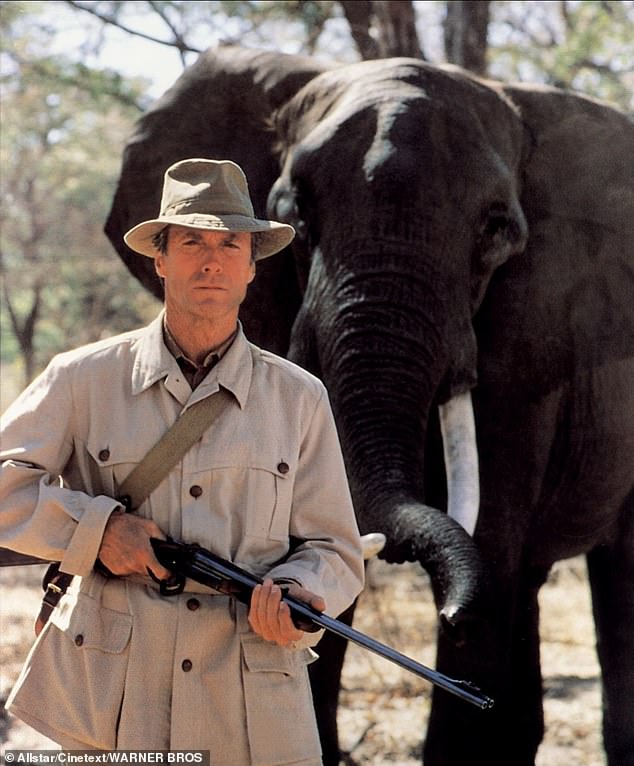

For Clint Eastwood, the bull elephant Abu was a natural in front of the cameras, a born pro. The Hollywood star-turned-director dubbed him “one-take Abu.”

Rescued from a wildlife park in Texas and given a new life in Botswana’s Okavango Delta, the giant tusker appeared in Eastwood’s famous 1990 film White Hunter Black Heart, as well as a succession of films and television shows, as well as in an IBM commercial.

But for a three-year-old orphaned elephant named Mafunyane, Abu played a different role. He was a father figure to the youngster, following him everywhere and copying everything he did.

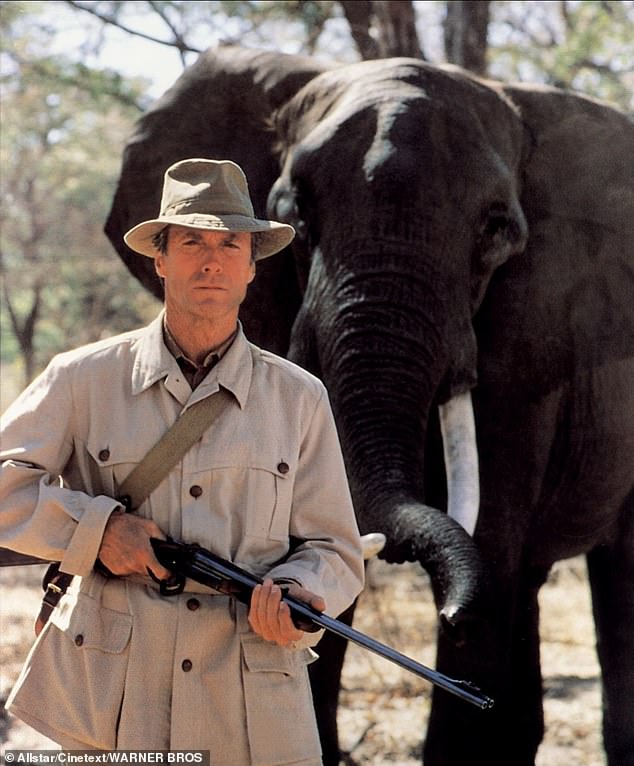

An Asian elephant calf found almost entirely buried head down in India. Five young elephants have been found buried in ditches like this in West Bengal since 2022

When Abu died in 2002, Mafunyane was grieved. For days, he watched over the body, keeping the hyenas at bay. Other elephants came to pay their respects to Abu. One of them, an older female named Cathy, was standing, the temporal glands on the sides of her head dripping with fluid. Just like humans cry tears, this is how elephants express their intense emotions.

Even today, twenty years later, Mafunyane still pauses when he passes the entrance to Camp Seba, the safari center, where Abu’s skull is on display. The Rangers have no doubt that he recognizes the remains of his friend and mentor.

It may seem fanciful to suggest that elephants mourn deceased loved ones, but ample evidence is emerging that they and other animals – including primates and whales – feel loss as keenly as humans do. And, like us, they use rituals to come to terms with their grief.

Foresters and tea workers in northern India have long claimed that elephants bury their dead in legendary graveyards.

Now, a team from the Indian Institute of Science Education and Research in Pune has published results that appear to confirm these stories.

In an irrigation ditch of a tea plantation in Jalpaiguri, West Bengal, the body of a one-year-old calf was discovered in 2022, upside down and almost entirely buried.

It could be the result of an accident, but in the past 18 months, four more dead baby elephants have been found buried in ditches. All had marks on their skin indicating that they had been dragged some distance after their death.

The report’s authors, Parveen Kaswan and Dr Akashdeep Roy, believe this indicates deliberate burial, while emphasizing that this behavior was not directly observed.

All the young elephants were dead before being placed in their graves.

It is possible, but unlikely, scientists say, that the ditches then collapsed due to the weight of the herd around them.

Abu the bull elephant starring Clint Eastwood in his acclaimed 1990 film White Hunter Black Heart. The animal was so natural that Eastwood called it “one-shot Abu”

But African elephants have been observed covering their dead with branches and leaves, known as “low burial.”

Veteran wildlife filmmaker James Honeyborne said: “We may never know exactly what goes on in an elephant’s mind, but it would be arrogant to assume that we are the only species capable of feeling loss and sorrow.”

In 2013, he produced the Africa series by Sir David Attenborough, which caused a sensation with a sequence showing a mother and her starving calf in times of drought. Cameraman Mark Deeble followed the two men for days. Even after the calf died, the distraught female continued to try to lift and move it with her feet.

Finally, she seemed to understand that there was nothing more she could do. But instead of wandering off in search of the food she desperately needed, she simply stood over the body for a long time, as if paying homage.

Elephant bonds can match in intensity anything in the human world, and breaking these bonds can be fatal.

Dame Daphne Sheldrick runs a sanctuary in Kenya where baby elephants orphaned by poachers are hand-reared and returned to the wild. One of its first cases was reported only a few days ago. Lady Daphne devoted herself to the calf, barely leaving it for the first six months and feeding it gallons of human formula (elephant calves cannot digest cow’s milk).

But ultimately she had to leave someone else to look after him for a week, to attend her daughter’s wedding – and when she returned, she was devastated to learn the baby had died. He had wanted her before he collapsed, dead of a broken heart.

“I made the mistake of thinking that another human could replace me,” Lady Daphne said.

“Now, to prevent them from becoming too attached to one individual, all the keepers at the Sheldrick Trust take turns sleeping alongside each elephant in the nursery.”

It’s not just elephants who experience such emotions.

Just as humans cry, elephants display intense emotion when “tears” escape from the temporal glands on the sides of their heads.

At a 2022 funeral in Batticaloa, Sri Lanka, grieving relatives were moved to see a gray langur monkey sitting near the coffin. Taking the dead man’s arm, he raised his hand and let it fall. Then he leaned forward and nuzzled against her cheek, seeming to give her a mourning, farewell kiss.

The man’s name was Peethambaram Rajan, a kind 56-year-old man known for his kindness to animals, and this monkey was one of his favorites.

Apes react to death in a very human way. A 2021 study for the Royal Society, looking at more than 400 reported cases involving 50 species of primates, found that female monkeys mourned dead babies for days, cradling the corpse and carrying it around.

Chimpanzee society is so complex that researchers are constantly reporting new behaviors. A group in Guinea built a cairn of rocks at the base of a tree. “Perhaps we have found the first evidence that chimpanzees created a kind of sanctuary,” said Laura Kehoe, a doctoral student from Berlin.

Most of the best evidence comes from wildlife documentaries.

In 2019, filmmaker John Downer and his team built one of their signature “spy creatures”: a robotic baby langur with a camera in one eye for their series Spy In The Wild. The mechanical monkey was abandoned at a temple in Rajasthan, India, where it was found by a troop of langurs. One of the young females picked it up to play with, then dropped it from a height.

While the doll remained motionless, the adults gathered around it. It was clear that they thought the “baby” was dead. Little by little, they began to embrace and comfort each other, like mourners at a funeral. Parents grabbed their children and held them.

Perhaps the most compelling evidence of their “humanity” comes from a gorilla named Koko, who lived in captivity in California with researcher Dr. Francine “Penny” Patterson for more than 40 years.

Koko learned American Sign Language, with a vocabulary of 1,000 words or more, and was able to hold conversations with Dr. Patterson. In 1985, Koko received a kitten, a gray Manx who she named All Ball. She adored him, cuddled him and groomed him constantly.

When All Ball was crushed and killed, Koko was helpless.

She reacted with horror when Dr. Patterson announced the news, letting out a long moan that is the gorilla equivalent of a sob. On several occasions, she signed the words “sad”, “bad” and “frown”.

Later, Dr. Patterson asked Koko if she knew what death meant. The gorilla replied: “Trouble old…comfortable hole, goodbye…sleep.”

This strongly implies that the idea of physical burial is instinctive, hardwired into the primate brain.

Lady Daphne, widowed almost 50 years ago, says she learned from animals how to cope with grief.

She draws strength from the courage of her elephants “and the way they can turn a page, cry, cry and cry, and then focus on the living.” This is a lesson for every human heart.