Table of Contents

Legal & General, the £13.69bn FTSE 100 company that handles £1tn of retirement savings and other spending, is being restructured under chief executive Antonio Simoes.

It promises investors a “simpler, better connected L&G” and is restructuring the complex group to achieve this.

Plans include the sale of CALA, the homebuilding division acquired in 2018 in a diversification effort.

Curious to know that L&G is selling CALA now?

The government wants to build 1.5 million homes in this parliament.

But the policy will not bring immediate benefits and Portuguese-born Simoes wants to simplify L&G, which he sees as a way to boost shareholder returns. Persimmon is seen as the most likely buyer for CALA, at a price of around £1bn.

Any other changes?

Simoes wants to boost corporate pensions by securing “block annuity” deals. Companies are more interested in “de-risking” – that is, getting rid of the onerous liabilities that come with their company pensions.

They are willing to pay a sum to a major insurer, such as L&G or Aviva, to take full responsibility for the scheme.

Is L&G already a major player in the annuity market?

It is a powerful player. In 2023, L&G completed £12bn of annuity deals, including a £4.8bn purchase of Boots and a £2.7bn purchase of British Steel, the company’s fourth.

Actuaries estimate that around £50bn of pension liabilities will be released in 2023, and the total for this year could be £80bn.

Any other movements?

Another government policy should allow L&G to make the most of an area in which it specialises: investing in “private” assets, meaning companies not listed on stock markets.

As part of her pensions “Big Bang”, Chancellor Rachel Reeves wants pension funds to channel more money into such companies, particularly those in energy, road building and other infrastructure areas.

When L&G was founded in 1836, infrastructure was the focus. The Stockton & Darlington, the world’s first public railway, was one of its first initiatives.

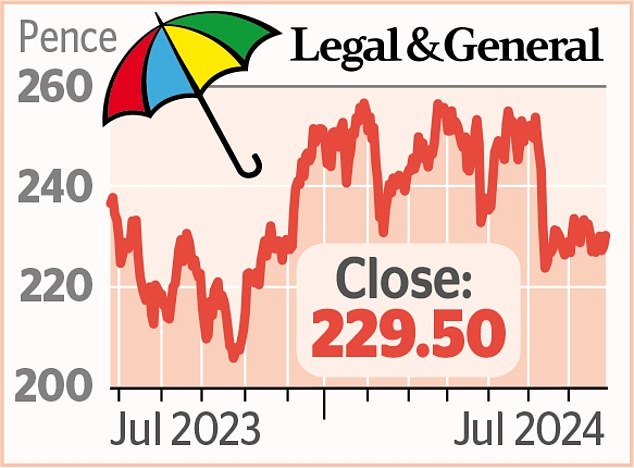

Exciting, but why has the stock price dropped this year?

Shares have fallen 9 percent since January, largely in response to news that dividends will not rise as quickly as expected.

Simoes could argue that a £200m share buyback is more than adequate compensation for the reduced payouts. (Share buybacks reduce the number of shares outstanding, which should give a boost to the price of the remaining shares.)

However, some shareholders remain unconvinced.

Where are the stocks headed?

Despite the dividend disappointment, analysts rate the stock as “hold” or “buy” with an average price of 266p, against 229.5p yesterday.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.