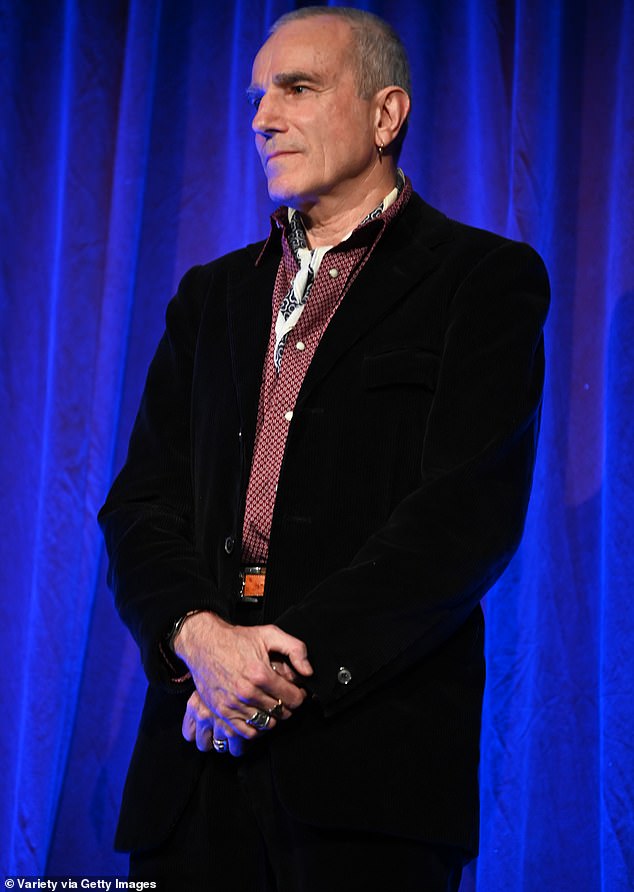

Daniel Day-Lewis, 66, currently has no plans to come out of retirement after leaving the film business seven years ago.

The legendary actor gave an Oscar-nominated performance in Paul Thomas Anderson’s 2017 film Phantom Thread and then retired from acting entirely.

Last month, however, he sparked a whirlwind of comeback rumors when he was spotted reuniting with Jim Sheridan and Steven Spielberg, who directed Daniel in Oscar-winning performances.

However, Jim, who directed Daniel three times including My Left Foot, has now quashed hopes of Daniel returning to Hollywood.

‘He says it’s over, I’m still talking to him. I would love to do something with him again,” the Irish filmmaker told daily screen.

Daniel Day-Lewis, 66, currently has no plans to come out of retirement after leaving the film business seven years ago; photographed in January at the National Board of Review Awards Gala

The legendary actor gave an Oscar-nominated performance in Paul Thomas Anderson’s 2017 film Phantom Thread (pictured) and then retired from acting entirely.

“It’s like everyone else, you open the streamers and there are seven thousand options, none of them are good,” he explained.

‘The film has passed from the public domain to the private domain; you have a remote control, you can stop it. It’s not the same experience.’

However, the Dublin-born director said: “It would be great to see Daniel come back and do something because he’s so good.”

Daniel won his first Academy Award for My Left Foot, a 1989 comedy-drama in which he played a man suffering from cerebral palsy.

In 1993, he and Jim collaborated again on In The Name Of The Father, a crime drama about the Troubles that earned Daniel another Oscar nomination.

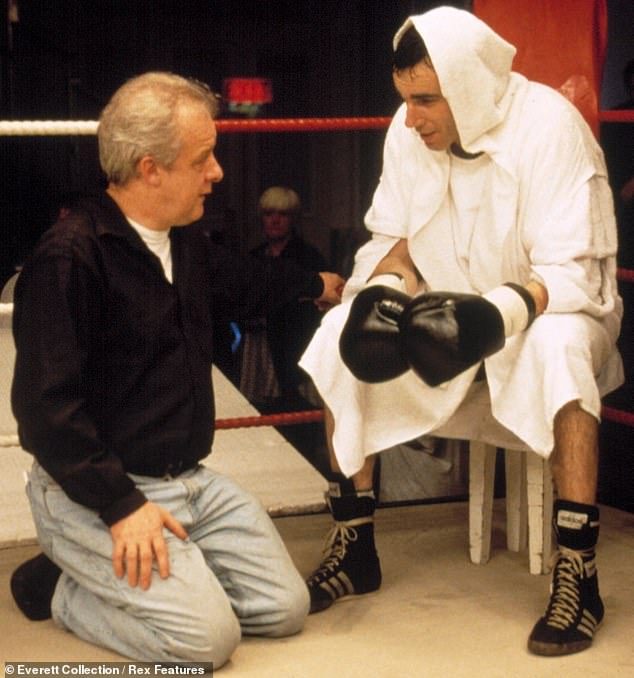

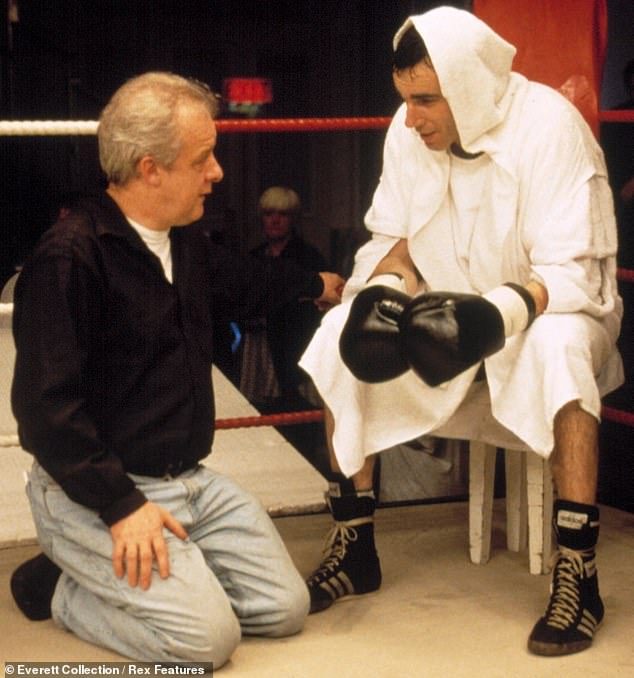

They returned to the IRA theme with the 1997 film The Boxer, starring Daniel alongside Emily Watson and Brian Cox.

Daniel won a total of three Oscars, including one for his gripping 2007 western There Will Be Blood, directed by Paul Thomas Anderson.

His last Oscar win came with Steven Spielberg’s 2012 film Lincoln, in which Daniel played the lead role of the 16th president of the United States.

Daniel won his first Academy Award for My Left Foot, a 1989 comedy-drama in which he played a man suffering from cerebral palsy.

In 1993, he and Jim collaborated again on In The Name Of The Father, a crime drama about the Troubles that earned Daniel another Oscar nomination.

Daniel appears on the set of his 1997 film The Boxer with its director Jim Sheridan, who also directed My Left Foot and In The Name Of The Father.

Paul and Daniel reunited for what would turn out to be the latter’s final film: Phantom Thread, loosely inspired by the life of Cristóbal Balenciaga.

A few months before the film’s release, Daniel dramatically announced through a spokesperson that he was retiring.

“This is a private decision and neither he nor his representatives will make any further comments on this matter,” the statement concludes.

In a later interview with W.He explained that he had wanted to withdraw several times before and finally issued the announcement to force his own hand.

‘I knew it was unusual to make a statement. But I did want to draw a line. I didn’t want to get caught up in another project,” she said.

“My whole life I’ve talked about how I should stop acting, and I don’t know why it was different this time, but the impulse to stop acting took root in me and it became a compulsion. It was something I had to do.”