey of more than 1,000 adults clearly shows that demand for in-person banking services is low across all generations, including among baby boomers age 65 and older,” Murray said.

‘Overhead costs (rent, maintenance, supplies and staff salaries) are likely to be a major factor, especially considering our survey shows how infrequently people visit physical banks.’

In fact, closures can result in significant savings, as operating a stand-alone bank branch costs on average about $2.6 million a year.

Banks must report all planned openings and closings to the Office of the Comptroller of the Currency (OCC), a federal banking regulator.

Each week, it publishes a summary of these closures. DailyMail.com analysed them to compile the details of the total closures so far this year.

The most affected state was California which recorded 72 national bank closures in the first half of the year.

New York ranked second with 51 closures, followed by Pennsylvania with 40.

“Over the past few years, we have resized our branch network and may continue to combine two older existing branches into one better-located location,” Wells Fargo told DailyMail.com in a statement.

“Doing so does not diminish the importance of our customers or the communities we serve.”

Bank of America also said they tend to consolidate two branches into one when there is a closure.

Bank of America closed most of its branches in the first half of 2024

“These changes to our branch network reflect the fact that our customers are increasingly using digital banking for their everyday financial needs and are turning to financial centers for more important needs or to have conversations about their finances,” the corporation explained.

The US bank also highlighted customer migration to online banking and a “desire for greater simplicity” as reasons for its mass closures.

“As we evolve with our customers, we are re-evaluating our physical presence and, in some cases, consolidating branches in select markets,” the bank said in a statement.