Table of Contents

The prospect of a “100-year life” is increasingly likely thanks to medical advances and improvements in our standard of living.

As people live longer, the number of years they spend in retirement will also increase.

For today’s workers, a 35-year retirement is a growing possibility. But can they afford it?

According to ONS figures, the number of people over 65 is expected to grow by 40 per cent between 2023 and 2050, and the number of over 80s will increase by 90 per cent.

The state pension age will increase to 67 years between 2026 and 2028, and will reach 68 years between 2042 and 2044.

But that would still leave 32 years of retirement to be paid, compared to the current average retirement length of just over 20 years for women and just over 18 years for men.

100-year life: More and more people reach the century, but this also means they need to finance a longer retirement

That’s not taking into account those who live to be over 100, and the number of centenarians is expected to increase by 200 percent in the next 30 years or so.

Worryingly, however, data from pension company Canada Life indicates that three-quarters of people would be concerned about their quality of life if they lived to be 100, and only 49 per cent have spoken about their intentions to do so. of care or inheritance.

More than a third said they are worried about running out of money in retirement.

Annabelle Williams, spokesperson for pension consolidation service Pensionbee, says: “In previous generations only a small minority could expect to live to be 100, so financial planning for such a long life was rarely considered.”

“However, today someone in their twenties, thirties or forties has a much higher chance of living to age 100, and while living longer is a blessing, this trend will pose a significant challenge for retirement planning.

“Someone who is 30 years old today and plans to retire at 60 may have 40 more years ahead of them, which means they will need a much larger pension to last them throughout retirement.”

How big should my pension be?

How much you need to save for such a long retirement depends largely on the expected costs during this time.

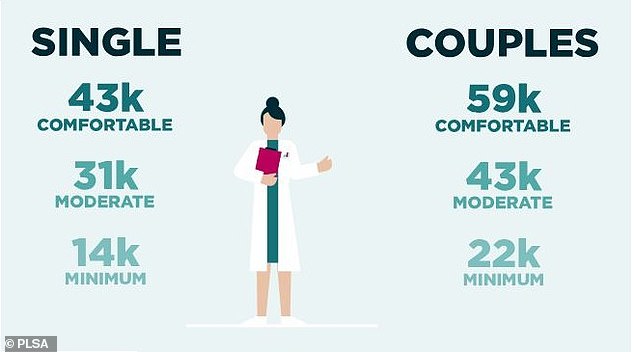

The Life Savings and Pensions Association sets three benchmark figures for what it calls a “minimum” retirement – enough to live on, but not much for luxuries -: £14,400 for a single person.

This figure rises to £31,300 per year for a “moderate” retirement and £43,100 per year for a “comfortable” retirement.

For couples, these figures are less than the equivalent of two single people, with a minimum standard of living requiring £22,400, a moderate retirement requiring £43,100 and £59,000 to fund a comfortable retirement.

With a state pension of £11,500 a year, this means a retiree would need around £20,000 more each year to fund a moderate retirement.

According to investment platform Nucleus Financial, a £20,000 annuity bought at age 65 and increasing by three per cent each year would cost around £380,0000.

Meanwhile, a pension fund large enough to receive £20,000 a year for 35 years would have to be £700,000. To reach the £43,100 needed for a comfortable retirement over a 35-year period, a pension fund of £1.1m would be needed.

Building a pot like this is not an easy task. The average pension for a person in their sixties is £228,200 for men and £152,600 for women, well below what is needed to fund a 100-year life according to PLSA figures.

It’s also worth noting that these figures don’t take into account income tax, which is currently charged on 75 per cent of your pot, with the first quarter available tax-free.

Beyond this, pensions are taxed in the same way as normal income, with 20 per cent paid between £12,571 and £50,270.

Above £50,270 the higher rate of 40 per cent applies, while above £125,140 45 per cent is charged.

Pension fund: PLSA says single people need at least £31,000 a year to fund a moderate retirement

How can I increase my pension fund?

As a general rule, pension savers have been advised to have saved one year’s salary by age 30, then three times their salary by age 40, six times by age 50 and eight times by age sixty. The goal of this is to reach ten times your salary before retirement age.

Alternatively, savers can aim to contribute half a percent of their income for each year of their life. At age twenty, this figure would be 10 percent, rising to 15 percent at age thirty.

Pensionbee’s Williams, however, says: ‘Traditional wisdom is being challenged by increasing longevity and the many competing demands on income faced by younger people, in particular.

‘For example, buying a house is much more difficult, making it less likely to own it outright before retirement. Rents are more expensive, childcare is more expensive, and many under 30s will also have to pay off their student loans.

“This means that younger generations will likely be worse off financially at retirement age than their parents and grandparents.”

As a result of this, it is even more important to start saving for pensions early so you can benefit from employer contributions and the growth of your pension investments and the compounding effect of reinvestment.

This also means that there are considerably fewer benefits to saving for a lump sum contribution later in life. You’ll lose the benefits of employer contributions if you reduce your own contribution, plus you’ll lose the compound growth of your fund over a long period.

Therefore, making monthly contributions is the best way to do it.

According to Nucleus, this could look like this for a £380,000 fund, without taking into account tax relief and employer contributions, or increases in personal contributions:

- If you start contributions at age 25 and pay over 40 years: approximately £240 per month

- If you start aged 30, approximately £320 a month

- If you start at age 35, approximately £430 a month

- If you start at age 40, approximately £600 a month

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.