Table of Contents

The words “capital” and “preservation” are some of the most reassuring in the English language, particularly at a turbulent economic and political time in history.

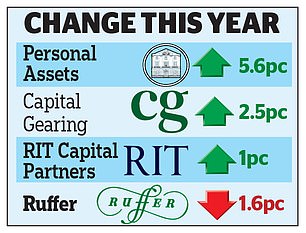

That’s why investors are once again looking at capital preservation trusts: Capital Gearing, Personal Assets, RIT Capital Partners and Ruffer. Its goal is to provide a buffer when stock markets become stormy and global conflicts increase.

One of these trusts, the £2.7 billion RIT Capital PartnersIt houses some of the wealth of the Rothschild dynasty, illustrating that even people with deep pockets find it worthwhile to diversify against adversity.

Some of the interest in the capital preservation sector is being spurred by the prospect of bargain hunting.

Against the backdrop of the love affair with shares of Amazon, Nvidia and other American tech titans, share prices of capital preservation funds have fallen, meaning some are at a discount to their net asset value (NAV). .

RIT Capital Partners has a 26.85 percent discount. But the trust is taking advantage of this shortfall to gain new clientele, a strategy that could revive the stock.

Harbor in a Storm: Capital Preservation Trusts Aim to Provide a Buffer When Stock Markets Turn Stormy and Global Conflicts Increase

Manager Maggie Fanari states: “I think we have a very interesting growth opportunity, especially with the discount at which we are trading today.”

Another factor behind the focus on the capital preservation sector is this week’s cut in the premium rate of the £126bn Premium Bond fund operated by National Savings & Investments (NS&I). This reduction is a reminder that risk-free returns above 4 percent may not be available indefinitely.

NS&I, which is sponsored by the Treasury, offers a 100 per cent guarantee on every penny committed to its care.

Capital protection trusts cannot make such a promise, as they are not immune to turbulence. However, they do strive to offer a sanctuary when stock markets stumble, but also the potential for appreciation through their typical mix of assets: bonds, gold, currencies, commodities and stocks.

Sebastian Lyon, manager of the £1.5bn personal asset fund, says its mission is to “protect and grow (in that order)” shareholders’ capital.

The fund invests in indexed bonds, but also in bullion. The price of gold, widely considered a safe haven, has risen 27 percent this year.

Jasmine Yeo, co-head of the £915m Ruffer fund, says: “We can invest in any asset anywhere in the world, whether it’s shares, bonds, derivatives, commodities or currencies.”

This confidence also favors overlooked and unloved “ugly duckling” assets that don’t have much to fall, but could turn into swans.

Peter Spiller, manager of the £947m Capital Gearing Trust, is proud to have had only two bad years in the trust’s 40-year history. Anyone who had entrusted £10,000 to the trust at its launch would now have £2.2 million, or £2.6 million if the dividends had been reinvested.

Capital Gearing’s portfolio is divided into three parts: cash, shares, indexed UK bonds and indexed US government bonds or ‘Tips’ (Treasury Inflation Protected Securities).

The belief is that Tips should serve as a shield if higher inflation results from tariffs and other policies of President-elect Donald Trump.

These defensive offerings could appeal to anyone who already has a savings cushion in deposit accounts and NS&I schemes, and who suspects their portfolio may be overexposed to US technology stocks.

This will almost certainly be your situation if your portfolio contains mainly global equity trusts and funds, many of which have placed big bets on technology’s Magnificent Seven: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

American exceptionalism may be here to stay. But it might be wise to have some counterweight in case Trump’s actions trigger a second wave of inflation in the United States and elsewhere.

Darius McDermott of the FundCalibre platform notes that the performance of capital preservation trusts over the past three years has been lackluster.

RIT Capital Partners has earned a negative 24 percent return over that period, but over ten years, the return is 59.7 percent and 7.7 percent over one year.

In part, this is a consequence of this fund’s holdings in unlisted companies that some consider “esoteric,” which seems like a polite way of saying “exciting but risky.”

These holdings represent about 33 percent of the trust. Listed stocks and bonds account for the rest.

The downward pressure on shares of all trusts was amplified by cost disclosure rules for all investment trusts, which made their charges appear prohibitively expensive.

Although the system has changed, this perception is likely to persist, and McDermott suspects it will take a sharp drop in the share price to bring a flood of money into the sector. But this suggests it could be an opportune time to strike.

He highlights RIT Capital Partners, which could prove to be a bargain as Fanari is moving his portfolio into listed stocks.

It is also trying to improve disclosure to investors, something other trustees across trusts and funds could consider. Much of the literature remains arcane or simply confusing.

If you find the unlisted element of RIT Capital Partners exciting, but not exactly reassuring, Interactive Investors rates Capital Gearing as one of its best buys. This trust is at a small discount of 1.97 percent, thanks to an avalanche of share buybacks.

Personal goods also have a minimum discount (1.29 percent). Lyon candidly describes escrow as “an affordable luxury,” implying that peace of mind is worth paying for.

This is something I agree with, and it’s why I will continue to hold Ruffer in the hopes that the 6.37 percent discount narrows.

Although I am not satisfied with the fund’s performance, which was particularly poor in 2023, I like the mix of bonds and precious metals, including silver, which has risen in price 30 percent this year as a result of a production shortfall.

Demand for silver comes from the electronics industry, but the metal is also a key component of solar panels. Ruffer also has some exposure to China, a contrarian choice as it is currently a risk-filled market.

Backing capital preservation trusts is a bet on trustees’ renewed determination to show they can provide a worthwhile service in what could be a difficult era.

If you want to relax with complete peace of mind, stick with the cash, although keep in mind that this also carries an element of risk.

Interest rates will not be reduced as quickly as expected just a month ago. However, in the long term, they will head further downwards, leaving you in a less welcoming state.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.