Online daters may believe they are too smart to fall for one of the romance scammers who scam millions from lovesick Americans every year.

Maybe they need to think again.

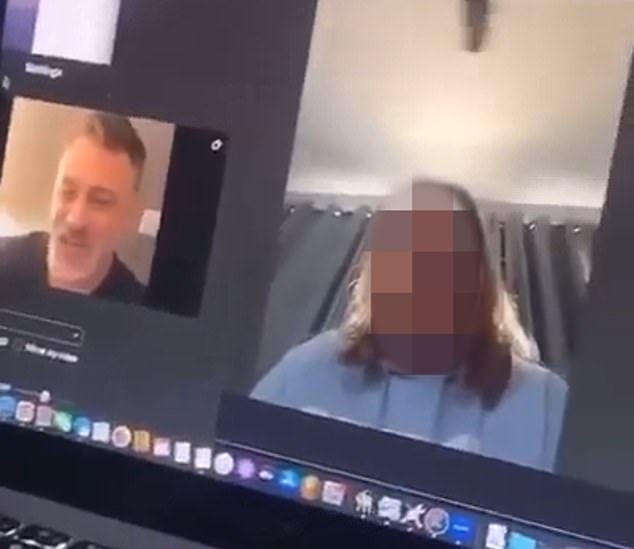

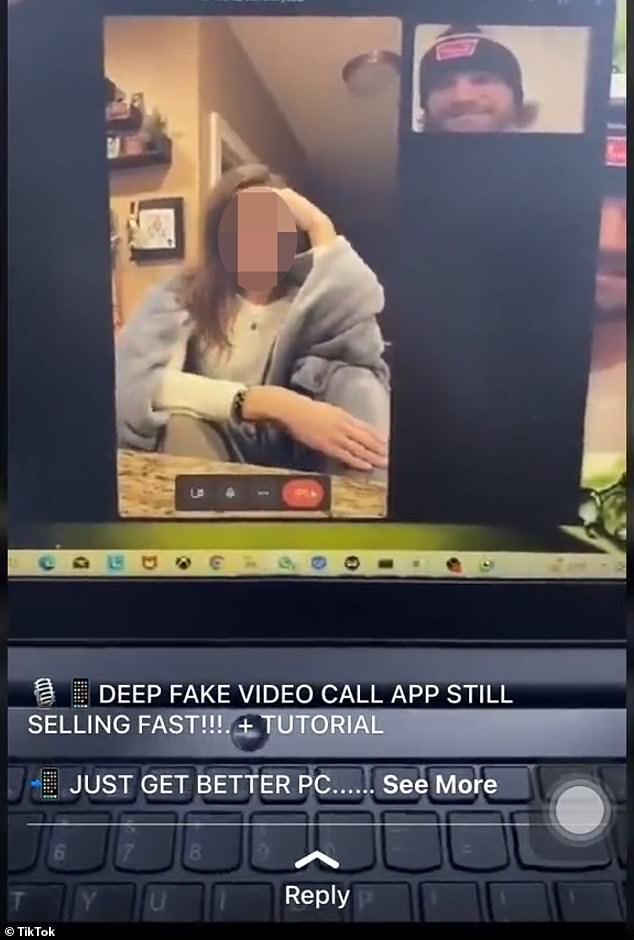

Scammers have upped their game and are attacking targets with deepfakes in real time in terrifyingly persuasive video calls.

For the victims, often ordinary middle-aged homebodies, it is all too convincing.

They meet an attractive suitor online, start chatting, and then move on to Zoom or WhatsApp video calls.

‘Yahoo Boys’ scammers share videos with each other on how to run a deepfake scam in real time

The target believes they are talking to a bearded, muscular, coiffed suitor a few years younger than her. In reality, he looks very different and is thousands of miles away.

The chats are flirty and full of praise. For victims, it’s the real-life romance they’ve been waiting for.

But the face they speak with is not real.

It has been stolen from a social media account and manipulated with available tools to turn it into a deepfake in real time.

Targets may think they are talking to a sleek white professional from a neighboring state.

But behind the face-swapping technology, there is actually a scammer.

In reality, they are 6,500 miles away, in West Africa, probably with an accomplice operating a complicated cell phone setup.

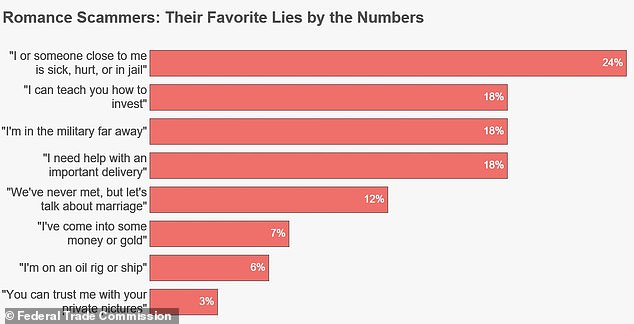

Before long, the conversation turns to a reason why the target should part with the cash.

Usually it is a needy family member in the hospital or jail.

Other times, it’s a once-in-a-lifetime investment opportunity.

Sometimes it’s something as mundane as cash for a ride or a couple hundred dollars to help with a delivery.

The deepfake face used by scammers was most likely taken from a social media profile or a hacked account that was traded on the dark web.

In others, the scammer wants racy photos, which could then be used for blackmail.

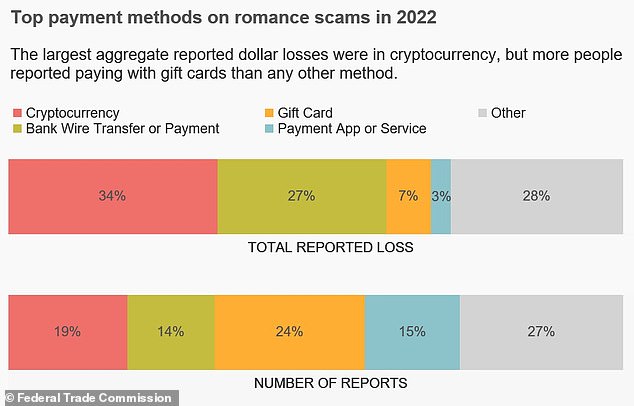

Nearly 70,000 people reported a romance scam in 2022, according to the Federal Trade Commission, a government watchdog.

Reported losses reached a staggering $1.3 billion.

On average, victims lost $4,400.

David Maimon, a professor at Georgia State University and head of fraud analysis at security firm SentiLink, says he knows of some victims who lose “hundreds of thousands of dollars.”

This “new wave of scams” with real-time deepfakes is alarming, he told DailyMail.com.

But the known losses are “just the tip of the iceberg,” he added, as many victims are ashamed and do not report their losses.

A recent study by cybersecurity firm McAfee found that 31 percent of Americans had experienced online chats with a suitor who turned out to be a scammer.

Brazen scammers are not ashamed of their deceptions.

They brag about it and share scam instructional videos on Telegram and other networks.

David Maimon says online daters should ‘be alert’ as criminals know how to spot a target

Maimon provided DailyMail.com with his archive of messages shared between scammers.

The videos are heartbreaking.

The targets, men and women, seem in love and sincere, but also agonized by the pressure they are under.

Scammers are calm, self-confident, and skilled at manipulating people.

Maimon says he is impressed by the level of detail in his frauds.

Scammers often send pizza or teddy bears as gifts to establish rapport with their targets.

They fake photographs of their alter egos in hospital beds to reinforce their story.

Some exchange advice with other scammers about the best software to use.

Microsoft’s new VASA-1 program, which launched this month, will be popular.

Scammers have been experimenting with very fake video clips for about two years, Maimon said.

In recent months they have started making ultra-fake video calls in real time.

They are known as the ‘Yahoo Boys’, an informal collective of scammers, often based in Nigeria.

Online cybercriminal groups can have thousands of members.

Yahoo Boys sell video tutorials on how to make a more convincing rom-con

Romance scams vary greatly, but scammers have some common phrases they use to lure victims.

They are a young generation of West African school dropouts dabbling in identity theft and romance scams on social media.

Young people who should be in class can be found chatting with foreigners in internet cafes, hoping to extort money from them.

For some, the scam is the only way to make money in a region with persistent poverty, high youth unemployment and political and economic uncertainty.

Romance scams are lucrative and popular, but they’re not the only ones they run.

Cybercriminals engage in sextortion, crypto scams, and phishing scams.

According to Maimon, deepfakes are now being used in real time to trick business owners into handing over cash in what they believe is a genuine business transaction.

Federal Trade Commission says nearly 70,000 people were duped in a romance scam in 2022

“People need to be alert,” he said, as the scale of scam increases every year.

Scammers try to catch their targets alone, when they are most vulnerable, Maimon said.

People who are unsure about a suitor include a friend or family member in the conversation.

They can offer a second opinion and possibly scare away the tricksters.

Internet users are advised to do basic research on those who target them on dating sites.

They often use fake photos that appear elsewhere online and can be traced using a reverse image search.

They are also urged to ask questions of their alleged suitors and never share personal financial information or send their own funds.