<!–

<!–

<!– <!–

<!–

<!–

<!–

She has kept the world waiting for months after revealing to fans that she was working on her solo music.

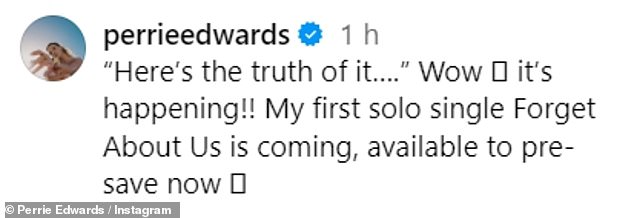

But fans don’t have much longer to wait as Perrie Edwards took to Instagram on Tuesday night to reveal she’s dropping her first solo single.

The singer, 30, shared her new album cover and revealed her new song is called, Forget About Us.

She wrote: ”Here’s the truth about it…. Wow it’s happening!! My first solo single Forget About Us is coming which can be saved now.

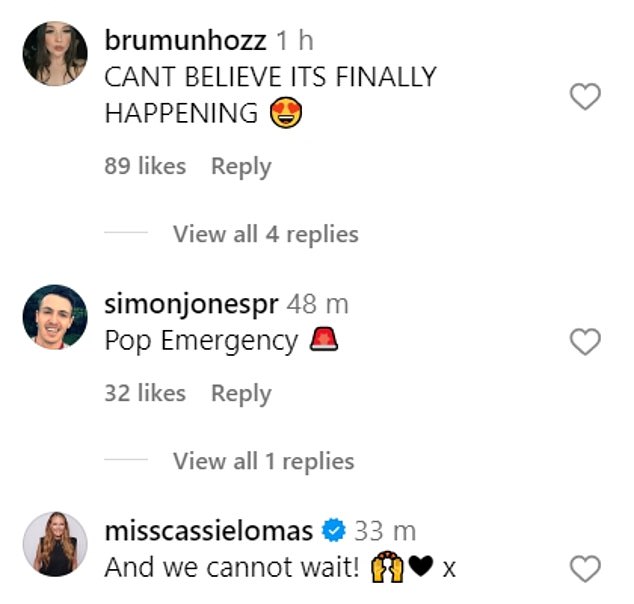

Fans were thrilled with the news, with Perrie’s former Little Mix bandmate Jade Thirlwall commenting with a series of excited emojis.

She has kept the world waiting for months after revealing to fans that she was working on her solo music

But fans don’t have much longer to wait as Perrie Edwards took to Instagram on Tuesday night to reveal she’s dropping her first solo single

One fan wrote: ‘CAN’T BELIEVE IT’S FINAL’, while others said: ‘It’s happening!!! perrie is coming ahhhh!!’

‘Omggggggg I literally CAN’T WAIT.’ and “Yeah girl we’ve been waiting for x,” added another.

‘Perrie’s era is coming, so excited and so proud of you!!!’

Little Mix announced their split in December 2021 when they revealed the trio would be taking a break after 10 ‘amazing’ years together.

Since the bandmate split, Leigh-Anne has embarked on a successful solo career and even picked up Glamour’s Musician of the Year award last October.

Still, fans have been eagerly awaiting new music from Perrie, and it looks like they won’t have too long to wait.

Last month, Perrie teased the release of her new music. She has kept a relatively low profile in recent months as she is busy in the studio in preparation for the debut of her long-awaited solo career.

Sharing a series of snaps from the studio, Perrie appeared to be singing her heart out as she hit the notes she’s known for.

She captioned the post: ‘Singing my little heart out…music awaits…’

The singer, 30, shared her new album cover and revealed her new song is called, Forget About Us

Fans were left thrilled by the news, with Perrie’s former Little Mix bandmate Jade Thirlwall commenting with a series of excited emojis

Last month, Perrie teased the release of her new music. She has kept a relatively low profile in recent months as she is busy with her studies

Little Mix announced their split in December 2021 when they revealed the trio would be taking a break after 10 ‘amazing’ years together