Forget the Magnificent Seven and FAANG: A new portfolio of tech stocks is ready for the moon, says one analyst.

The new group of stocks to watch features just three AI leaders: Microsoft, Nvidia, and now Meta.

The rising stock prices of big American technology companies over the past decade have been the driving force behind stock market and 401(k) gains.

The dominance, initially, of Facebook, Apple, Amazon, Netflix and Google led CNBC’s Jim Cramer to call them FAANG.

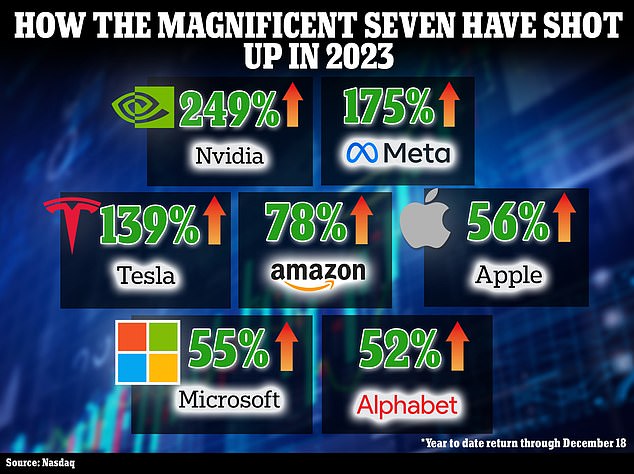

Last year, the Magnificent Seven emerged, adding Tesla, Microsoft and Nvidia, but abandoning Netflix.

Microsoft, Nvidia and Meta are stocks to watch, says Raymond James analyst Josh Beck (pictured). He then nicknamed him ‘MnM’, not to be confused with rapper Eminem or M&M’s.

Collectively, the seven rose 75 percent in 2023, but since then Tesla, in particular, and Apple have faltered. Tesla is down 27 percent this year.

“MnM? “Microsoft, Nvidia and *now* Meta are leading the AI era,” Raymond James analyst Josh Beck said in a note to clients.

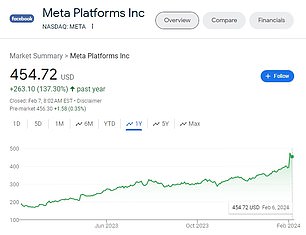

This year, Microsoft is up 10 percent to $405, overtaking Apple as the world’s largest company; Nvidia is up 44 percent to $693, and Meta, formerly Facebook, is up 33 percent to $459.

Tesla is down 27 percent since January 1, while Apple is holding steady. Amazon and Netflix are on the rise, but are not seen as having the potential for AI-driven MnM.

DailyMail.com asked another analyst about MnM and whether it was too late to invest.

eToro’s Bret Kenwell said: ‘It’s been a fantastic period for the so-called “MnM” trio: Microsoft, Nvidia and Meta.

‘Meta and Nvidia are up about 30 percent and 40 percent so far this year and about 145 percent and 220 percent over the past year, respectively.

‘Microsoft has not been far behind either, with an increase of almost 60 percent in the last 12 months.

‘Can you continue? Some consolidation would certainly be reasonable given the recent run, not only in these specific stocks, but also for the Nasdaq and the S&P 500 in general.

“Still, secular tailwinds remain strong for the MnM trio.”

By this he means there is still positive news for all three stocks in light of the race to AI.

Before Beck came up with MnM on Friday, there were other, less creative alternatives to the Magnificent Seven.

eToro’s Bret Kenwell gives his thoughts on MnM: Microsoft, Nvidia and Meta

The Super Six, for example, would exclude Tesla, while the Fabulous Five would also exclude Apple.

Beck focused Friday’s story on Meta, whose shares rose 22 percent that day, gaining more than $200 billion in market value.

It is the largest increase in the value of a company listed in the United States, according to Dow Jones Market Data.

DailyMail.com also asked eToro’s Kentwell what he thought about the three individually.

Read his thoughts below….

GOAL

‘Despite Meta’s meteoric rise to new highs, the company initiated a dividend and added a whopping $50 billion to its buyback plan, in addition to a strong quarterly report.

“However, it only trades at 23 times forward earnings estimates, which are forecast to grow nearly 32% this year.”

Meta’s stock price also got a boost last week when it announced its first quarterly dividend of 50 cents per share and an additional $50 billion in share buybacks.

Buybacks and dividends help boost stock prices by rewarding investors with cash simply for holding company shares. Meta’s first cash dividend of 50 cents per share will be paid on March 26 and quarterly thereafter.

NVIDA

“It’s easy to criticize Nvidia simply based on the immense rally in the stock (and the idea that AI is just a fad),” Kentwell said.

‘But that’s not the case with AI, a movement in which Nvidia is at the forefront. He is a clear leader in the AI revolution and a high-quality company to boot.

“With a market capitalization of $1.7 trillion, Nvidia is no longer flying under the radar. But it’s not as if the stock’s gains have come without a catalyst. Profits and sales have soared, as have margins and free cash flow. The rally is not simply due to feverish speculation, but is in anticipation of strong AI-driven demand.

‘Nvidia’s valuation is a bit more exaggerated, thanks in large part to its nearly 50% rally over the past three months.

‘However, it would be shortsighted to forget that Nvidia spent the second half of 2023 consolidating below $500. The recent breakup has been powerful, but it shouldn’t be considered all that surprising.

MICROSOFT

“Microsoft is a little quieter this year, up about 8 percent, but its fiscal year ends in June,” Kentwell said.

‘After that, consensus expectations accelerate and call for double-digit earnings and revenue growth in fiscal 2024 and 2025, respectively.

‘With its strong balance sheet, immense cash flow and solid margins, it remains a top name in mega-cap technology.

“With an expected acceleration in profits and sales, along with its exposure to AI through OpenAI and various business units, it stands to reason that Microsoft would be attractive to investors looking for safer ways to play with AI.”

Nvdia, which makes computer chips, has enjoyed returns of nearly 250 percent this year and is the top performer in the S&P 500.

CAN NVIDIA OVERCOME AMAZON?

Wall Street’s enthusiasm for artificial intelligence has Nvidia poised to become more valuable than Amazon for the first time in two decades, and the AI chipmaker is not far behind Google owner Alphabet.

A 40 percent rise in Nvidia so far in 2024 has lifted its market capitalization to $1.715 trillion as of midday Wednesday, only about 3 percent below Amazon’s $1.767 trillion value and less. 6 percent below Alphabet’s $1.812 trillion value, according to LSEG Data.

Nvidia will report its quarterly results on February 21.

Morgan Stanley raised its price target to $750 from $603, and analyst Joseph Moore wrote in a client note that “demand for AI continues to rise.”

After Nvidia stock tripled in 2023, it has already become the fifth most valuable company on the US stock market.