Sophie Grégoire Trudeau ‘repartnered’ with an Ottawa pediatric surgeon months before her shocking split from Canadian Prime Minister Justin Trudeau was announced, according to allegations in a divorce lawsuit filed against the doctor.

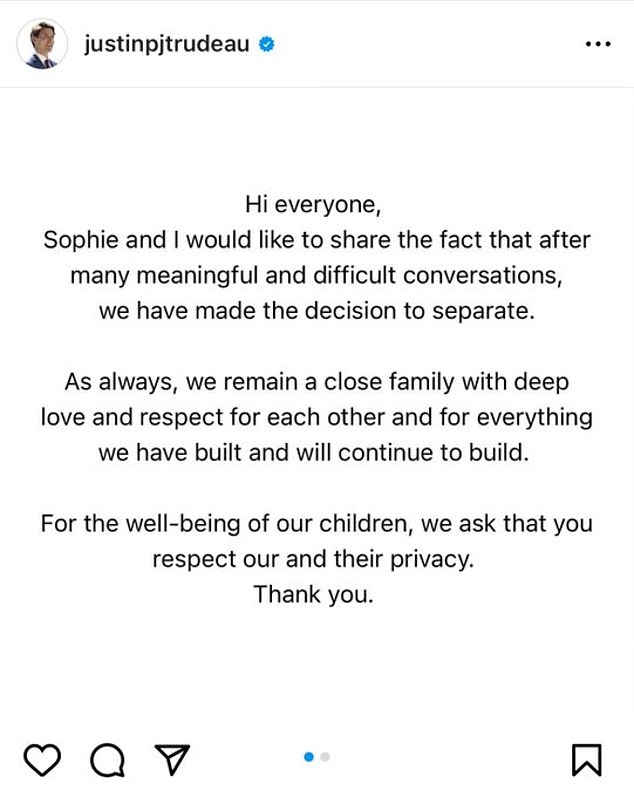

The Trudeaus revealed on August 2, 2023 that they had legally separated after 18 years of marriage and three children together.

The reasons for their split were unclear, however, with the couple saying at the time that it came after “many difficult conversations.”

However, it has since been reported by Canadian media, including The National Postthat when their decision to separate was announced to the world, Sophie had already begun a relationship with Ottawa-based pediatric surgeon Dr. Marcos Bettolli.

In a divorce petition filed on April 26, 2023, Dr. Bettolli’s ex-wife, Ana Remonda, claimed that he had “re-associated with a high-profile individual who attracts significant media attention and presents significant considerations.” of security”.

Sophie Grégoire Trudeau ‘repartnered’ with an Ottawa pediatric surgeon months before her shocking split from Canadian Prime Minister Justin Trudeau (pictured together in 2017) was announced, according to allegations in a divorce lawsuit against the doctor.

The person was not named in court documents, but The National Post claimed it had been confirmed that Remonda’s allegation refers to 48-year-old Sophie.

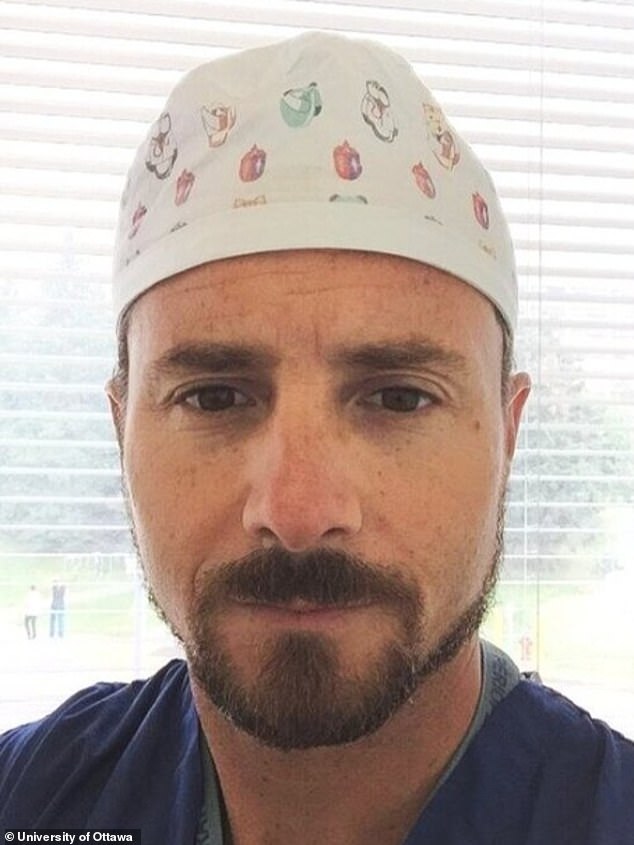

Dr. Bettolli, 48, works at the Children’s Hospital of Eastern Ontario (CHEO) and also teaches at the University of Ottawa’s faculty of medicine.

He completed his medical studies at the Catholic University of Córdoba, Argentina, according to his biography at the University of Ottawa. website.

The doctor moved to Canada in 2004 before becoming educational leader of the university’s Pediatric Surgery undergraduate program in 2010.

In 2014, he was promoted to Associate Professor and earned his distinction as a Fellow of the Royal College of Surgeons of Canada (FRCSC).

His ex-wife, Mrs. Remonda, who is a housewife, reportedly said in her divorce petition that she “does not take any position” on her former partner’s personal life.

However, she insisted that the new relationship had given rise to unspecified safety issues “to which the children are exposed while in their father’s care” and sought a court order to ensure the privacy and protection of her two children. .

‘Ana had thought that the parties had reached an agreement that the (children) would not interact with the new couple, but Marcos has not respected that and has caused discomfort and anxiety to (the children),’ she reportedly stated in the petition.

Now, Canadian outlets such as The National Post have reported that when their decision to separate was announced to the world, Sophie had already begun a relationship with Ottawa pediatric surgeon Dr. Marcos Bettolli (who is believed to be in the photo).

The Trudeaus (pictured in 2016) revealed on August 2, 2023 that they had legally separated after 18 years of marriage and three children together.

But Dr Bettolli reportedly insisted his ex-wife’s attitude towards his relationship with Sophie “is not in the best interest of the children” in his response to the divorce suit.

He is said to have claimed that Remonda threatened to return to Argentina, where they were both born, if the new relationship was revealed.

Dr. Bettolli and his ex-wife separated in January 2020 after 22 years of marriage.

The October National Post report made clear that none of the allegations contained in the divorce complaint have been proven in court and that the case is ongoing. It is unclear if any progress has been made at the time of writing.

Remonda’s lawyer, Katherine Cooligan, and Dr. Bettolli’s lawyer, Gil Rumstein, declined to comment to the publication, while Sophie could not be reached for comment.

MailOnline has contacted Katherine Cooligan, Dr Bettolli, Gil Rumstein and the Office of the Prime Minister of Canada for comment.

In April, Sophie, who became “fast friends” with Meghan Markle in 2016 when the Duchess of Sussex was living in Canada, will teach yoga at a solar eclipse wellness retreat weekend in Ontario.

Tickets cost from £450 for two nights and the event promises to bring guests closer “as Mother Nature will show us the beauty of the dark”, according to The times.

The retreat will also include meditation and mantra chanting with a spiritual practitioner, according to The National Post.

Meanwhile, following their separation, the Trudeaus’ three children will continue to live with the Prime Minister at Rideau Cottage, while Sophie has moved to another house in Ottawa.

The reasons for their separation were not clear, however, the couple said it came after “many difficult conversations.”

In their statement, they promised to “remain a united family with deep love and respect for each other and for all they had built.”

Over the years, the couple has publicly shared candid reflections on the “challenges” of marriage and the difficulties of balancing family with the demands of higher work.

Some have speculated that such statements, as well as a series of awkward exchanges between the couple on television, may have hinted at trouble in the prime minister’s marriage.

Following the announcement, a video went viral on social media appearing to show an awkward exchange between the Prime Minister and his wife.

The video shows the two kissing in front of a camera, sharing a Canada Day message from Ottawa Food Bank Farm in 2020.

At the end of the video, the couple look at each other and Justin leans in to kiss. He whispers something to his wife as she leans in. She kisses him back, but quickly turns around and looks at something off camera.

Justin also steps back, looks around, and opens his stance before the clip cuts out.

In another on-camera moment, Sophie was seen shaking her husband’s offered hand as she received her Covid vaccine.

The two were filmed together in April 2021 receiving their first dose of the AstraZeneca Covid-19 vaccine in Ottawa.

Grégoire and Trudeau share three children. Two sons, Xavier, 15, Hadrien, 9, and his daughter Ella-Grace, 14

Justin received the injection first, and his wife held his hand firmly throughout the process. As they prepared Sophie’s arm for the injection, her husband offered her a hand to support her.

Sophie turned, hand on her leg, and smiled, but waved her hand dismissively. The Prime Minister removed his hand from her and looked at the camera with his palms open.

The couple laughed about the interaction and the funny encounter still received positive reception online.

Two years later, Justin and his wife were seen together at the King’s Coronation. As they walked hand in hand, the Prime Minister looked at his wife and seemed to ask her to smile. She looked away from him with a slight smile on her face.

It came six months after a podcast interview with Meghan Markle, in which the host introduced Sophie knowing all about “crushing the guilt of expectations” in her role.

Sophie had a ‘full plate’ while being a mother and wife in the public eye after being married to Justin for 18 years, the duchess claimed on the podcast.

Sophie agreed, saying of the guilt of being a woman and having to take on multiple roles: “I think we’ve learned to self-impose.” A little girl is not born feeling guilty about being a girl.

‘We learn it. And that is completely unacceptable. As I began to become a big girl in early adulthood, I realized that we often define “freedom” as a way of being free from the world, but it’s actually a way of being free in the world.

He added: ‘Women across the planet remain the nucleus of the family, still carrying the majority of the burden of household chores, contributing to the well-being of the family and to most decisions regarding children.

“But I think we are all that lioness, we all have that within us and we all long to be free in who we are.” During the roughly hour-long podcast, Sophie never indicated any marital conflict.

In the past, the couple has often been very candid in their Instagram posts, sharing tender reflections on the challenges of long-term relationships.

In an Instagram post from September 2020, Sophie wrote: ‘Our first date was 17 years ago… we’re not that young anymore but what an adventure it’s been.

‘Despite all the ups and downs, you are still my person. I love you. #TBT to a moment of tranquility that we shared somewhere along the way.”

The couple has been married since 2005 and share three children, the youngest of whom is nine years old.

Sophie was a childhood friend and classmate of Justin’s younger brother Michel, who died in an avalanche in 1998 at age 23.

Justin and Sophie began dating in 2003 after reconnecting as adults and got engaged shortly after.