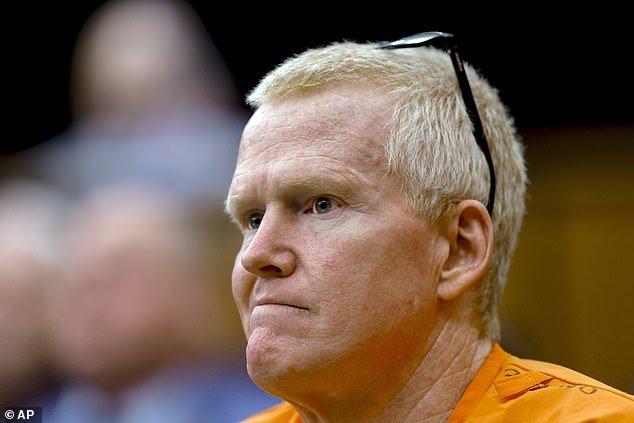

Alex Murdaugh has been sentenced to 40 years in prison for stealing millions of dollars from clients of his law firm, a punishment he will serve concurrently with his 27-year sentence for state fraud convictions.

The 40-year sentence will be insurance on top of insurance for Murdaugh to spend the rest of his days in prison. She will run consecutively to the disgraced lawyer’s pair of life sentences for the murders of Maggie and Paul.

Murdaugh will also have to pay nearly $9 million in restitution.

In total, Murdaugh took money from the settlement or inflated fees or expenses from more than two dozen clients. Prosecutors said the FBI found 11 more victims than the state investigation found and that Murdaugh stole nearly $1.3 million from them.

The killer again apologized to his victims at his sentencing on Monday, saying he felt “guilt, sadness, shame, embarrassment and humiliation.” As at his state sentencing, he offered to meet with his victims so they could say whatever they wanted and ‘closerly inspect my sincerity.’

Convicted murderer Alex Murdaugh (pictured) has been accused of failing a polygraph test that was part of his deal with prosecutors for the multiple financial crimes of which he is accused.

Murdaugh, 55, is already serving a life sentence without parole in state prison after a jury found him guilty of murder for shooting his wife and young son.

“There is not enough time and I do not have enough vocabulary to adequately put into words the magnitude of how I feel about the things I did,” Murdaugh said.

A report from federal agents recommended a prison sentence of between 17 and a half years and just under 22 years.

The 22 federal charges are the latest pending charges for Murdaugh, who three years ago was an established attorney negotiating multimillion-dollar deals in a small town where members of his family served as elected prosecutors and ran the area’s top law firm for nearly a century. .

It comes after the disgraced lawyer, 55, was accused of failing a polygraph test that was part of his deal with prosecutors for multiple financial crimes.

Prosecutors had asked a court Tuesday to release the federal government from its agreement with the disgraced lawyer, who they say was not truthful about where more than $6 million he stole ended up and whether another lawyer helped him. to steal from his clients and his lawyer. firm.

Murdaugh’s biggest plan involved the children of his housekeeper Gloria Satterfield. She died in a fall at the family home.

Murdaugh told Satterfield’s sons (Bryan, left, and Tony, right) at his funeral in February 2018 that he would obtain insurance settlements for his death and take care of them, according to a lawsuit filed by the sons.

U.S. District Judge Richard Gergel said he sentenced Murdaugh to a harsher punishment than suggested because Murdaugh stole from “the most needy and vulnerable people,” such as a client who was left quadriplegic after an accident, a state trooper who was injured at work and a Trust Fund for children whose parents died in an accident.

‘They put all their problems and all their hopes on Mr. Murdaugh and he is one of those people that he abused and stole from. “It is a set of actions that is difficult to understand,” Gergel said.

Murdaugh’s biggest plan involved the children of his housekeeper Gloria Satterfield. She died in a fall at the family home. Murdaugh promised to take care of Satterfield’s family and later worked with a lawyer friend who pleaded guilty to a scheme to steal $4 million in a wrongful death settlement with the family’s insurer.

In all, Murdaugh took money from the settlement or inflated fees or expenses from more than two dozen clients. Prosecutors said the FBI found 11 more victims than the state investigation found and that Murdaugh stole nearly $1.3 million from them.

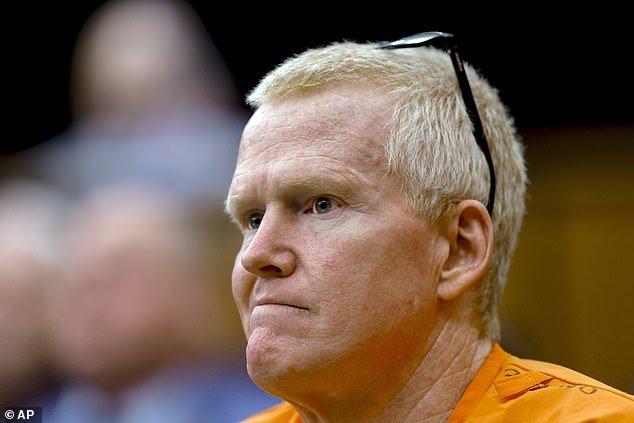

Murdaugh’s lawyers claim the FBI agent who conducted the test unnerved the killer by asking strange questions and sharing that he had just examined Natalee Holloway’s killer, Joran van der Sloot (pictured).

Murdaugh’s lawyers said the FBI examiner asked Murdaugh if he could keep a secret and then told him he had just arrived from Alabama, where he examined van der Sloot, who admitted to killing Natalee Holloway in 2005 in Aruba.

Murdaugh blamed nearly two decades of opioid addiction for his crimes and said he was proud to have been clean for 937 days.

Gergel mocked him, blaming drugs.

“No truly disabled person could carry out these complex transactions,” the judge said of the maze of fake accounts, doctored checks and money passed around to conceal the thefts over nearly 20 years.

Murdaugh’s lawyers claimed last week that the FBI agent who conducted the test misled the killer by asking strange questions and sharing that he had just examined Natalee Holloway’s killer, Joran van der Sloot.

In their response, Murdaugh’s lawyers said the results were unreliable because the FBI examiner, who just before the exam asked Murdaugh if he could keep a secret, then told him that he had just arrived from Alabama, where he examined van der Sloot, who admitted to killing. Natalee Holloway in 2005 in Aruba.

The examiner also told Murdaugh that he believed he had not killed his wife and son and asked him a confusing question about hidden assets, the defense said.

“There are legitimate questions about whether the government intentionally manipulated the results to void the plea agreement and achieve prosecutors’ stated desire to ‘ensure that he is never a free man again,'” wrote defense attorneys Jim Griffin and Dick Harpootlian.

Each of the 22 counts to which Murdaugh pleaded guilty in federal court carries a maximum penalty of 20 years in prison. Some are up to 30 years old.

Murdaugh, 55, is already serving a life sentence without parole in state prison after a jury convicted him of murder for shooting his wife and young son.

He later pleaded guilty to stealing money from clients and his law firm in state court and was sentenced to 27 years, which South Carolina prosecutors say is an insurance policy to keep him behind bars in case of that his murder conviction would ever be overturned.

The federal case was supposed to be even more certain, as Murdaugh accepted a plea deal so that his federal sentence would run at the same time as his state sentences.

Prosecutors now want Murdaugh to face the harshest possible sentence since violating the plea agreement and to serve his federal sentence at the end of the state sentences.

Each of the 22 counts to which Murdaugh pleaded guilty in federal court carries a maximum penalty of 20 years in prison. Some are up to 30 years old.

Prosecutors also want to keep secret four statements, including the polygraph, that Murdaugh gave to the FBI.

Investigators believe Murdaugh is trying to protect a lawyer who helped him steal and that his claim that more than $6 million of the stolen money went toward his drug addiction is not true. The release of the statements could harm an ongoing investigation, the U.S. Attorney’s Office said.

State prosecutors estimated that Murdaugh stole more than $12 million from his clients by diverting settlement money into his own accounts or stealing from his family’s law firm.

Investigators said that as Murdaugh’s financial plans were about to be exposed in June 2021, he decided to kill his wife and son in hopes of turning him into a sympathetic figure and diverting attention from the missing money.

Paul Murdaugh was shot several times with a shotgun and Maggie Murdaugh was shot several times with a rifle outside the family’s home in Colleton County.

Murdaugh has strenuously denied killing them, and has even testified in his own defense against the advice of his lawyers.

Federal prosecutors said Murdaugh appeared to be telling the truth about the roles banker Russell Laffitte and lawyer and old college friend Cory Fleming played in helping him steal.

Laffitte was convicted and sentenced to seven years in prison, while Fleming is serving nearly four years behind bars after pleading guilty.