It is the question on everyone’s mind when he or she retires: how can you get the most out of your retirement savings?

Most workers will have unlimited access to their pension from age 55 and will receive little expert help in making big decisions about how the money is spent or invested, where it is kept and how much income they can afford themselves.

Ten years ago, then Chancellor George Osborne announced that savers would be given the keys to their pensions, under a major shake-up known as ‘pension freedoms’.

Until 2015, when those freedom rules came into effect, most retirement savers had to use their retirement savings to buy an annuity. You give a company a fixed amount from your pension in exchange for a guaranteed annual income until your death.

Since then, savers have had the option to tap into their pension pot instead and withdraw as much as they want, whenever they want. But it’s a fine balance: spend too much and you risk running out of money too quickly, but spend too little and you’ll miss out on the fruits of decades of hard work.

Life is a beach: what is the best strategy for your finances later in life: annuity or withdrawal?

The number of people taking out annuities has plummeted in the wake of pension freedoms and low interest rates, but contracts have seen a recent revival as interest rates have risen, with sales up 46 percent last year. And there’s something to be said about the peace of mind that securing a guaranteed income gives you.

So, what’s the best strategy for your finances: annuity or withdrawal? Wealth & Personal Finance crunched the numbers to see which would make you richest.

Ten years after the announcement of the ‘pension freedoms’, the first cohorts to face this choice will today be in their sixties and seventies. With the help of experts from pension company Aon, we looked at how they fared, depending on the option they chose.

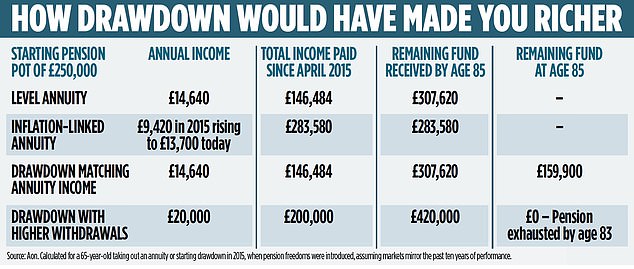

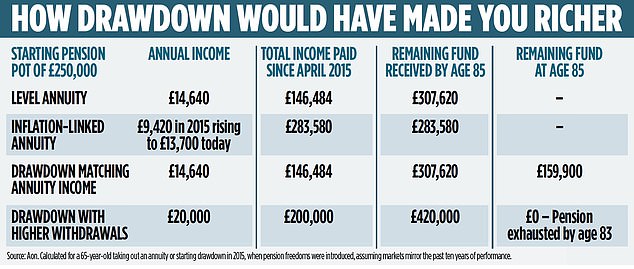

A 65-year-old with £250,000 in pension in 2015 could have an annual income of £14,640 (£1,220 per month) if he had used his entire pot to buy an annuity. Since then, they are said to have received a total income of £108,640 over the past nine years, according to Aon.

If they had put their £250,000 into a withdrawal account and taken exactly the same annual income of £14,640, they would still have £212,300 in their account today at the age of 74. That’s because any money that isn’t withdrawn is typically invested in the stock market and therefore continues to grow every year.

Aon’s calculations assume that 40 percent of pension savings is invested in global shares and 60 percent in bonds. This is a typical portfolio composition for someone in retirement, although retirees can choose to increase or decrease their equity holdings depending on whether they want to take on more or less risk.

If they continued to withdraw the same amount, by the time they turned 85 (the average male life expectancy for 65-year-olds today) they would still have £159,900 in their withdrawal account, based on past investment performance. Crucially, this leftover money can be passed on to family members tax-free as part of an inheritance, unlike annuities where payments typically end upon your death.

Some annuities are paid to a spouse after the holder dies, but these are more expensive. If the pension holder dies before the age of 75, no tax is due at all. Otherwise, recipients only pay income tax at their marginal rate.

This means that the pensioner who opted for a withdrawal could have taken a higher income during retirement than the £14,640 per year they would have received with an annuity.

The larger the pension, the greater the gap between the income you can receive with an annuity and the withdrawal. But it’s a fine line: if you take too much, your pension will be depleted prematurely.

For example, if the 65-year-old were to withdraw £20,000 a year – equivalent to 8 per cent of their pension pot – they would run out of money at the age of 83. That leaves them potentially two years short, while they are solely dependent on the state pension.

But by then they would have had a combined income of £420,000, compared to just £307,620 with the annuity. The full new state pension currently pays £10,600 a year and will rise to £11,500 on April 8, 2024.

Although drawdown seems to be the winning strategy, there are some important factors to consider before diving in.

Steven Leigh of Aon says: ‘In retrospect, it’s easy to say that using flexible withdrawals with reasonably high investment allocation growth seemed to have been a better option for many people accessing their retirement savings in 2015. But this doesn’t tell the whole story.

‘While there is the possibility of a better outcome with a withdrawal, unlike an annuity, there are no guarantees as to what will happen to your money in the future.’

If you leave your pension pot invested, your money could be at risk in the event of a major stock market crash. However, with an annuity you always receive the same income, even during economic turbulence.

Your life expectancy will also play a major role. It’s impossible to say how long you’ll live, but if you’re healthy and live well into your 90s, you’re more likely to run out of money with a withdrawal account. While the annuity covers you until the end of your days – however far that is.

Annuity rates have risen in line with rising interest rates over the past two years after being at a long low.

For years, annuities were so low that it was unlikely that most buyers would get back their initial investment.

This means your money will give you a much greater guaranteed income today. But the enormous leap they have made in the past twelve months is especially impressive.

Someone trying to achieve a moderate lifestyle in retirement on an income of £26,700 a year would have needed £643,000 in March 2023, according to calculations by asset manager RBC Brewin Dolphin.

But today they would only need $475,800 to buy that same annual income – that’s $167,200 less than last year.

Carla Morris, wealth director at RBC Brewin Dolphin, says annuities are “looking attractive” at the moment. She adds: ‘Annuities provide certainty – and that can be especially reassuring if you’re concerned about recent stock market volatility.’

Someone with £250,000 in pension today could buy an income of £15,193 a year. This is £553 more per year than anyone could have secured in 2015, but it is not appreciably higher.

So even though they are more attractive today, it is unlikely that this will be enough to defeat a drawdown strategy.

Ms Morris added: ‘Annuities are inflexible; you can’t change your mind once you buy an annuity, and you can’t adjust your income to reflect changes in your circumstances.”

Big decisions: Choosing the right retirement option can be difficult. That’s why we’ve listed your options

So should you spend money on inflation protection? Most annuities sold are “level,” meaning they pay out the same fixed amount of income for the rest of your days, without increasing as consumer prices rise.

This leaves you exposed to the damaging effects of inflation, with little means to protect your purchasing power.

You can buy ‘escalating’ or ‘indexed’ annuities, which increase by a fixed amount annually or in line with consumer prices.

However, these are usually unpopular because the income you receive at the start of the policy will be much lower than that from an annuity. And restraint on these contracts would have proven correct over the past decade.

According to Aon, a 65-year-old with a pension of £250,000 who took out an inflation-linked annuity in 2015 would have received a starting income of £9,420 (versus £14,640 for a flat annuity).

That income would now have risen to £13,700, meaning those on this policy would still be waiting to catch up on the income from the annuity. Even if income is maintained, it can take years to recoup the money they have missed over the years.

The good news for those who are still on the fence is that there is a third option, which means the annuities versus tapering debate is not as black and white as it seems.

You do not have to use your entire pension pot to buy an annuity. With part of your pension you can buy a guaranteed income, with which you can supplement your AOW pension and cover the costs of your daily necessities.

This gives you the peace of mind that all your basic expenses will be covered throughout your life.

You can leave the rest in a drawdown pot, which you can then dip into as and when you need extra money.

This gives you the flexibility to take out lump sums if, for example, you want to go on holiday in the sun, treat your loved ones to birthday gifts or if you need a new car.

- You can make an appointment for free impartial guidance with the government’s pension service, Pension Wise, at moneyhelper.org.uk.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.