<!–

<!–

<!– <!–

<!–

<!–

<!–

Shockwaves continue to arise from the news that Thames Water, the private supplier to London and the South East, has been declared ‘non-investable’ by its shareholders.

Advisors are working to restructure the debt-laden company, but it may still need to be temporarily renationalised. Yesterday the parent company defaulted on interest payments on a £400 million bond.

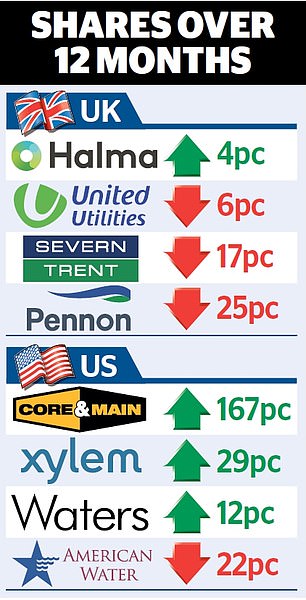

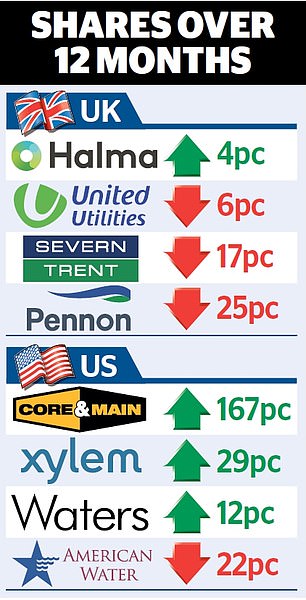

The reverberations have hit the shares of Pennon, Severn Trent and United Utilities, the three listed companies in the sector which, like Thames Water, have a terrible record of both leaks and pollution.

But the crisis at Thames Water appears to be putting their strengths in the spotlight. Not only are their debts much lower, they are also perceived as more resilient thanks to their stock exchange listing. Pennon is a member of the FTSE 250, and Severn Trent and United Utilities are members of the FTSE 100.

The publicity surrounding Thames Water is also having a wider impact, both domestically and globally, encouraging some investors to look for companies that are trying to improve supply and environmental standards.

Splurge: Some investors are looking for companies that are trying to improve offerings and environmental standards

Caroline Langley, deputy director of the Quilter Cheviot Climate Assets fund, said: ‘Population growth, urbanization and climate change are increasing pressure on systems worldwide.’

These trends underlie predictions by US analytics group Precedence that the global water sector, estimated to be worth £261 billion in 2023, could grow to £457 billion by 2032.

The main beneficiaries of this expansion, it is argued, will be listed players in Britain and elsewhere, as the transparency required by listed status requires a water company to be ‘more community and environmentally conscious’. This is what John Moore of asset manager RBC Brewin Dolphin claims.

The arguments in favor of listed water companies come amid calls to bring all water companies back into public hands.

But it is difficult to imagine how any government would consider such an outcome, given the resources required to address decades of underinvestment in infrastructure. For example, the cost of eliminating combined sewer overflows ranges from £350 billion to as much as £600 billion.

These bills provide another argument that water companies need access to long-term capital that only a stock exchange listing can provide.

Until the prospects become clearer, it seems worth sticking with Pennon, Severn Trent and United Utilities.

However, this uncertainty means that more investors will look outside Britain. Dan Boardman-Weston of BRI Wealth Management says: ‘The world will face an increasing water problem due to population growth, urbanisation, increased prosperity and poor infrastructure. We are investing in JO Hambro’s Regnan Sustainable Water and Waste fund, which supports companies that provide solutions.’

Among the holdings of this fund are the American groups Core & Main and Xylem, the global water treatment group. Shares have risen 46 percent to $128 in the past six months, but analysts at BNP Paribas are targeting a further rise to $150.

Shares in the Quilter Cheviot Climate Asset fund include the aptly named Waters, another US multinational that specializes in water testing.

The Thames Water scandal may make you want to stay away from water. But it may be wise to be prepared for the consequences of the affair. Stricter regulations on environmental impact may result, which makes me consider dipping a toe (so to speak) into the shares of FTSE 100 company Halma. It has six companies, all concerned with water conservation and improvement.

Halma shares are worth 2270p. But broker UBS recently tipped them as a buy with a 2700p price target, which would certainly justify my, er, splurges.