Shark Tank star Barbara Corcoran has revealed when house prices will skyrocket.

The self-made real estate millionaire said a drop in interest rates is key to lowering the cost of borrowing and attracting buyers who will drive up prices.

The ‘magic number’ is a 1 percent drop to bring mortgage rates below 6 percent.

“If rates go down, just another percentage point, prices will skyrocket,” Corcoran said in a fox business interview on Wednesday.

‘Everyone will go out and buy. “There are probably 10 buyers on the sidelines (for every house on the market) waiting for interest rates to go down,” he continued. “So everyone is going to charge the market.”

According to the latest data from government-backed lender Freddie Mac as of March 21, the average 30-year fixed-rate mortgage is 6.87 percent.

This is down from the 8 percent rates seen in October of last year, but still double the historically low rates of around 3 percent seen during the pandemic.

What will it take to get the mortgage rate to fall below the 6 percent that Corcoran considers “the magic number that gets people excited?”

While the Federal Reserve does not directly set mortgage rates, the benchmark borrowing rate it sets indirectly influences the amount Americans pay for a loan to purchase a home.

Mortgage rates track 10-year Treasury yields, which are determined by a variety of factors including inflation, economic growth and the Federal Reserve’s benchmark funds rate.

The Federal Reserve left interest rates unchanged for the fifth straight meeting earlier this month, keeping benchmark borrowing costs at a 23-year high between 5.25 and 5.5 percent.

The Federal Reserve’s series of aggressive rate hikes were aimed at pouring cold water on runaway inflation, which peaked at 9.1 percent in June 2022.

At their last meeting, Fed policymakers planned cuts of three-quarters of a percentage point by the end of the year, but did not commit to a date when they could begin cutting rates.

If interest rates fall, this will have an impact on mortgage rates.

But Corcoran warned Americans that instead of getting a cheaper deal when rates drop, the housing market could actually heat up.

Corcoran warned Americans that if interest rates fall, it will mean that home prices will rise even more as purchasing demand suddenly skyrockets.

According to the latest data from government-backed lender Freddie Mac as of March 21, the average 30-year fixed-rate mortgage is 6.87 percent.

“If you wait for interest rates to go down another point, I don’t think you’ll win, I think you’ll end up paying more because I wouldn’t be surprised if real estate goes up another 8 or 10.” percent if interest rates drop another point,” he said.

High mortgage rates and a historic shortage of homes for sale have meant that home prices are already high, leaving many Americans out of the market.

In 2023 alone, the US housing market gained $2 trillion in value.

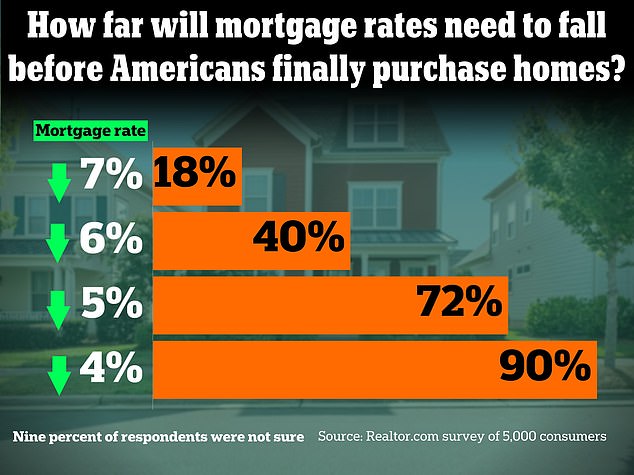

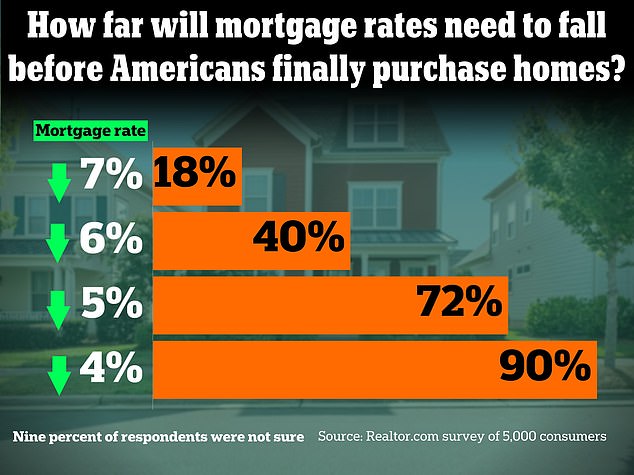

Corcoran’s comments come after a survey by real estate listings company Realtor.com revealed that most home buyers would need mortgage rates to drop to 5 percent before proceeding with a purchase.

About 72 percent of potential home buyers said pulling the trigger would be feasible if mortgage rates fell below 5 percent.

According to the survey of 5,000 American consumers, conducted during the first week of November, when rates were at their highest, about 18 percent of Americans said they were expecting rates to fall below 7 percent.

If they fell below 6 percent, an additional 22 percent of respondents said they would buy a home.

But the vast majority – about 72 percent – said rates would have to drop below the “magic” mortgage rate of 5 percent before they would sign the dotted line to buy a home.