Table of Contents

Dear Sir Patrick Sergeant

The natural focus for this commentary today would be public finances, amid data showing Britain’s debt levels have risen to 100 per cent of total output.

After all, Rachel Reeves’ first budget is due on 30 October, when the Chancellor will set out the fiscal framework (without taking into account financial and geopolitical shocks) for the next five years.

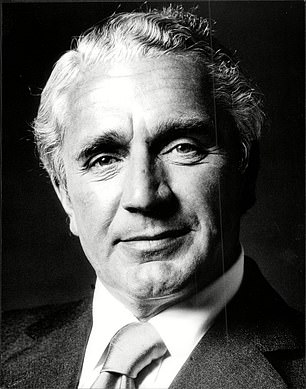

In the context of the life of my most illustrious predecessor, Sir Patrick Sergeant, who died at the age of 100, that is a mere trifle.

As the City’s first deputy editor and then occupant of that chair from 1966 to 1984, Sergeant, assisted by some of the most distinguished financial writers of the last century, presided over 6,491 columns.

This was coupled with his business genius in recognising how the City of London was changing dramatically after the Second World War.

It was becoming, partly as a result of ill-conceived American regulation, the banking capital of the world.

The creation of eurobonds, syndicated loans and eurocurrency markets in the Square Mile was the fertile ground in which Sergeant launched Euromoney magazine. He was the quintessential chronicler of the birth of the modern City, which today contributes 12% of the nation’s wealth, employs 2.5m people across the UK and pays more than £100m in tax. Some might say that’s enough. There is a latent concern that a new Labour government, by penalising wealth, could drive financial services – much more mobile in the age of AI – offshore.

My own knowledge of Sergeant came when I was a junior financial and economics journalist at the Guardian. I quickly learned that, despite the Financial Times’ role as the City’s salon paper, the best place to go if you wanted to connect with the beating heart of the Square Mile was Sergeant’s commentary. Readers of these pages, many of them private shareholders, relied on Sergeant’s wit, wisdom, fun and biting commentary to guide them through the tick-tock of financial news.

His ability to pick up the phone and speak to titans of the corporate world and communicate directly with traditional commercial banks meant that the commentary column, more often than not, included scoops. It also provided the reader with vital information on whether to buy, sell or hold stocks and, in the process, accumulate personal wealth.

All this was done, as Robert Hardman’s glowing obituary in yesterday’s paper noted, with uncommon cordiality and generosity of spirit. My first personal encounter with the Sergeant’s whirlwind came in Washington. The setting was the cavernous Sheraton conference hotel, where commercial bankers, central bankers and finance ministers gathered each fall for the annual meetings of the International Monetary Fund.

The arrival of the Sergeant and his entourage was that of an all-conquering hero. He would be accompanied by a generous stack of copies of the day’s Daily Mail, packed with commentary on the day’s crisis, as well as free editions of Euromoney, as thick as a telephone directory. And most importantly of all, there would be no shortage of champagne. Sadly, IMF meetings have since become more sober affairs, held amid heightened security in the city centre at the organisation’s headquarters. Delegates are more likely to be sipping from a bottle of mineral water than drinking Moet.

Before the Sargento era, financial journalism tended to be dull. There were excellent, if sometimes impenetrable, economics columnists, such as the FT’s Samuel Brittan and the Times’s Peter Jay. But investment, interest rates and public finances were not entertaining subjects.

Sergeant changed that, humanising the City’s big names and helping to make equity investing accessible. He pilloried those who failed to live up to expectations. One can only guess what he would have made of Labour’s poor start to government and the current high levels of debt.

What I have learnt from my predecessors at the Mail, Sergeant and the late Andrew Alexander, is that monthly public finance figures are the difference between two very large and unequal figures: taxes collected and money spent by the government. They need to be handled with great care.

Let us hope that the Chancellor is listening to the lessons of the wise.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.