Americans’ view of the economy improved in May – for the first time since January – amid optimism about the labor market.

US consumer confidence unexpectedly improved in May after falling for three straight months.

Despite the improved labor market sentiment, concerns about inflation persisted and many households expected higher interest rates over the next year.

And Tuesday’s Conference Board survey also showed that more consumers think the economy could fall into recession in the next 12 months.

However, they were very optimistic about the stock market and many more planned to buy major appliances over the next six months.

The positive outlook comes after several top US bankers, including JPMorgan chief Jamie Dimon, issued dire warnings about the economy.

Americans’ view of the economy improved in May, but they were still concerned about rising prices.

The economy is expected to slow this year as a result of a series of interest rates. Federal Reserve increases from March 2022, designed to control inflation.

But despite the cooling effect that rate increases have on growth, economists and most business executives do not predict a slowdown.

“Continued positive job growth, rising wages, a buoyant stock market and healthy household balance sheets will keep consumers spending despite elevated prices and borrowing costs,” said Oren Klachkin, financial markets economist at Nationwide.

The Conference Board said its consumer confidence index rose to 102.0 this month from an upwardly revised 97.5 in April.

Economists polled by Reuters had forecast the index would fall to 95.9 from the previously reported 97.0. It topped the University of Michigan Sentiment Index.

Confidence remains within the relatively narrow range it has been hovering in for more than two years.

The improvement occurred across all age groups, with consumers with annual incomes over $100,000 seeing the largest increase in confidence.

On a six-month moving average basis, confidence remained highest among the under-35 cohort and those with annual incomes over $100,000.

Consumer perceptions of the labor market also improved, with the survey’s so-called labor market spread, derived from data on respondents’ views on whether jobs are plentiful or hard to get, widening to 24 from 22. 9 in April, although opportunities probably won’t be as plentiful as last year.

“The level of this measure remains elevated by historical standards and points to a still strong labor market,” said Michael Hanson, an economist at JPMorgan.

The measure correlates closely with the unemployment rate in the Labor Department’s employment report. The resilience of the labor market, characterized mainly by historically low layoffs, is underpinning the economic expansion.

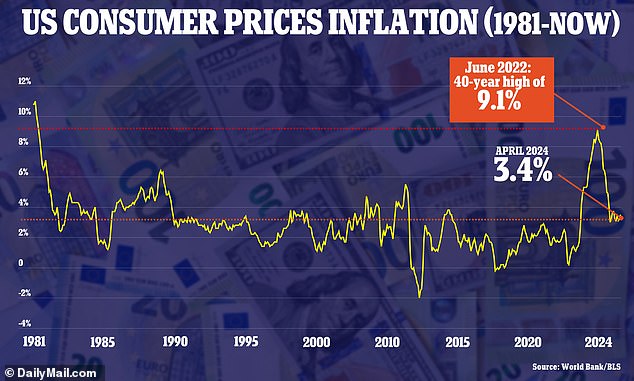

The latest official inflation figure showed it had cooled slightly to 3.4 percent in April from 3.5 percent in March. Americans feel it is higher.

Consumers’ 12-month inflation expectations rose to 5.4% from 5.3% in April. That’s much higher than official figures, which showed it had cooled slightly to 3.4 percent in April from 3.5 percent in March.

“Consumers cited prices, especially for food and groceries, as having the greatest impact on their view of the U.S. economy,” said Dana Peterson, chief economist at the Conference Board.

“Perhaps as a result, the percentage of consumers expecting higher interest rates over the next year also increased, from 55.2% to 56.2%.”

About 48.2% of consumers surveyed expect stock prices to increase over the next year, compared to 25.4% who anticipate a decrease.

Stocks on Wall Street were trading higher, with the tech-heavy Nasdaq index breaking above the 17,000 level for the first time. The dollar fell against a basket of currencies. US Treasury prices were lower.