Apple has shut down a popular feature just a year after launching it, dealing a blow to iPhone users.

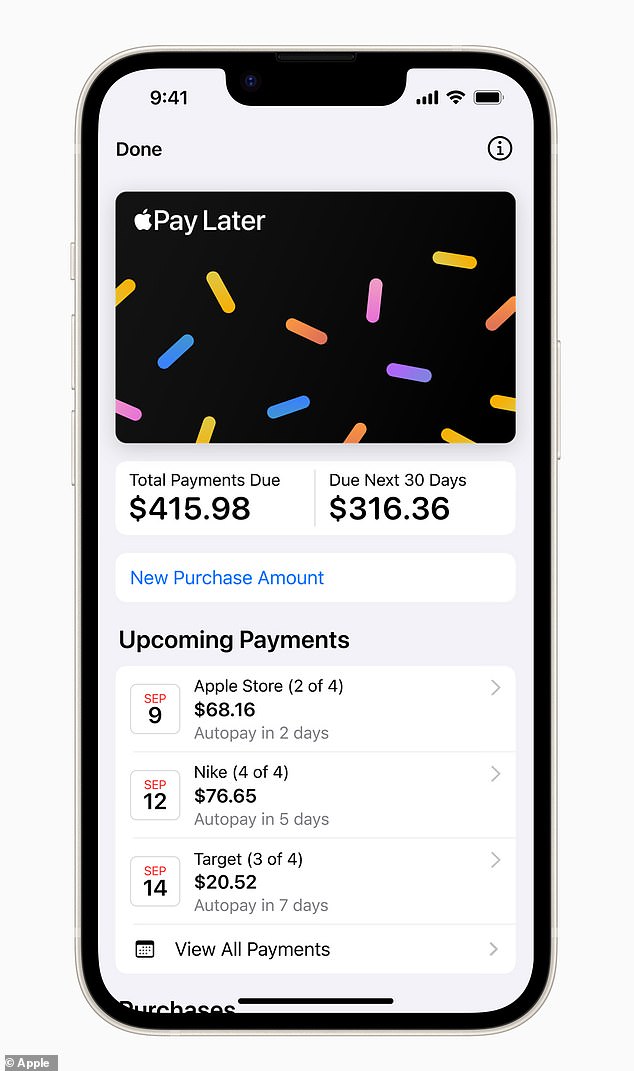

The tech giant removed its “buy now, pay later” feature from Apple Pay, which allowed users to apply for loans for purchases of up to $1,000 and pay them off in four installments over six weeks.

While the option is no longer available, consumers who have existing loans will not be affected.

Apple’s decision to cancel its “buy now, pay later” service comes as it said it plans to introduce a similar program in the fall that will allow users to access loans provided by eligible credit and debit card companies.

Apple announced it was ending the “pay later” option on Tuesday, but clarified that people who have taken out existing loans will not be affected.

“Starting later this year, users around the world will be able to access installment loans offered through credit and debit cards, as well as lenders, when paying with Apple Pay,” Apple said. 9to5Mac.

Instead of working as a lender, Apple will focus on helping users get other lending options that “will allow us to bring flexible payments to more users, in more places around the world, in collaboration with Apple Pay-enabled banks and lenders.” “. the company added.

This option will be available in the US with the Discover credit card and retail loan lenders Synchrony Financial and Fiserv Solutions, which can be accessed directly through Apple Pay.

The new feature will also allow users to apply for a loan with Affirm, a buy now, pay later lender that offers short-term loans for online and in-store purchases.

Users will be able to add the loan option during checkout, allowing them to apply for the loan through a credit card and loan service or directly through Affirm.

The new loan feature will continue to skip hidden fees, offer zero percent interest and allow users to split payments into four installments to be paid over six weeks.

According to a June survey According to LendingTree, about 13 percent of 889 respondents said they had used Apple’s buy now, pay later feature, while one in three Americans said they had considered taking out an installment loan.

Users in Australia, Spain and the United Kingdom, who previously did not have access to Apple’s buy now, pay later feature, will also have access to installment payment options starting in the fall.

The ‘buy now, pay later’ feature (pictured) allowed users to split payments of up to $1,000 into four installments that would be settled within six weeks.

Apple launched ‘early access’ to the feature in March 2023, issuing the loans itself, but it didn’t officially launch until October.

The partnership with former competitor Affirm could help the company expand its lending program to offer longer-term repayment options, according to JPMorgan analyst Reginald Smith.

‘Affirm does not expect a significant impact on FY25 revenue. . but it’s hard to imagine that adding a platform of this magnitude won’t change the situation,” Smith wrote last week, according to the Financial times.

The move to partner with Affirm and other credit and debit card companies to replace buy now, pay later was unveiled at the Worldwide Developers Conference in California last week.

DailyMail.com has contacted Apple for comment.