As the United States anxiously waits to see the results of the presidential election, another key decision will be made this week that will affect the finances of millions of Americans.

The Federal Reserve, led by its chairman Jerome Powell, will announce on Thursday whether it will cut interest rates again this year. The decision is based on a vote of the 12-member Federal Reserve committee.

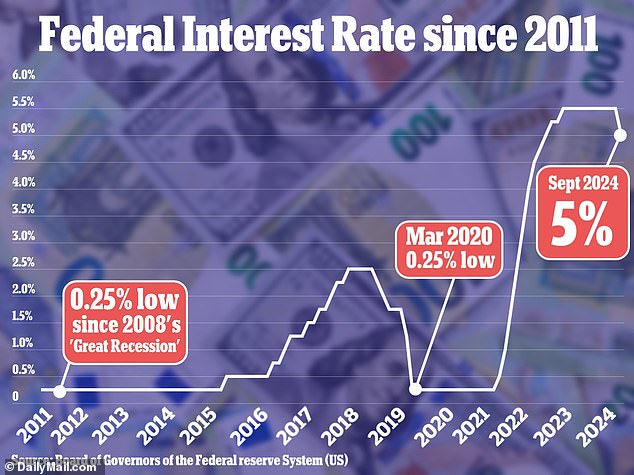

The central bank cut rates in September for the first time since the early days of the Covid-19 pandemic in 2020.

It also cut benchmark borrowing costs by the most in 16 years, lowering rates to between 4.75 percent and 5 percent with a 50 basis point cut.

Investors are almost certain that the Federal Reserve will make another cut at its November meeting, but it will be a more modest decrease.

The Federal Reserve, led by its chairman Jerome Powell, will announce on Thursday whether it will cut interest rates again this year.

According to the CME FedWatch tool, which forecasts interest rate changes based on market predictions, investors have priced in a 98.8 percent chance of a standard 25 basis point cut on Thursday.

At an event in Nashville in September, Powell said that if the economy performed as expected, then the Federal Reserve would likely cut interest rates two more times this year.

At the time of his comments, the November and December meetings were the only two remaining in 2024, so economists forecast a 25 basis point cut in each.

There could also be additional such measures from policymakers next year, which would make borrowing money less expensive, taking some of the pressure off consumers’ wallets.

While the Federal Reserve rate does not directly affect loan and credit card rates, it does strongly influence them.

Lower rates are also generally considered good for businesses: When they go down, the stock market goes up, which will help boost 401(K) plans invested in major indexes.

However, there may be a delay before credit card companies, for example, pass on lower rates to customers. And despite falling borrowing costs, mortgage rates have actually risen in recent weeks.

Since September, there have been several sets of economic data indicating that the economy is on solid ground, paving the way for a rate cut.

The economy far exceeded job growth expectations in September, adding 223,000 jobs and dashing economists’ expectations. The unemployment rate also fell to 4.1 percent that month.

Inflation has slowed to 2.4 percent according to the latest September data, moving closer to the Federal Reserve’s 2 percent target.

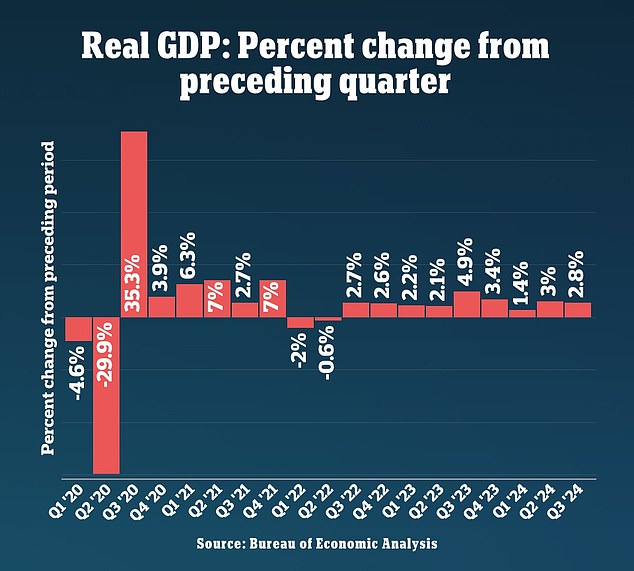

Gross domestic product (GDP) also expanded at an annual rate of 2.8 percent in the three months between July and September, slightly below an annual growth rate of 3 percent in the second quarter.

GDP, which is a measure of all goods and services produced over a period of time, was slightly below economists’ expectations for the third quarter.

But U.S. growth this year is expected to outpace other advanced economies such as Germany, France and the United Kingdom, according to recent estimates from the International Monetary Fund.

One economic piece of data that seemed less positive was the October employment report, which was released last week.

The central bank cut rates in September for the first time since the early days of the Covid-19 pandemic in 2020

The economy far exceeded job growth expectations in September, adding 223,000 jobs and dashing economists’ expectations.

Gross domestic product (GDP), which is a measure of all goods and services produced, expanded at an annual rate of 2.8 percent between July and September.

Job creation last month slowed to its weakest pace since December 2020, a Labor Department report revealed Friday.

Employers added approximately 12,000 jobs in October, missing estimates of a 100,000-job gain by a huge margin.

However, the Boeing strike and the devastating impact of hurricanes Helene and Milton had an impact on the numbers, the Bureau of Labor Statistics said, and the stock market largely ignored the weak data.

Unemployment in October was also unchanged from the previous month at 4.1 percent.

“For policymakers, this report isn’t likely to change plans much, but we can probably expect to see more interest rate cuts and labor market support on the horizon,” said Cory Stahle, an economist at the Indeed Hiring Lab. , on Friday.

A cooling labor market and slowing price growth give the Federal Reserve “more confidence in its ability to cut rates without reigniting inflation,” said Julia Pollak, chief economist at ZipRecruiter. Insider business information.

Some economists believe the U.S. economy has already achieved a rare “soft landing,” which occurs when rampant inflation is brought under control without tipping the economy into a recession.

Some economists believe the U.S. economy has already achieved a rare “soft landing,” which is when runaway inflation is brought under control without pushing the economy into a recession.

Trump has threatened to meddle in the Federal Reserve’s normally independent interest rate decisions if he becomes president.

While it is still unclear who won Thursday’s presidential election, Powell will announce the Fed’s decision anyway.

He has repeatedly told reporters that policy remains separate from decisions made by the central bank.

The Federal Reserve’s future actions could become more unstable once a new president and Congress take office in January, particularly if Donald Trump wins a second term.

The former president’s proposals to impose tariffs on all imports and launch mass deportations of unauthorized immigrants could reignite inflation, economists warned.

Higher inflation, in turn, would force the Federal Reserve to slow or stop its rate cuts.

Trump has also threatened to meddle in the Federal Reserve’s normally independent interest rate decisions if he becomes president.

“I think the president should at least have a say,” he said during his campaign cycle.

“In my case, I made a lot of money, I was very successful, and I think I have better instincts than, in many cases, the people who would be on the Federal Reserve or the president.”