<!–

<!–

<!– <!–

<!–

<!–

<!–

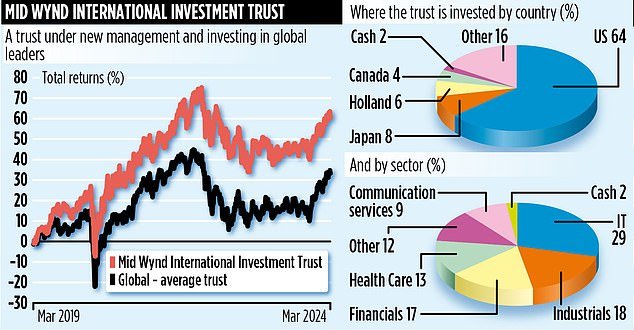

Everything has changed at the Mid Wynd International investment fund over the past six months. New trustees were appointed, the fund’s portfolio was revamped and trust charges were reduced.

Although it is too early to assess whether the transformation will result in higher returns for shareholders, the new fund managers are confident that the upgrade will benefit investors.

“Our philosophy is simple,” says Louis Florentin-Lee, who, along with Barnaby Wilson, now runs the £411m trust which is listed on the London Stock Exchange. “Big companies can make big investments.”

The duo work for Lazard Asset Management, which won the race to take over the trust last October. They ousted investment house Artemis after the trust’s board became concerned when managers assigned to the fund left the company.

Lazard’s approach is based on identifying “quality growth” companies: global businesses that generate long-term sustainable profits from the capital they employ, thereby creating value for shareholders. It is an investment strategy that Lazard developed 13 years ago, and assets worth £1.6bn are managed in line with that mandate.

“Investment theory asserts that market dominance cannot persist because of the laws of competition,” says Florentin-Lee. ‘We fundamentally disagree with this. Some companies are able to build strong moats around what they do and, as a result, prosper over the long term and withstand competitive forces.’

Lazard says there are more than 200 quality growth companies it tracks. All of them are characterized by operating in markets where entry barriers make it difficult for competitors to effectively challenge the status quo. They all also have the ability to continue making profits and reinvesting in their businesses.

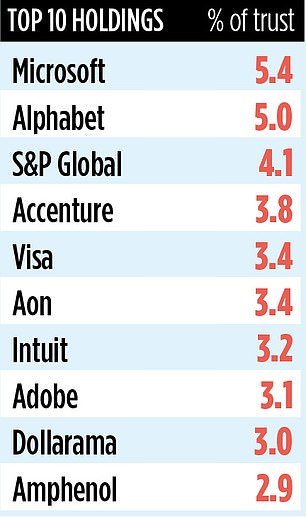

The only differentiator is their market valuation, which determines whether Lazard buys, holds or sells them. Mid Wynd currently has 41 holdings, of which only six remain from the Artemis era. A recent addition to the portfolio is Swiss-listed VAT Group, a producer of vacuum tubes used in semiconductor manufacturing.

“Valves play a critical role in ensuring that the semiconductor production process is not affected by dust particles,” says Florentin-Lee. ‘IVA has a 75 percent market share and supplies companies such as Dutch giant ASML and Taiwan Semiconductor Manufacturing Company. Its importance is such that it is often included in the design of new products.’

Another holding company acquired last October is US-listed Amfenol, a manufacturer of electronic and fiber optic interconnectors used in the aerospace and automotive industries.

“Without them, your laptop wouldn’t work,” says Wilson. “Amfenol is known for the quality of its products and its position in the market is such that it generates high returns on the capital it employs.”

Only one UK-listed company falls into Mid Wynd’s portfolio: analytics firm RELX. But bosses insist there are many “high-quality British companies” on their watch list. In terms of profitability, Florentin-Lee and Wilson have generated respectable shareholder returns of 10 per cent over the last six months. But their strategy is largely focused on the long term: The companies they buy tend to last seven to ten years.

The fund’s overall annual charges are 0.62 per cent, lower than when Artemis was manager. Income generation is of secondary importance with payments equal to one percent annually. The stock market identification code is B6VTTK0 and the symbol is MWY.