A New Hampshire mother was given custody of her baby even though she allegedly abandoned him in the woods after giving birth.

Alexandra Eckersley, the adopted daughter of Major League Baseball’s Dennis Eckersley, appeared in court in Manchester on Friday for a pre-criminal trial hearing.

Eckersley faces charges including child endangerment after she gave birth to her now one-year-old son in a wooded area in December 2022.

Prosecutors allege she abandoned the child and tricked police into finding the newborn after giving birth in a freezing tent.

In court on Friday, Eckersley was seen reunited with her son, and the couple has been fully reunited after months of limited visits, according to WMUR.

In court on Friday, Eckersley was seen reunited with her son and the couple has been fully reunited after months of limited visits.

Eckersley faces charges including child endangerment after she gave birth to her now one-year-old son in a wooded area in December 2022.

Her attorney Kim Kossick told the outlet, “She had a baby that she didn’t know she was having.”

‘I think people should understand that there is room for compassion for people who have a medical emergency.

‘That’s really what this was. We have maintained it from the beginning.”

Kossick said Eckersley had remained sober since the day she gave birth and the two now live with her family in Massachusetts.

He added: “She’s done all the things she’s supposed to do.” She has gone to treatment. She has done everything she was asked to do.

‘That’s why he is reunited with his son. She has been in rehab. She’s done all the counseling.’

The hearing was reportedly going to focus on the use of expert witnesses in his upcoming trial, but has been postponed until next week. With a trial set for July.

Eckersley allegedly misled police for 73 minutes, telling them that the baby was born near the West Side Ice Arena around midnight, before they finally arrived at the store he shared with George Theberge near the Piscataquag River on Electric Street.

Eckersley was found wearing blood-stained clothing and under the influence of drugs, according to reports.

Alexandra diverted the police at first and after an hour they found the baby struggling to breathe and naked in 18 degree weather.

Eckersley claimed she did not know she was pregnant and gave birth in the store with Theberge present.

When asked why she didn’t take her baby to the bridge to meet the police after making the 911 call, she responded: ‘What do they tell you when a plane crashes? Save yourself first.’

Officers found their baby lying on the floor next to the bed, behind a blanket, after they “noticed a trail of blood that appeared to run down the side of the bed,” according to the police report, seen by the boston globesaying.

Eckersley was found wearing blood-stained clothing and under the influence of drugs, the outlet reported.

Eckersley claimed she did not know she was pregnant and gave birth in the store with Theberge present.

She also told police that the baby “cried immediately after birth, however it was less than a minute,” according to the police report. “Once she gave birth, she didn’t know what to do,” police said.

Last August, Theberge was sentenced to a minimum of one year in prison for endangering the baby’s life.

Theberge pleaded guilty to the misdemeanor charge of child endangerment after reaching a deal with prosecutors.

He received an additional six months behind bars for a probation violation stemming from his arrest in January and a drug charge.

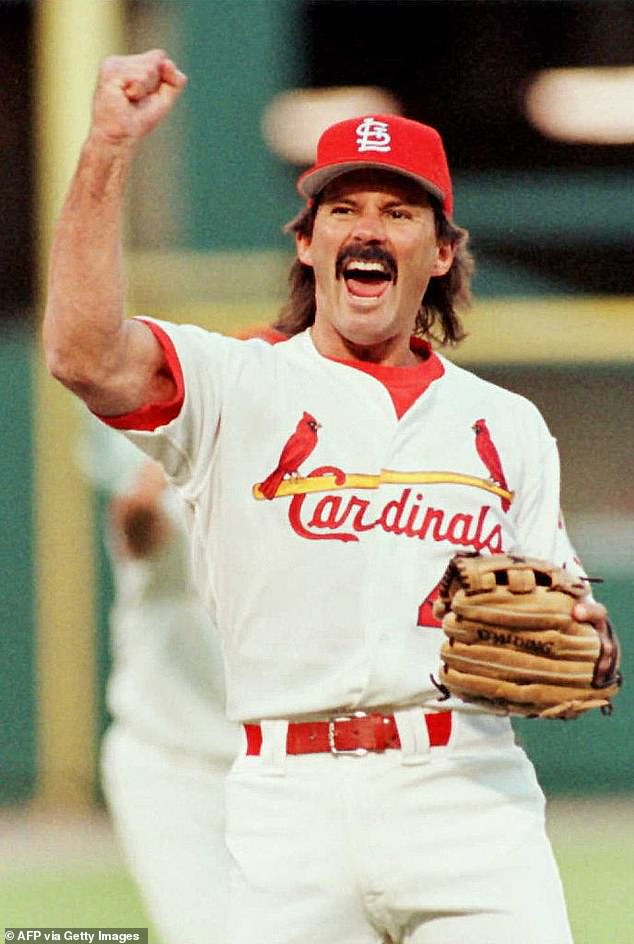

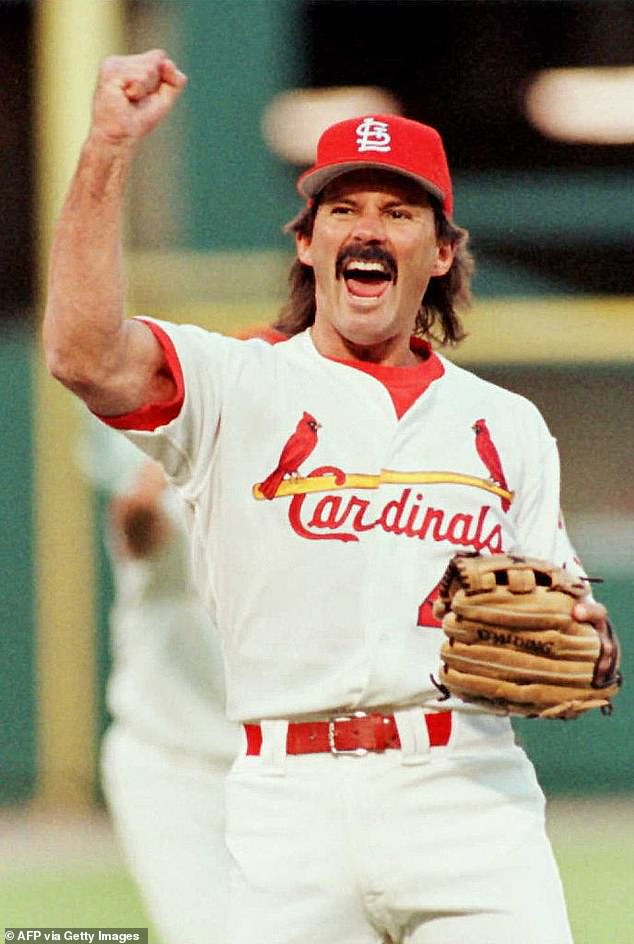

Eckersley’s father, Dennis Eckersley, nicknamed ‘Eck’, was an American former professional baseball commentator and pitcher.

Last August, Theberge was sentenced to a minimum sentence of one year in prison for endangering the life of the infant.

Dennis Eckersley, nicknamed ‘Eck’, was an American professional baseball pitcher and former commentator who adopted Alexandra with his ex-partner Nancy O’Neil.

Between 1975 and 1998 he pitched in the MLB for the Cleveland Indians, Boston Red Sox, Chicago Cubs, Oakland Athletics and St. Louis Cardinals.

Between 1975 and 1998 he pitched in the MLB for the Cleveland Indians, the Boston Red Sox, the Chicago Cubs, the Oakland Athletics and the St. Louis Cardinals.

The 68-year-old rose to prominence after becoming the first of two pitchers in Major League history to have a 20-win season and a 50-save season in their career.

He played 24 seasons and was inducted into the Baseball Hall of Fame in 2004.

The Eckersley family released a statement at the time of her arrest saying they had no prior knowledge of Alexandra’s pregnancy. They said she had suffered from “serious mental illness all of her life” and did everything they could to get her help and support.