A Microsoft security engineer has been sentenced to seven years in prison for accessing a dark web hitman site and organizing a murder-for-hire plot against the parents of his adopted children.

Christopher Robin Pence, 42, of Cedar City, Utah, was sentenced Thursday in the Northern District of New York. He pleaded guilty to soliciting and paying for the murder of a 35-year-old man and a 38-year-old woman in December last year.

Pence later confessed to FBI agents that he coordinated the murder of the upstate New York couple because he believed child abuse was occurring at their Hoosick Falls home.

The Utah man first accessed the darknet site in July 2021 using The Onion Router, a peer-to-peer overlay network that allows users to browse the Internet anonymously.

Documents reviewed by DailyMail.com show that Pence arranged the murders with another user and an administrator of the website in exchange for approximately $16,000 in Bitcoin.

He was arrested at his $1 million estate in Cedar City, Utah in 2021 and held in federal custody until his sentencing on Thursday.

“The anonymous user provided the site administrator with the names, addresses and photographs of the intended victims, as well as the manner in which the murder was to be carried out,” the criminal complaint reads.

Pence instructed that the murder“This should appear to be an accident or botched robbery and, if possible, care should be taken not to harm any of the three children known to be in the care of the intended victims.”

He transferred the money using methods that included a cryptocurrency wallet service that was advertised as a means to protect monetary transfers from prying eyes.

Investigators linked cryptocurrency exchange account information, including date of birth and social security number, to Pence, who accessed the site until August 2021.

In an interview later that year, FBI agents told Pence that they had taken over the murder-for-hire site and that the site’s operator provided them with user names, including his own.

Investigators interviewed Pence’s intended victims in September 2021 and learned that his family had adopted five of his children, “and that there was an escalating dispute between the two families.”

Tensions were so high that the Hoosick Falls couple wanted to retain custody of their children and even reported Pence’s family to local child welfare authorities, documents reveal.

The criminal complaint notes that the photographs Pence provided to the site’s administrator matched those “provided by the intended victims to Pence and his family for use as a “baby book,” featuring the intended victims’ children.”

He and his wife, Michelle, adopted five children from an upstate New York couple whom Pence later targeted in the murder-for-hire plot, believing they were abusing the children.

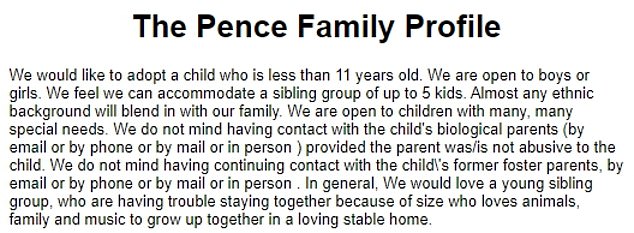

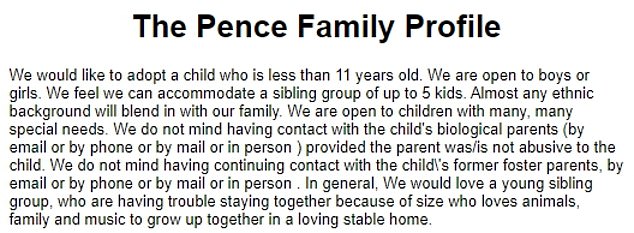

Pence shelled out $16,000 in Bitcoin to anonymous darknet users on a hitman site, instructing them that the murder “should be made to look like an accident or botched robbery” (pictured: a photo of the Pence family’s adoption profile on line)

Agents executed a federal search warrant at Pence’s Cedar City home the following month to seize electronic documents.

It was then that he admitted his involvement in the plan.

Transcripts show that two agents exchanged small talk with Pence while sitting in a government-issued Chevy Tahoe on the morning of October 27, 2021.

An agent told Pence that he was not in custody and had “no obligation” to speak to them.

‘We would appreciate your help, okay? I’m just trying to figure it out, because obviously we’re here for a reason, right? the agent said.

That was enough to convince him. In 2018, Pence disclosed that he and his family, who were residing in Washington at the time, were passing through Massachusetts on a six-week cross-country tour.

His wife, Michelle, suddenly received a message from a woman asking for help for her five children. The Pence family, including her 10 children, agreed to meet with the woman and pray with her.

Pence alleged that the woman said her children were not safe being around her husband, who had been propositioning other women.

“The mother basically said, look, I need a place for my kids to go, they’re not safe here,” Pence told agents.

‘So, we left. “We arrived in Massachusetts with 10 children and left with 15.”

Pence claimed he began distancing the children from their biological parents after the adoption, but the couple followed them to Texas and then asked them move his trailer to the family property in Utah.

Property records show the seven-bedroom, seven-bathroom home and surrounding 20 acres are valued at about $1 million.

Pence further alleged that one of the children had been abused through discipline by his biological parents and refused to stand aside any longer.

‘With everything you’re facing, everything you’re doing, you’re the protector of these kids, okay?’ an agent said.

“You are the savior of these children and you do it for the family, I am clear about that.” I didn’t understand why before, but it’s very clear to me that you would do anything for these children.’

Pence did not seem convinced. ‘Have I ruined my life?’ he said.

When asked if he wanted anything from the house, the Microsoft engineer replied: “I would like a time machine, if you have one.” He was arrested the same day.

When FBI agents invaded his Utah home in October 2021, Pence admitted his involvement in the plot.

His family continued to support him, with his wife Michelle urging GoFundMe donors to “pray for the charges to be dropped.”

Pence’s sister, April Foltz, organized the fundraiser on behalf of her family, including 10 of her own and Michelle’s children.

A website seen by DailyMail.com shows that Christopher and Michelle Pence were actively seeking children to adopt, advertising through a “family profile.”

‘We are open to children with many special needs. “We do not mind having contact with the child’s biological parents (via email, phone, mail or in person) as long as the parent has not abused the child,” Michelle wrote.

She noted that her husband “works full time for Microsoft as a computer network security engineer and has a flexible work schedule” and added that his sense of “morality” derived from his “Christian beliefs.”

In the years before his sentencing, Pence’s family continued to support him.

His sister, April Foltz, created a GoFundMe in December 2021 that included several photos of Pence, Michelle and their group of children.

‘This is my brother’s family. They are a very happy and loving family. “He has been accused of a terrible crime that did not involve any harm or misconduct to his children or wife and did not involve any infidelity,” Foltz wrote.

He described Pence as a “solid provider” and explained that the pending case left them “without money to pay the mortgage, buy food, utilities, put gas in the car, etc.”

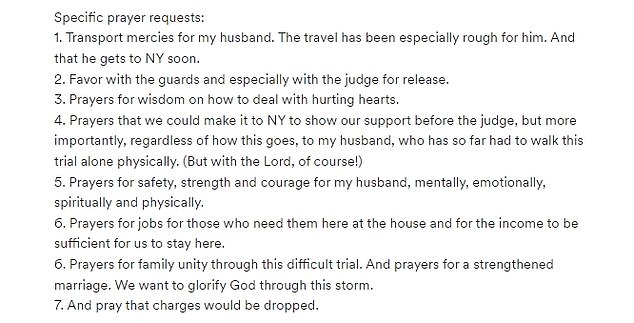

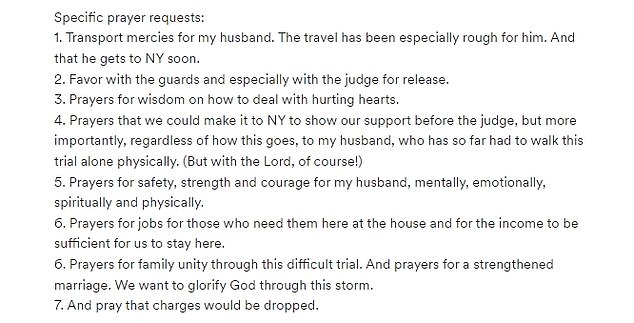

In a follow-up post, Michelle asked for prayers.

These included requests for “favor to the guards and especially the judge for release” and “family unity through this difficult trial.”

“And pray that the charges are dropped,” Michelle wrote.

Pence pleaded guilty to one count of use of interstate commerce facilities in the commission of a murder-for-hire plot on December 6, 2023.

Following his prison sentence, Pence has been ordered to serve a three-year supervised release sentence.