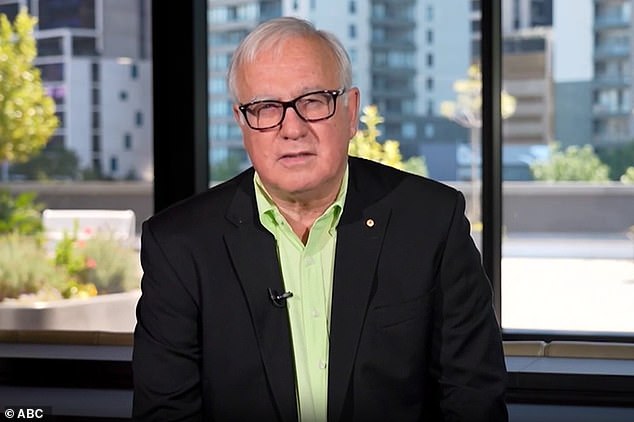

ABC finance expert Alan Kohler has described the housing affordability crisis as the worst financial mistake ever made in Australia.

The situation is now so bad that a median-priced home is unaffordable for a single average-income person, even in the seemingly most affordable capital cities, where house prices are much lower than those in Sydney, Melbourne or Brisbane.

Adelaide is surprisingly the second least affordable state capital in Australia when you compare the average full-time salary in South Australia with the average property price in the city.

In January, the average price of houses and units in Adelaide was $721,376, 7.9 times higher than the average full-time salary in South Australia, which was $91,068.

This was well above Australia’s national debt-to-income ratio of 7.5.

“There are a couple of things that might surprise you: Adelaide became the second least affordable Australian city last year,” Mr Kohler explained.

‘Adelaide has just replaced Hobart in second place.

“What’s happening: Simply put, incomes in Adelaide, Hobart and Brisbane are not keeping up with house prices, which are being driven up by rapid population growth and by home buyers. first home”.

Kohler noted that when he and his wife bought their first house in Melbourne for $40,000 in 1980, he was earning $11,500 as a journalist.

This meant his house cost just 3.5 times his income before the mortgage deposit.

“When my wife and I bought our first home in 1980, the median home price was 3.5 times the median income,” he said. ‘Now it is 7.5 times and still increasing.

“That didn’t have to happen – it’s Australia’s worst economic mistake.”

ABC finance expert Alan Kohler has called the housing affordability crisis the worst financial mistake ever made in Australia.

In November, the Reserve Bank raised interest rates for the 13th time in 18 months, taking the cash rate to a 12-year high of 4.35 per cent, and has also diluted what banks can lend.

Borrowers would now be unlikely to be able to borrow more than five times their salary, leaving younger single buyers out of the market unless they had help from their parents.

Kohler said parents were now shoring up first-home buyers’ mortgage deposits, effectively bringing forward their inheritance, causing loans for them to rise by 21 per cent in 2023.

“Despite rising prices and crushing interest rates, first-home buyers were the fastest growing type of borrower,” he said.

“The Bank of Mom and Dad dumping early inheritances and politicians showering them with subsidies and concessions, desperate to appear to be doing something about affordability while actually making things worse.”

Along with high interest rates, record immigration is driving up home prices and worsening the rental market.

Australia’s median property price of $759,437 in January was 7.6 times the national full-time average of $99,174, including bonuses and overtime.

The situation is now so bad that a median-priced house is unaffordable for a single average-income person, even in the seemingly most affordable capital cities, where house prices are much lower than those in Sydney, Melbourne or Brisbane (in the photo, young voters).