Man’s best friend and our feline pets may exhibit strange behavior during the April 8 solar eclipse, and experts warn there are some signs we should look out for.

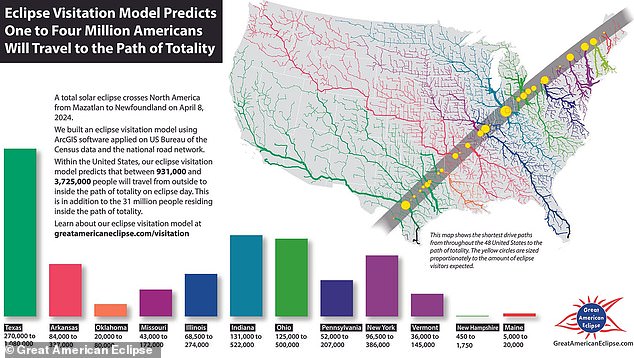

The path of totality will stretch from Maine to Texas, and during the 3.5 to four minutes of darkness, your pets might get confused and think it’s time for bed.

Your dog may also respond to the eclipse by showing signs of anxiety, such as pacing, scratching, and howling, similar to how they react to a thunderstorm or fireworks display.

The full reason why animals exhibit unusual behaviors during solar eclipses is not yet fully understood, but scientists have theorized that pets react to the dimming of natural light and the drop in temperature when the moon blocks the sun.

Pets may exhibit anxious or confused behaviors and could show signs that they think it’s time to sleep when the solar eclipse occurs on April 8.

The solar eclipse will occur on the path of totality that extends between Maine and Texas

The solar eclipse could be disrupting animals’ circadian rhythms: the 24-hour biological clock that tells humans or animals it’s time to wake up or go to bed.

“Most animals respond (to the dimming of eclipse light) in a way like, ‘Okay, it’s time to sit down, rest and go to sleep.'” Dr. Bryan Pijanowski, professor of forestry and natural resources from Purdue University, said cnn.

He continued: ‘…And then there are nocturnal animals that suddenly say, ‘Oh, it’s time for me to wake up and be active.’

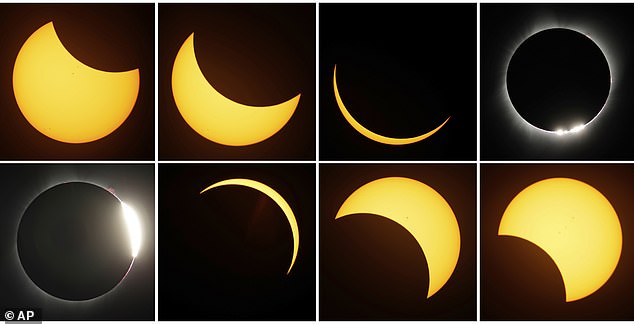

During Monday’s eclipse, the moon will be directly in front of the sun, plunging millions of people across the United States into darkness.

While people flock to the best viewing spots and express excitement about the upcoming phenomenon, your furry friend may be less enthused.

Some dogs may begin to howl and show signs of anxiety, such as pacing, panting, and scratching.

You can help calm your dog by staying calm, which could make your dog less anxious because he tends to imitate human behavior, according to the Dogster Magazine.

This could be the “most concerning” reaction for pet owners because the anxiety behaviors would be similar to how a dog reacts to thunderstorms, vet visits or fireworks, said Erica Cartmill, professor of anthropology, animal behavior. and cognitive science from Indiana University. PEOPLE.

But for cats, particularly indoor ones, and some dogs, Cartmill said they’re more likely to simply think it’s nighttime and start exhibiting the same behaviors they would exhibit before going to bed.

“The most likely answer is that the animals begin their nighttime routines and exhibit nocturnal behaviors,” Cartmill told the outlet.

“If you have a dog or cat, they might go to bed, calm down, or start yawning and stretching.”

And he added: A solar eclipse is “like dropping a small piece of night in the middle of the day.” So they could act as if it were night.

NASA hopes to find out how animals react to a solar eclipse during the April event through a citizen science project called Eclipse Soundscapes.

Viewers of the event participate by recording data, analyzing audio, and submitting their observations of animals in the wild.

Scientists have previously noted that animals behave strangely during lunar and solar eclipses, including whales and dolphins swimming to the surface of the water, giraffes gathering and running, Galapagos tortoises beginning to mate, and llamas. who meet in groups.

“They’ve done a lot of studies in 2017, when we had an eclipse in some of the zoos in the United States, and some of the animals were affected by it,” said Steven Greene, director of Lubbock Animal Services. KCBD News.

Scientists studied the behavior of animals during the last solar eclipse in 2017 to better understand why they exhibit unusual behavior when the moon blocks the sun.

Up to one million are planned for Texas, 500,000 in Indiana and Ohio and nearly 400,000 people could travel to New York

Reports of unusual animal behavior during eclipses have been made for decades, dating back to 1851, when a swarm of ants carrying food stopped moving until the sun reappeared in Sweden.

Another report of cockroaches infesting a Massachusetts pantry during the 1932 solar eclipse, while during the 1991 solar eclipse in Mexico reports emerged of spiders tearing their webs.

In 2017, researchers at North Carolina State University conducted a study about how animals at the Riverbanks Zoo in Columbia, South Carolina, reacted to the solar eclipse.

«A total eclipse occurs anywhere on Earth once every 375 years. “So it’s not like you’re learning something new that you can use again in the future, and that’s certainly true for animals,” said Adam Hartstone-Rose, who led the study. Washington Post.

‘But it is a unifying event. “We all have this experience together,” she said, adding that during the April 8 eclipse, “we will all commune with the animals and think about how they experience it.”

Hartstone-Rose will conduct another study during this year’s solar eclipse at the Fort Worth Zoo in Texas and will have more than 1,000 volunteers across the United States recording animal behavior through the Solar Eclipse Safari Project.

The solar eclipse will be seen between 2:27 pm and 3:35 pm EST in Oklahoma, Arkansas, Missouri, Illinois, Indiana, Ohio, New York, Pennsylvania, Vermont, New Hampshire and Maine, but according to Astronomy.comSky watchers in Texas will have the best view.