A doctor spends 30 minutes every day discharging sick people with a mental health illness, but the GP says returning to work could be better for them.

Dr John Harvard revealed there had been a “significant increase” in the number of people laid off from work, which has been exacerbated by the coronavirus pandemic.

But he says it may not be a “smart plan” for those feeling anxious or depressed to stay home, as they “need support from home, family, friends and also those at work.”

It comes as the number of people of working age in Britain who are economically inactive reaches 9.4 million, meaning they are neither employed nor looking for work.

Meanwhile, at the end of last year, 4,000 sickness benefit claims were being made every day.

Dr John Harvard, whose practice at Saxmundham Health Center is based in Suffolk, says he spends 30 minutes every day writing sick notes for people.

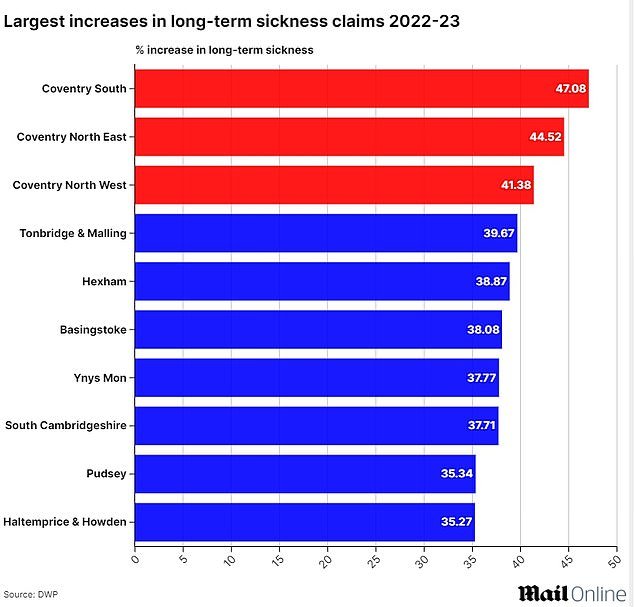

The graph above shows the areas that have had the biggest increase in long-term illness claims in 2022-23.

Dr Harvard, whose practice at Saxmundham Health Center is based in Suffolk, estimated that GPs across the country probably spend at least “half an hour each day” issuing “repeated adjustment notes” to those who have Been off work for a while.

He said: “There has certainly been a significant increase in the number of patients who are out of work due to mental health problems.”

“This appears to have been exacerbated since Covid.”

His office often checks in with patients to see how they are recovering in an effort to get them back to work.

This is because doctors believe that this may be better for your recovery.

Dr. Harvard added: “When patients are anxious or depressed, there are several ways we can help. But being away from work is not necessarily a smart plan.

“Interaction and support from colleagues can be helpful, which means dismissing some people from work may not be in their best interests.”

He spoke after Rishi Sunak announced plans to strip GPs of their power to dismiss people from work, as part of a crackdown on what he calls the “sick note culture” in the UK.

The Prime Minister says benefits have become “a lifestyle choice” for some people, leading to “spiraling” welfare costs.

He announced on Friday that the government will try to get “work and health professionals” to issue “fitness notes” instead of GPs.

Sunak hopes this will free up overworked GPs and allow specialists to carry out a more detailed assessment of a person’s ability to work.

It is rolling out the plans amid concerns about the rise in long-term illnesses since the pandemic, which has been driven mainly by mental health issues.

The Conservative leader added that he would “never dismiss or downplay the illnesses that people suffer from,” but also argued that there is a need to be “more honest about the risk of over-medicalizing life’s everyday challenges and concerns.”

Disability campaigners have reacted angrily to the plans, with charity Scope calling them an “outright attack on disabled people”.

Dr Havard said: ‘If the Government has a plan for issuing repeat certificates I would welcome the idea.

“However, I currently have no knowledge of how it would work.”

He added: “As a general rule, I think patients with anxiety and depression need support from home, family, friends and also work.

“We should never underestimate the strength of the broader community in providing support.”

The overall welfare bill for the British taxpayer currently stands at £297 billion and is forecast to rise to £360 billion over the next five years, equivalent to 11 per cent of all of Britain’s economic output.

Over the same period, spending on sickness benefits is expected to rise from £66 billion to more than £90 billion.

Almost 3 million people of working age are currently on long-term sick leave, the highest number ever recorded, it was revealed on 17 April.

A recent survey by this newspaper showed that in the 16-24 age group, 280,000 people receive unemployment benefits, double the number a decade ago and 50,000 more than before the arrival of Covid.

And it seems that the younger generation is more likely to be affected by negativity about their mental health.

Research by the Resolution Foundation revealed that the number of young people aged 18 to 24 who are economically inactive due to mental health problems has more than doubled in the last decade, from 93,000 to 190,000.