Americans were sold on the promise that electric vehicles would bring manufacturing businesses and an influx of jobs to small towns across the country as part of a modern gold rush.

However, as interest in electric vehicles has waned, lithium-nickel facilities (metals used in lithium-ion batteries for electric vehicles) are taking cost-cutting measures, including mass layoffs and suspension of operations. .

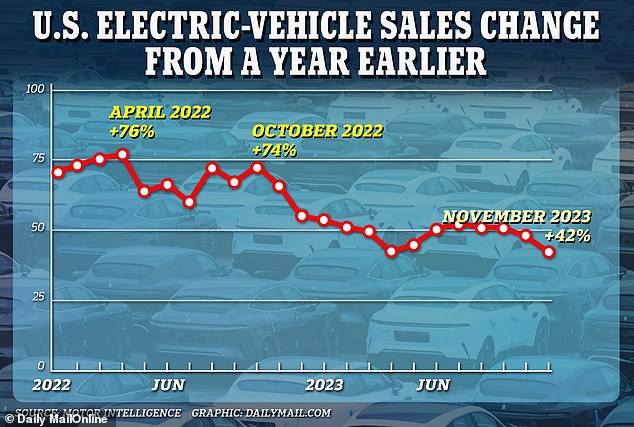

Demand for electric vehicles increased in 2022, rising 76 percent in April of that year, but by the end of 2023, the number of vehicles sold had fallen to 50 percent.

Car buyers are still reluctant to trade in their gas-guzzling vehicle for an electric vehicle due to the high price and concerns about their ability to easily charge the vehicle.

Ford cut 1,400 jobs at its once-promising lithium factory in Michigan, while Tesla halted production at its electric vehicle factory in Berlin and halted construction of its lithium factory in Mexico.

Tesla CEO Elon Musk also reportedly asked managers which jobs are “critical,” stoking fears of mass layoffs.

Billion-dollar lithium mine production suspended as demand for electric vehicles declines

“I think what we’re seeing is a shift in how quickly people are willing to buy electric vehicles right now because they’re expensive and there’s concern about charging infrastructure,” said Alan Amici, executive director of the Automotive Research Center. NBC News.

‘If you are an efficient car manufacturer, you are trying to adapt your production to demand. It doesn’t help anyone to fill a yard with electric vehicles that aren’t selling.’

On average, it takes automakers three weeks longer to sell an electric vehicle than a standard gasoline vehicle, leading companies to offer discounts and deals with lower interest rates to attract buyers.

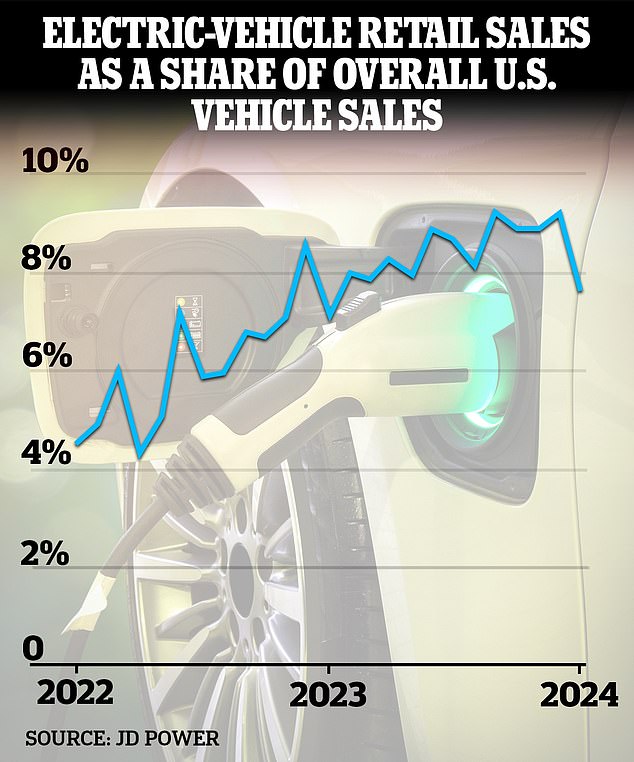

Electric vehicle sales as a percentage of total U.S. vehicle sales have declined from 9 percent to 8 percent over the past three months.

As a result, companies such as General Motors (GM) and Ford were forced to slow the expansion of electric vehicle development and battery production plants, even as they made new promises to open more production plants in the next two years.

“It’s true, the pace of growth in electric vehicles has slowed, which has created some uncertainty,” said Mary Barra, president and CEO of General Motors in a earnings call last month.

“We will take advantage of demand and are encouraged by the fact that many third-party forecasts indicate that US electric vehicle deliveries will increase from around seven percent of the industry in 2023 to at least 10 percent in 2024, which which would mean another year of record electric vehicle sales.”

He stated that GM has 100,000 reservations for EV trucks for this year and next, but warned that if demand for electric vehicles changes, the company will look to make more internal combustion engine (ICE) vehicles.

Electric vehicle sales growth has begun to slow in the U.S., a trend that worries automakers betting big on the emerging technology.

“We know the electric vehicle market is not going to grow linearly,” GM Chief Financial Officer Paul Jacobson said on the earnings call, adding: “We are prepared to flex production between internal combustion engines and electric vehicles “.

This marks a significant shift from GM’s 2021 goals of selling only all-electric vehicles by 2035 and investing $27 billion in electric vehicles, Barra said in a LinkedIn post. mail At the time.

However, although the growing pace of demand for electric vehicles has slowed, the company believes it is still moving in the right direction, James Cain, GM’s executive director of finance and sales communications, told Dailymail.com.

The price of lithium has fallen 90 percent since January last year, and demand for electric vehicles is already slowing and halting mine production of lithium and nickel, metals used in lithium-ion batteries for electric vehicles.

In February 2023, Ford pledged to build a $3.5 billion electric vehicle battery plant in Michigan to take advantage of President Joe Biden’s landmark climate law that would ensure two-thirds of all cars sold in the U.S. .be completely electric by 2032.

Lithium prices fell 90 percent last year in response to slowing demand for electric vehicles, meaning companies can’t afford to continue operations and have to pause construction of future lithium mines. nickel and lithium.

Biden is expected to roll back strict measures to give auto companies time to make the switch to electric vehicles, even as more U.S. consumers turned to hybrid vehicles than the all-electric alternative last year, according to The New York Times.

Hybrid vehicles accounted for 8.3 percent of auto sales in 2023, compared to fully electric vehicles that accounted for 6.9 percent of cars sold.

Because electric vehicle sales aren’t rising as fast as auto companies had hoped, slowing lithium and nickel production means people are losing their jobs in a once-promising industry.

This comes as lithium and nickel prices plummet, affecting major lithium producing companies in the United States, such as Albemarle, which was supposed to begin construction of a lithium plant in South Carolina this year.

Albemarle planned to produce enough lithium to power 2.4 million electric vehicles a year, but the company was forced to suspend spending at the plant and lay off four percent of its workforce, which totaled 300 employees.

“Where the prices are today, the economics are not there for those projects,” said Albemarle CEO Kent Masters.

GM laid off its nearly 1,000 workers at the Orion Assembly plant in Detroit until the end of 2025, while Ford eliminated 1,400 workers at its lithium production mine in Dearborn, Michigan.

Piedmont Lithium, located in Belmont, North Carolina, said The Charlotte Observer last week that it plans to hire more than 400 employees with an average salary of $82,000, even as the company announced it would lay off 27 percent of its workforce.

‘Ultimately, everything stems from demand, and demand just isn’t getting to where all these CEOs thought it would be.

“So a lot of the initial goals set by GM or Ford a couple of years ago may have proven to be too optimistic and probably too aggressive,” Gabe Daoud, senior sustainable energy analyst at TD Cowen, told NBC News.

“I think everyone expected the entire fleet of cars to switch overnight and go electric, but that is obviously impossible and impractical.”