Major European carmakers have reported a drop in profits as demand for electric vehicles (EVs) stagnates.

Volkswagen and Mercedes-Benz said they were seeing a slow appetite for all-electric cars as drivers switched back to gasoline or hybrid models.

Germany’s Mercedes was the hardest hit in the first quarter, with profits falling 30 percent year-on-year to £3.3 billion.

Electric vehicle (EV) sales fell 8 percent during the period, Mercedes said.

The luxury carmaker said the slow adoption of purely electric cars was dragging down the entire industry, noting that hybrids were expected to “play an important role” in the future.

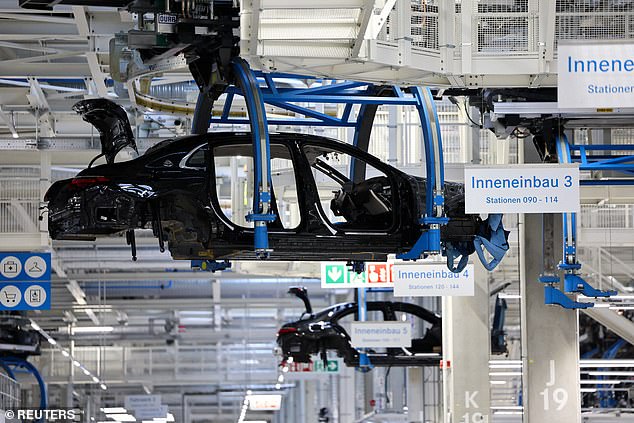

Slowdown: Major European automakers, including Volkswagen and Mercedes, said they were seeing a slow appetite for all-electric cars as drivers turn to gasoline or hybrid models.

In February, the company backtracked on its sales targets and forecast that the share of fully electric and plug-in hybrid vehicles will remain stable this year at around a fifth of total sales.

And this trend was repeated at rival Volkswagen, which also reported a slower start to the year.

Volkswagen said profits fell by a fifth in the first quarter to £3.9 billion as it struggled to offload its more premium brands such as Porsche.

Earlier this month, the German group revealed that sales of electric vehicles in Europe fell 24 percent in the first three months of the year, as high inflation and rising energy prices weakened demand.

But Jeep and Vauxhall maker Stellantis was more optimistic about electric vehicle sales, which rose 8% during the first quarter.

The group has launched four models since the beginning of 2024, out of a total of 25 planned for the entire year, including 18 electric vehicles.

However, the company, whose brands include Peugeot, Fiat and Alfa Romeo, said revenue fell 12 per cent year-on-year to £36 billion as overall shipments fell.

Mamta Valechha, an analyst at investment manager Quilter Cheviot, said the numbers set a “sobering tone for the quarter.”

The figures come at a testing time for manufacturers who are balancing ambitious electric vehicle goals alongside supply chain challenges and questions about consumer demand.

Prime Minister Rishi Sunak’s decision to delay the ban on the sale of new petrol and diesel cars from 2030 to 2035 has also made hybrids more attractive.

The lack of charging infrastructure has also been noted as an ongoing concern. John Plassard of the Mirabaud financial group said: ‘Car manufacturers seem to be under a lot of pressure. However, we seem to be approaching the bottom of the cycle.’