Table of Contents

According to new data, auto insurance prices fell by a record amount in late 2024 as competition in the industry began to intensify again.

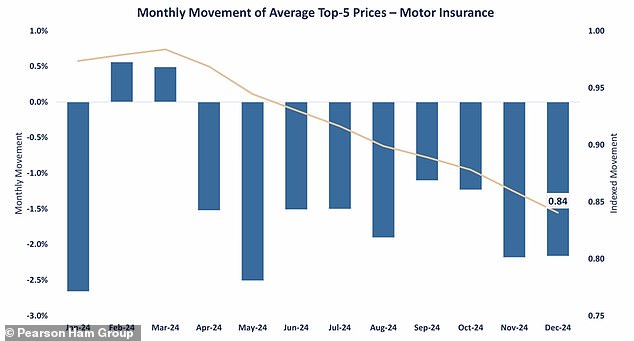

The latest general insurance price index from Pearson Ham Group shows that motor insurance premiums fell 5.5 percent during the fourth quarter of 2024, bringing the total reduction in the second half of the year to -10 percent hundred.

Prices have fallen steadily every month since April, with a total reduction of 16 percent in prices for drivers throughout 2024, down from a high of 46 percent towards the end of 2023.

Despite the reductions, prices are still 21.4 percent higher than at the beginning of 2020.

Drivers have seen significant increases in their insurance costs in recent years as persistently high inflation caused the cost of auto parts and labor to skyrocket.

It now appears that the market has reached a turning point and premiums are beginning to reach more manageable levels.

Auto insurance premiums fell significantly throughout 2024

The index shows that younger drivers experienced the largest year-on-year reductions, with premiums for those under 30 plummeting almost 17 percent over the year.

Drivers between 50 and 60 years old followed closely, with a drop of 16 percent, while reductions for drivers over 60 averaged less than 14 percent.

The smallest declines occurred among drivers over 70, whose insurance premiums fell 13.4 percent.

The price decline has been largely driven by increased competition in the industry, as some insurers opted to make more aggressive cuts in the second half of the year.

Stephen Kennedy, director of Pearson Ham Group, said: “This deflation offers much-needed relief for many policyholders, particularly younger drivers who faced some of the steepest increases in previous years.”

Elsewhere, home insurance premiums saw more modest reductions, with quoted prices falling 1.7 percent in the fourth quarter.

Most of the drop came in December, when there was a 1.3 percent drop, marking the biggest drop since May 2022.

Despite the downward trend, prices are still almost 12 percent higher than a year ago and, in two years, premiums have increased by 56 percent.

This is largely due to the complicated costs and frequency of claims, says Pearson Ham Group, although insurers are likely to stop imposing steep price increases in the coming months.

Frances Luery, product manager at Pearson Ham Group, said: ‘The fall in home insurance prices during the fourth quarter signals a welcome change in the market after prolonged periods of strong inflation.

“While premiums remain significantly higher than two years ago, this recent stabilization is a sign of things to come this year.”

SAVE MONEY, MAKE MONEY

1% refund

1% refund

About debit card expenses. Maximum £15 per month*

Energy bills

Energy bills

Find out if you could save with a fixed rate

free stock offer

free stock offer

No account fee and free stock trading

4.5% Isa 1 year

4.5% Isa 1 year

Hampshire confident of Hargreaves Lansdown

Sip Rate Offer

Sip Rate Offer

Get six months free on a Sipp

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence. *Chase: Refund available during the first year. Exceptions apply. Over 18 years of age, resident in the United Kingdom.