Americans paid $363.3 billion in property taxes in 2023 after taxes soared at their fastest pace in five years, new data shows.

A report from a real estate data company ATOM found that the figure rose 6.9 percent from $339.8 billion in 2022, having already increased 3.6 percent the year before.

The average tax on a single-family property is now $4,062 per year, as homeowners face a perfect storm of falling home prices and rising tax bills.

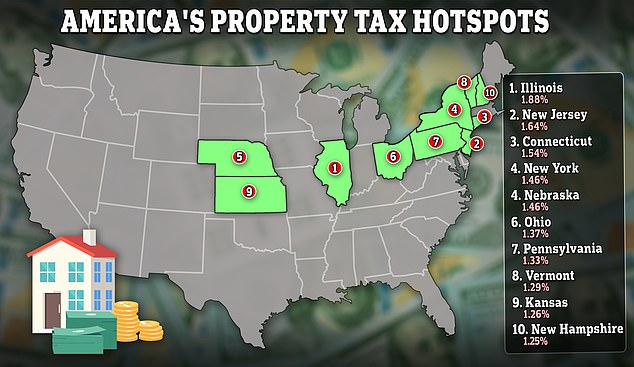

Illinois has the highest effective property tax rate of any U.S. state, with residents paying 1.88 percent of the value of their homes.

New Jersey and Connecticut followed, where homeowners pay 1.64 percent and 1.54 percent respectively.

Illinois has the highest effective property tax rate of any U.S. state, with residents paying 1.88 percent of the value of their homes.

The average tax on a single-family property is now $4,062 per year, as homeowners face a perfect storm of falling home prices and rising tax bills.

The ten states with the highest taxes were based in the Northeast or Midwest, ATTOM found.

By contrast, Hawaii has the lowest property tax: 0.31 percent of a home’s value.

Arizona had the second cheapest at 0.41 percent, followed by Alabama at 0.42 percent.

In real terms, it means that residents in some states pay on average ten times more in bills than those in other places.

For example, in New Jersey, the average single-family homeowner faced a tax of $9,488 in 2023.

But in West Virginia the typical bill was just $989, the smallest average sum of any state.

Rob Barber, chief executive of ATTOM, said: ‘Property taxes took an unusually high turn last year, driving up effective rates, while huge gaps remained in average tax bills between different parts of the country.

“The tax increases were likely related, at least in part, to inflationary pressures on the cost of operating local governments and schools, along with increases in public employee salaries and other major expenses.”

He added that the disparity in rates across the country was due to different levels of government services and different local economies.

Property taxes tend to increase in hot real estate markets when there is high demand for housing and little available stock. They can also increase when local governments and schools need more funding.

Your browser does not support iframes.

According to data from ATTOM, property values decreased by 1.7 percent in 2023 as rising mortgage rates crippled buyer activity.

The average rate on a 30-year fixed-rate mortgage is now 6.79 percent, according to government-backed lender Freddie Mac.

This is more than double what they were three years ago, when they were around 3.17 percent.

It means that a buyer who purchases a $400,000 property today faces monthly payments of $2,474. This analysis assumes a 5 percent down payment.

However, if they had purchased in March 2021, this figure would be only $1,637, a difference of $800 per month.

Higher rates have created a so-called “lock-in effect” in Ameria’s housing market, as homeowners are reluctant to move and give up the cheap deals they scored in recent years.

Experts are divided on where the housing market is headed now after prices remained surprisingly resilient.

Last week, Shark Tank star Barbara Corcoran predicted that even the smallest drop in mortgage rates would cause property values to skyrocket.

He told Fox Business: “If rates go down, just another percentage point, prices will skyrocket.”