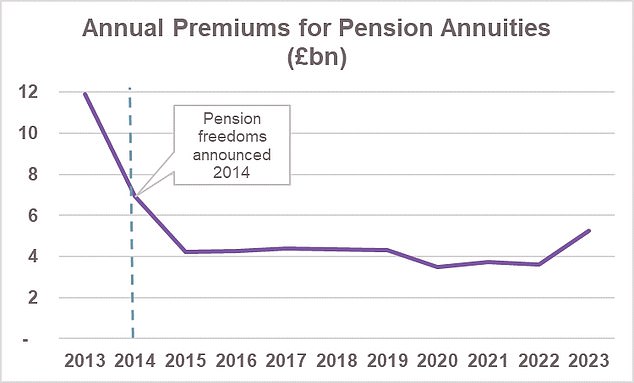

Annuity sales rose 46 per cent to £5.2bn last year following a strong recovery in the retirement income they can buy, new industry figures reveal.

The number of annuities purchased rose by a third to 72,200, as interest rate increases led providers to offer much better deals.

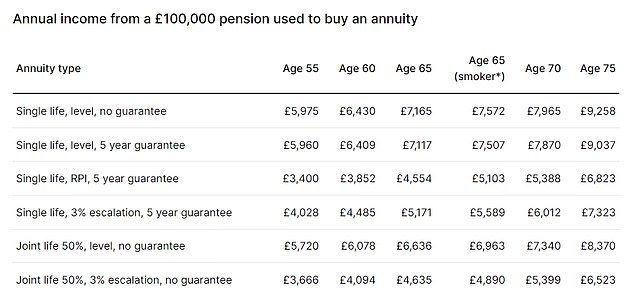

For £100,000, a healthy 65-year-old can earn an income of more than £7,000 a year, according to data from Best Buy (see below).

Annuity Sales: The recent series of interest rate increases to combat inflation means that annuity providers can afford to finance much more attractive arrangements.

Annuity sales in 2023 hit the highest level since pension freedom reforms in 2015 caused most retirees to begin living off funds invested in old age.

Industry body the Association of British Insurers says sales were £1.5bn in the final quarter of the year, after a strong third quarter in which sales were £1.4bn million pounds sterling.

> Should you buy an annuity? Find out what to consider next

Annuities provide a guaranteed income until your death.

But they were shunned for years due to low fees and restrictive conditions, and after earning a bad reputation in the wake of annuity mis-selling scandals.

The 2015 pension freedom reforms led most savers to keep their funds invested and live off the withdrawals, despite the financial market risk it implied.

However, the recent spate of interest rate increases to combat inflation means annuity providers can afford to fund much more attractive deals, prompting a resurgence in sales.

Industry figures show that for £100,000, a healthy 65-year-old can now buy a retirement income of around £7,120 a year, with no inflation protection and a five-year guarantee period, protecting their cash immediately after purchase.

For the same sum, the same person with a spouse three years younger could buy an inflation-protected but unsecured joint annuity providing £4,640 a year, according to the latest data from Hargreaves Lansdown (see below).

Source: Best Buy industry figures from Hargreaves Lansdown, February 15

The ABI says: ‘With six providers now offering annuities to new customers, in 2023 also 64 per cent of annuity buyers shopped around, taking an annuity from a different provider to the one where their pension savings were held.

“However, only 29 percent of clients who purchased an annuity did so with the help of professional advice.”

Emma Watkins, managing director of retirement at Scottish Widows, said: “As defined contribution pensions become the main source of private retirement savings, recent volatile market conditions, combined with increased awareness of rates of higher annuities currently offered, have made annuities even more attractive. , particularly in light of the declining cost of living and the trend of people living longer.

‘Throughout 2023, this was due to sustained increases in interest rates, which led to better deals in the annuity market and, with interest rates appearing to remain higher for longer, the attractiveness of the annuities will be maintained.

ABI figures: Some 353,000 annuities worth £11.9bn were sold in 2013, before pension freedom reforms opened up the possibility of keeping the fund invested.

Pete Cowell, head of annuities at Standard Life, says: “Annuities have benefited from rising interest rates and it is clear that clients and advisers are responding to this and seeing the benefits of having a guaranteed income as part of an broader mix of retirement income. solutions.

‘It’s important to remember that retirement income planning doesn’t have to follow a “once done” approach. While an annuity cannot be changed once it is set up, there are several annuity options available and different ways to use them.

‘Annuities can also be purchased in stages during retirement or later in life, to help combat the effects of inflation on hard-earned savings.

‘People should remember the importance of comparing prices when looking for the best rate.

“While people can always consult a financial advisor to help them begin making decisions about which types of annuities are best suited for their needs, there is also free, impartial guidance available from Wise pensiona MoneyHelper service.’

> Should you buy an annuity? Find out what to consider below and explore how to invest your pension and how to combine pension drawdown with annuities.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.