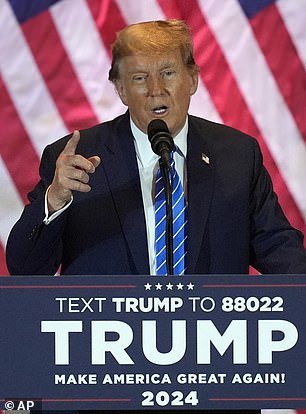

With Republican presidential candidate Nikki Haley officially ending her presidential campaign on Wednesday, former President Donald Trump’s bets are officially on.

While the vice presidential announcement typically does not occur until the summer of an election year (usually to generate excitement before a candidate’s party convention), Trump is not a traditional presidential candidate.

For starters, he already abandoned his original vice president, former Vice President Mike Pence, after the two fell out over Trump’s attempt to overturn the results of the 2020 presidential election.

Trump has also been teasing his vice president’s release for months, saying at a Fox News Iowa audience in January, “I know who it’s going to be,” though comments from his advisers suggested he didn’t actually know.

Haley would be an obvious choice for Trump’s vice president — to bring together the MAGA and more traditional Republican sides of the party — but neither the former U.N. ambassador nor the former president have shown much interest.

With Republican presidential candidate Nikki Haley (left) officially out of the race, former President Donald Trump’s (right) bets are officially up for grabs.

That leaves a list of Trump’s other key rivals and allies in 2024 as contenders for second place on the Republican ticket.

Tim Scott: A 2024 rival who endorsed Trump over the woman who appointed him to the Senate before a key race

South Carolina Sen. Tim Scott was on the tip of Trump supporters’ tongues when DailyMail.com polled voters in Super Tuesday states ahead of Tuesday’s election.

“I like Scott, I think Scott should be his running mate.” said Michael Hedrick, 72, while voting for Trump in North Carolina. Republican Party primaries Tuesday in Nash County, a major battleground.

In conservative Orange County, California, Trump voters echoed the sentiment.

‘I would like Tim Scott. Because he’s a very honest, nice, all-American guy, I think. He really cares about America. And the people,” said Bridget Hawley, 80, a retiree from Huntington Beach.

Michael Mesbah, 32, who works in advertising, and Allyssa Mesbah, 29, a dancer, support Trump and both named Scott as the best vice president.

“I really like Tim Scott,” Allyssa said.

Her husband noted that there were “a lot of interesting potential candidates that I really like.”

“I think Tim Scott is probably a viable option,” he said.

Scott abandoned his own presidential bid in mid-November and then endorsed Trump days before the New Hampshire primary, Haley’s best chance to change the race.

It came after Haley first appointed Scott to the Senate, when she was serving as governor of South Carolina.

Scott brings racial diversity and more than 10 years of experience working on Capitol Hill to the ticket.

South Carolina Sen. Tim Scott was on the tip of Trump supporters’ tongues when DailyMail.com polled voters in Super Tuesday states ahead of Tuesday’s election.

Kristi Noem: ‘She knows how Trump works’ and could help him in key Midwestern states

South Dakota Gov. Kristi Noem adds a woman to Trump’s list, and she has experience in the executive and legislative branches of government, serving in the U.S. House of Representatives before moving home to run for governor in 2018.

The South Dakota governor may have inside information on how to handle Trump, or so she suggested in her memoir, where she described how she worked with Trump to bring fireworks to Mount Rushmore.

She “had a good understanding of what motivates him,” Noem wrote.

She isn’t well known outside her state, but she could try to sell a Trump restoration in Midwestern battlegrounds like Michigan and Wisconsin, which have gone back and forth between Biden and Trump.

South Dakota Governor Kristi Noem adds a woman to the list, and she has experience as an executive and as a member of Congress.

Vivek Ramaswamy: The ‘America First’ presidential candidate who ran against Trump while showing loyalty

If loyalty is a primary criterion, and it almost always is in Trumpworld, the candidate who ran against Trump without actually running against Trump has earned a spot on the ticket.

Vivek Ramaswamy became the first rival to endorse Trump after repeatedly praising him from the debate stages that Trump skipped during the primaries.

The biotech entrepreneur was the top choice in DailyMail.com’s exclusive poll of New Hampshire Republicans.

He offered gentle hints that he could be the top messenger of Trump’s policies, then had a minor dispute with the winner shortly before Iowa, where he won just 8 percent in the caucuses.

The ‘America First’ candidate who said the movement was ‘bigger than one man’ immediately endorsed Trump and appeared on stage with him as he campaigned in New Hampshire.

Ramaswamy is an articulate salesman who can stick to the talking points and bring some youth to a Trump candidacy: He’s 38, half Trump’s age.

But he is new to politics and it is doubtful he will attract many voters who are not already pro-Trump.

Is the United States the first second fiddle? Ramaswamy is an articulate salesman who knows how to stick to talking points, and at 38 he is half Trump’s age.

Elise Stefanik: A Trump loyalist who is a favorite on third-party betting sites after taking on Ivy League presidents

One of the key decisions Trump faces is whether he should choose a woman.

Allies have already urged him to choose a female running mate or a black man, according to reports this week.

One contender is a senior House Republican whom Trump has called “a killer.”

Stefanik jumped to the top of Trump’s list of potential vice presidents when she helped unseat the Harvard president during high-profile House hearings on anti-Semitism on campus.

He has expressed his willingness to be completely loyal to Trump by referring to the January 6 defendants who broke into his workplace as “hostages.”

Stefanik harshly criticized Trump after the release of the Access Hollywood tape in 2016, but has become a loyal defender.

“Of course I would be honored” to serve in the Trump administration “in any capacity,” she said days ago when asked if she would be his running mate.

She is a leader on third-party betting sites and would solidify Trump’s support among the GOP’s MAGA base.

But there are concerns that he could attract the independents and moderates Trump needs to win the general election.

Rep. Elise Stefanik (R.N.Y.) inflamed conservatives with her attacks on college presidents for anti-Semitism.

Kari Lake: A firebrand former news anchor who has secured MAGA’s base. But what about the rest of the Republican Party?

Lake has long been rumored to be a possible vice president.

The former TV host turned failed gubernatorial candidate is telegenic and knows how to excite the MAGA crowd.

But his Arizona Senate bid got a boost on Tuesday with the announcement by incumbent Sen. Kyrsten Sinema, a Democrat turned independent, that she would leave the upper chamber at the end of the year.

That sets up a more traditional race between Lake and his likely Democratic opponent, Rep. Rubén Gallego.

Wired: Arizona US Senate candidate Kari Lake is a possible running mate

Sarah Huckabee Sanders: Your former press secretary and governor with a strong conservative record

Arkansas Governor Sarah Huckabee Sanders represents a familiar personality for Trump, having been his White House press secretary and, before that, a campaign aide.

He established working relationships with the White House press and then built a conservative record in a state where his father was previously governor.

Although Arkansas sent Bill Clinton to Washington, it is a small state that is sure to be in Trump’s column.

At 41 years old, he brings youth, experience in government and experience in the White House, although he would not have the seriousness in foreign policy of the recent elections.

And she hails from Hope, Arkansas, the famous birthplace of another American president.

Wild Card: The other wild card names in the mix, including Tucker Carlson and Tulsi Gabbard.

Trump has always considered wild cards, and his son, Donald Trump Jr. and his wife Melania, floated the idea to former Fox News host Tucker Carlson.

Carlson said he is not interested in the role.

Other unconventional picks include former Democratic Rep. Tulsi Gabbard.

Gabbard endorsed progressive Sen. Bernie Sanders’ presidential bid in 2016, though more recently she has embraced the MAGA right.

He could attract independents and other disaffected Democrats.