Table of Contents

Close Brothers is one of London’s most venerable banking institutions. Founded in 1878 by William Brooks Close and his brothers Fred and James, the bank rose to prominence by financing 19th-century infrastructure projects such as White Pass and the Yukon Route, Alaska’s first railroad.

Renowned for its old-world charm and links to the British aristocracy, the FTSE 250-listed lender has moved away from the risqué worlds of investment banking and high-frequency trading and stuck to the more traditional business of loans, deposit taking and, on the other hand, asset management.

But a decision made 40 years ago has come back to haunt the bank. When auto financing began to take off in the 1980s, Close Brothers decided to go all in. The sector was growing rapidly as demand for new and second-hand vehicles soared and, with it, the loans needed to pay for them.

The auto lending sector has boomed to the point that auto finance is now second in size to mortgage markets, surpassing even credit card lending.

At Close Brothers, car loans account for a fifth of total loans, or almost £2bn. Now, what once seemed like a reliable stream of revenue and profits has turned sour. There is speculation that the bank could be forced to sell assets to meet compensation claims, possibly including stockbroking operation Winterflood Securities, one of the City’s best-known names. Some observers fear that Close Brothers itself could become a takeover target.

“It’s easy to see why the decision (to enter the auto loan business) was made at that time,” said Gary Greenwood, an analyst at investment bank Shore Capital. “Unfortunately, it seems to have come unstuck.”

Slippery slope: Close Brothers shares are down more than 70 percent so far this year

The problem began in January, when the Financial Conduct Authority, the industry regulator, announced an investigation into hidden commission payments made by lenders to dealers without the customer’s knowledge or consent.

The issue intensified last month when the Court of Appeal ruled that commissions to car dealers can be illegal if they were not clearly disclosed to customers. Close Brothers says it intends to appeal to the Supreme Court, the highest court in the country.

Larger banks, including Lloyds, owner of market-leading car finance provider Black Horse, are also involved.

Lloyds set aside £450m earlier this year for potential claims, and Santander last week set aside £295m.

But while the major lenders are big enough to weather the storm, Close Brothers is the most exposed in relative terms to the growing scandal.

Its shares have fallen more than 70 per cent so far this year and its latest results showed costs had risen almost 50 per cent to £14.2m as the bank spent heavily on legal and professional fees. .

To make matters worse, its chief executive, Adrian Sainsbury, is on “temporary medical leave” and no date has been set for his return.

If it fails to win its appeal, Close Brothers could be forced to sell more assets to ease the nerves of investors and regulators.

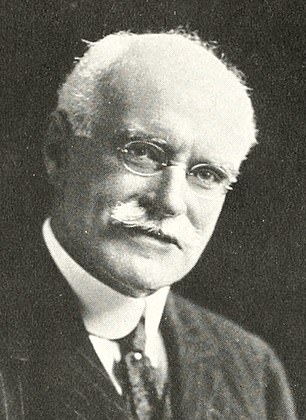

Founder: William Brooks Close

The bank has agreed to sell its wealth division to private equity firm Oaktree in a deal worth £200m.

It has also eliminated dividend payments to shareholders in a bid to shore up its finances.

Analysts say Winterflood could be next – an asset Greenwood says could be worth “tens of millions” of pounds. Potential buyers include rival Panmure Gordon.

Credit rating agency Moody’s has estimated that the final compensation bill for the industry as a whole could soar to £30 billion, making it the biggest mis-selling scandal since payment protection insurance (PPI).

‘We had just got through the IPP and there was a real feeling that British banks were investable again… and now this. “It will lose bank share prices over the next decade,” said Robert Sage, banking analyst at stockbroker Peel Hunt.

Close Brothers may be one of the remaining old-school commercial banks on the Square Mile, but its fate is now in the hands of our learned friends.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.