Table of Contents

Aldi could overtake Asda to become the UK’s third-biggest supermarket by opening more stores in an £800m expansion drive.

The discount chain’s UK and Ireland chief executive Giles Hurley said he wants more stores “across the length and breadth” of Britain amid a battle for market share.

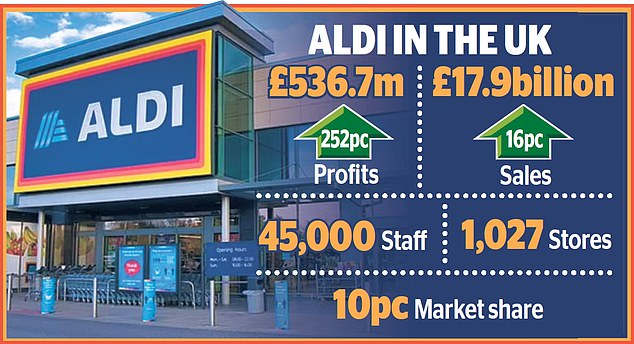

The comments came after the German supermarket announced that UK profits tripled to £536.7m last year, while sales rose 16 per cent to £17.9bn.

Expansion drive: Aldi UK and Ireland chief executive Giles Hurley said he wants more stores “across the length and breadth” of Britain amid a battle for market share

After overtaking Morrisons to become the fourth-biggest supermarket two years ago, Aldi is gaining ground on Asda. Figures from closely watched industry data firm Kantar

suggest it could soon overtake Asda, which is struggling after a private equity buyout three years ago and has its lowest ever market share of 12.6 per cent.

Aldi owns 10%, according to the latest available data for the 12 weeks to August 4. Data published this morning will provide a more up-to-date picture.

In Aldi’s biggest annual investment to date, 23 stores will open, including in Muswell Hill, north London, and Caterham, Surrey. This will bring the total to 1,050 by the end of the year.

The supermarket will invest £1.4bn in new stores over the next two years to reach its long-term target of 1,500 stores in the UK, with openings planned in Wales and Scotland as well as across England.

Hurley said: “For every £1 of profit we made last year, we are investing £2 this year, opening more stores and building the supply infrastructure to bring affordable, high-quality food to millions more families across Britain.”

Customers are switching to more expensive options as cost-of-living pressures ease, the supermarket boss said.

Premium private label products that have flown off the shelves include Wagyu steaks, ready meals and brioche buns.

“I think some customers are feeling the effects of lower inflation and are choosing to switch restaurants or possibly opt to treat themselves at home, rather than having the restaurant experience,” Hurley said.

The big four traditional supermarkets – Tesco, Sainsbury’s, Asda and Morrisons – all have plans to match prices with Aldi, but Hurley said he was “quite optimistic” there would be further price reductions in its stores before Christmas.

Aldi has enjoyed a sales boom after Russia’s invasion of Ukraine drove up food prices, driving many customers away from more expensive supermarkets.

But there have been signs it is losing momentum as inflation cools and its market share has fallen slightly from 10.2 per cent last year. Still, it has fared much better than private equity rivals Asda and Morrisons, which have both haemorrhaged shares.

Hurley also criticised the planning system, saying it can take years rather than months to move forward with plans for new stores.

“What we want to encourage is a planning system that ensures our investment reaches the British public as quickly as possible,” he said.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.