Trans TikToker Dylan Mulvaney has posted a late-night rant almost a year after the Bud Light debacle, in which she insists that she has a lot of work ahead of her and that her ’15 minutes’ of fame are not over.

Mulvaney, whose alliance with the beer maker last year sparked a costly boycott by conservatives, was reacting angrily to an online critic who had declared his “15 minutes were almost up.”

Clad in his pajamas, rolling around in bed and repeating himself, Mulvaney waved off the troll, pretending to look at a wristwatch, saying, “I think it’s been a little over 15 minutes, honey.”

Mulvaney insisted his career is progressing despite the Bud Light backlash, which saw the drink lose its position as the best-selling beer in America.

Tossing and turning in bed and grimacing, Mulvaney insists that he has a lot of work ahead of him, but he doesn’t say what it is.

“Seeing as I’m scheduling things two or three years out … I think it might be a little longer,” than 15 minutes, Mulvaney, 27, said.

Mulvaney held the phone up to his face and concluded in a creepy voice: “The longest 15 minutes of your life.”

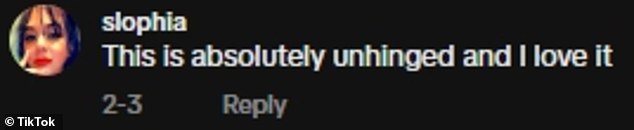

The post has been viewed 1.4 million times and received nearly 2,400 comments, many of them from die-hard fans who said they are ‘LMAO’ and liked ‘Dark Dylan’s’ sassy personality.

But others among Mulvaney’s 10.2 million followers pointed out his erratic showmanship, rolling around in bed, grimacing and repeating words in a way that suggested intoxication.

“This is absolutely insane,” one viewer posted.

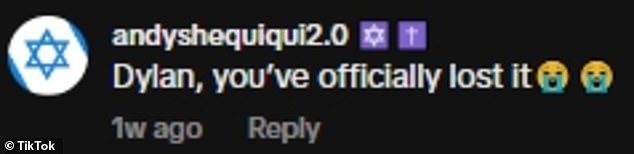

“Dylan, you’ve officially lost it,” said another.

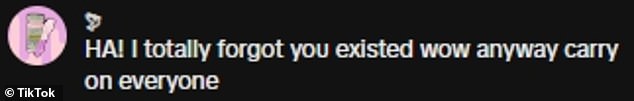

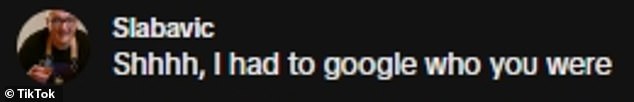

Others said Mulvaney’s ’15 minutes of fame’ – a phrase about the fleeting nature of the celebrity associated with 1960s artist Andy Warhol – was quickly coming to an end.

‘HA! I completely forgot you existed. Wow anyway, keep going,” one reviewer posted.

“Shhhh I had to Google who you were,” wrote another.

The late-night rant comes nearly a year after Mulvaney’s disastrous alliance with Bud Light, which sparked a boycott and cost the company nearly $400 million in U.S. sales.

In the late-night post, Mulvaney pretends to look at a clock and claims his 15 minutes of fame aren’t over

Many TikTok viewers commented on Mulvaney’s bizarre performance, calling it “unhinged.”

Another mocked Mulvaney’s failed beer relationship, saying: “How’s that bud light stock working out for you?”

Mulvaney, an unemployed theater artist, rose to internet stardom in 2022 by launching her hit TikTok series, Days of Girlhood, in which she documents her transition from a young man to a “girl.”

She has made millions of dollars promoting cosmetics, fashion and other products, appeared with President Joe Biden at the White House and appeared alongside Hollywood celebrities.

He broke out last April, when he posted a video to promote a Bud Light giveaway, saying the company had sent him a tall can with his face on it to celebrate his gender change.

This angered conservatives, who said one of their favorite beers had become “woke.”

They criticized on social media and boycotted the drink, costing parent company Anheuser-Busch $400 million in sales, a 13.5 percent drop.

Musician Kid Rock, NFL player Trae Waynes and model Bri Teresi were among the high-profile faces who stoked outrage, filming themselves shooting beer cans.

Mulvaney ends the post by holding the phone up to his face and saying in a creepy voice that it’s the “longest 15 minutes of your life.”

Mulvaney addressed a half-empty auditorium at Penn State in December, where he revealed plans for a one-man show.

The fallout led to a devastating streak for Bud Light, where it suffered repeated double-digit revenue declines on an almost weekly basis.

Mulvaney earned $2 million from promotional work last year, landed deals with Nike and Mac, and appeared at the Golden Globes in January.

In December she was named to Forbes’ 30 Under 30 list.

The magazine praised her for resisting Bud Light’s fallout, and Mulvaney criticized the beer company for throwing her to the wolves.

“I was waiting for the brand to contact me but they never did,” Mulvaney posted on Instagram.

‘For a company to hire a trans person and then not publicly support them is worse than not hiring a trans person at all.

“It gives clients permission to be as transphobic and hateful as they want.”

Still, it’s unclear what big projects Mulvaney has in the pipeline “two or three years from now,” he said in this month’s TikTok rant.

In December, he addressed a half-empty auditorium at Penn State, where he revealed plans for a one-man show.