The party ended on a high note with members of my family gathered around our guest artist singing a soulful version of John Denver’s classic Take Me Home, Country Roads.

Since my oldest son Justin and his wife Ruvani moved to Austin six years ago, country and western music, which abounds at festivals in the Texas hill country, has become an important part of all of our lives.

Every birthday is important, but celebrating my 75th at an Italian wine bar near our home in Richmond, south-west London, was particularly poignant. Much of last year was dedicated to cancer treatment and now it is clear to me. I went to great lengths to ensure that illness did not get in the way of my daily commentary on the city. But six months of chemotherapy made me refocus on my finances.

The assumption among readers is that as a financial writer for more than 50 years, everything would be in good order.

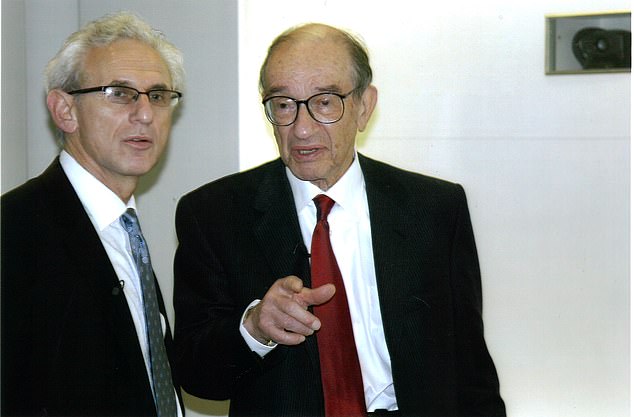

Alex Brummer, left, in 2007 with one of the leading financial figures of the last half century, the head of the US Federal Reserve, Alan Greenspan.

Winning the financial magazine of the year award. Alex Brummer writes: I have recaptured my youth with an expensive sports car, I can afford to travel in business class and luxury rentals for family summer holidays.

But the busier you are, the less time you have to focus on your own financial well-being. Furthermore, as a city editor – I comment daily on companies, markets and the economy – I have lived under an iron rule. If you buy shares or collective investments, such as unit trusts, they are to hold, not sell.

When my illness was diagnosed, my immediate reaction was to ensure that investments were managed properly. I got advice from a financial advisor I know at the London firm Charter Tax. It wasn’t cheap but the help requested was quick, sensible and worth it.

The recipe was to put my affairs in order. The first task was to rewrite my and my wife Tricia’s will to take into account changing family circumstances, i.e. grandchildren.

Secondly, make the most of transferable inheritance tax reliefs by setting up a discretionary trust (in itself an administrative nightmare).

Third, as someone with a full-time job, with an after-tax salary that exceeds expenses, use some of the excess current income to help fund the educational needs of family members. A special form was obtained from HMRC where such transfers can be properly recorded.

My last personal action was to make what I call a “death list.” Having lived through legalization for family members, parents, and a younger brother, I know what a nightmare it is to locate investments, especially in an era of online banking and brokerage.

The idea was to provide my legatees with scattered account details. This is a task that I have not yet been able to complete. But it’s on a “to do” list.

My circumstances are more complicated than most. Many people dream of retirement and, as the state pension age has risen (it will rise from 66 to 67 in 2026), it must seem to many like a mirage that fades as we get closer. Ten years past the typical retirement age, I am still working full-time as a copywriter on an executive salary.

I am also a pensioner entitled to a state pension, earned over a lifetime of work, and have all the additional benefits of older people, including a winter fuel allowance (meticulously donated to charities), a trip to London and, if lucky entry and under favorable conditions to museums and matinee shows. Those are privileges that are rarely used since I’m at my desk most of the time.

My state pension, which I pay the highest income tax on, is better than most because I decided to wait until I was 70 to start collecting. The accrual rate, the enhanced late payment, is remarkably generous.

HMRC’s latest notice, courtesy of the ‘triple lock’ – which provides the best of average income, consumer prices or 2.5 per cent – saw the weekly payment rise to £285.66. Never mind that almost half cruelly disappear in a harsh form of double taxation. Unfunded state pensions are paid for by HMRC taxes and National Insurance receipts.

The Conservative election promise to add an extra layer to the triple lock, increasing the tax-free allowance so that silver surfers don’t get caught in an income trap, doesn’t apply to me as a retiree. Fortunately, I am not at all dependent on what remains one of the most miserable state pensions among Western democracies.

My third source of income is a company pension. My advanced years mean that my Harmsworth Pension Plan is part of a legacy defined benefit plan. I decided to postpone collecting the company pension when I turned 65 and continued to take advantage of the company’s generous contribution until I was 60.

But at this point I recognized that the actuarial odds were against it and I decided to cash out. I took out the tax-free lump sum of several hundred thousand pounds and put some of it into a special rainy day gift fund. This still left me with a generous monthly stipend of which just under half disappears into income taxes.

I transferred the lump sum to a Funds and Shares account at platform broker Hargreaves Lansdown. Much to my chagrin, I was among the 300,000 victims who followed the then HL Wealth List. HL was a devoted admirer of the stock-picking skills of guru Neil Woodford’s now-closed Woodford Equity Income Fund, which collapsed in June 2019. The opportunity cost of the £30,000 invested, the money that could have accrued if Put the money into a simple fund tracker, it would be tens of thousands.

If this wasn’t daft enough, I also subscribed £10,000 to Woodford’s Patient Capital investment fund, now run by blue blood man Schroders.

My latest statement shows a loss of 84 percent. Woodford is still wealthy enough to indulge in jumping and other obsessions and has never apologized for robbing his clients of their hard-earned savings.

As someone still working, my company pension, like my other income, is subject to income tax.

Since there are no reliefs, the overall tax rate amounts to about 55 percent. My practice is to use the net sum to fund monthly Isa contributions up to the annual maximum of £20,000 each – all invested in shares and funds.

My financial situation at age 75 is fantastically favorable and I have three different sources of income. As someone who spent my previous career freelancing to pay independent school fees for three children and a huge mortgage, I’ve never had it so good. I have reclaimed my youth with an expensive sports car, I can afford business class travel and luxury rentals for family summer vacations.

These are accessories that I recognize will not be available to most readers. Being cash flow rich and keeping the taxman happy is a lifestyle choice. The ability to express my views on major issues of state during my advanced years is an enormous privilege.

My hope is that experience and knowledge of financial and economic history will mean that the article offers readers good value for money and a solid critique of the laissez faire capitalism in which I deeply believe.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.