Primark is one of the contenders to fill empty space at the downtown San Francisco shopping center, according to a new report.

The San Francisco Center, formerly known as Westfield Mall, has been without an anchor tenant since last August, when Nordstrom raised its bets amid rising crime and falling foot traffic.

Now, mall operators JLL and Trident Pacific are in talks to fill the five empty floors left by Nordstrom with a foreign, possibly European, operator, sources told The Associated Press. San Francisco Standard.

Potential contenders named by the outlet include Primark, the Dublin-based fast fashion retailer, and Eataly, the large-format Italian food hall with locations around the world.

Other possibilities being mooted include French department chain Printemps, Japanese bowling and arcade Round1 and Japanese clothing retailer Uniqlo.

The San Francisco Centre, formerly known as Westfield Mall, has been without an anchor tenant since last August, when Nordstrom left.

Irish discount fashion retailer Primark is a possible contender to fill empty space in the downtown San Francisco shopping center.

It was not confirmed which retailers the ownership group may have contacted and offered the examples only as speculative possibilities, the Standard reported.

Representatives for Primark and the mall’s owners did not immediately respond to a request for comment from DailyMail.com on Monday morning.

Primark has long enjoyed huge popularity in Ireland and the UK, but has recently begun an expansion push in the US, where it currently operates 24 stores in nine states, with plans to reach 60 stores in the US. USA by 2026.

Earlier this month, the Irish firm announced plans for a new distribution center in Jacksonville, Florida, to serve expansion plans in the southern United States.

Primark also announced plans for new stores in Woodbridge, Virginia; Hyattsville, Maryland; Franklin, Tennessee; and Katy, Texas.

So far, however, the retailer has no existing or announced U.S. locations west of Chicago, meaning a store in San Francisco would be a radical expansion of its U.S. presence.

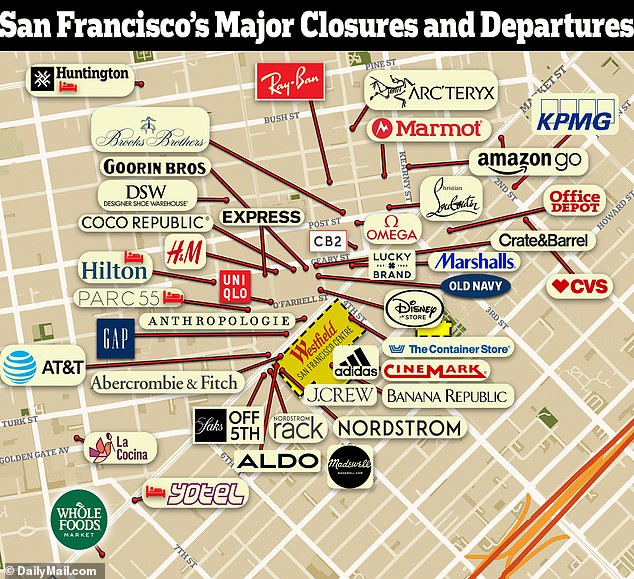

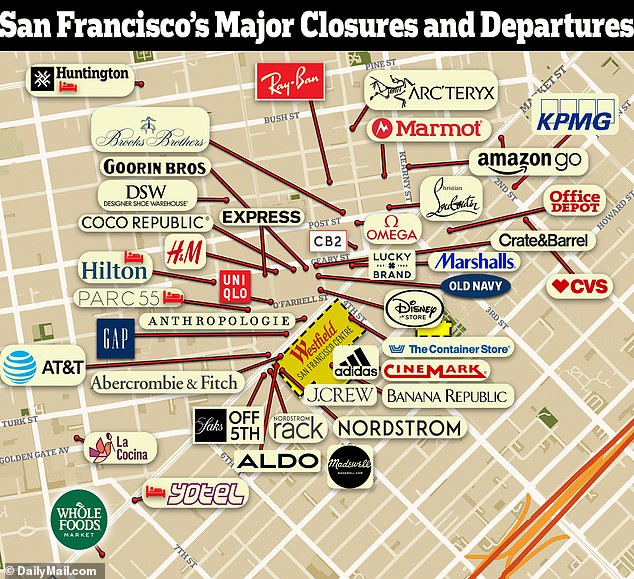

Meanwhile, San Francisco’s ailing downtown shopping center has suffered an exodus of retailers in recent months.

Last month, Madewell became the fifth retailer in a month to leave the mall, following sister brand J. Crew, as well as Adidas, Lucky Brand and Aldo.

San Francisco’s ailing downtown mall has seen an exodus of retailers in recent months

According to Real Deal, San Francisco Center has lost a staggering $1 billion in value since 2016 as a retailer.

The city’s largest shopping center, formerly owned by Westfield and Brookfield, which defaulted on mortgage payments last year, is now worth just $290 million, down 75 percent from seven years ago, according to Real Deal.

When its former mall operator Westfield turned over the property to its lender last year, it largely attributed Nordstrom’s exit to “unsafe conditions” and a “lack of law enforcement against rampant criminal activity.”

The mall is located in the troubled Union Square area of downtown, which has seen a drop in foot traffic since the pandemic, a change that has been variously attributed to crime, lack of housing and work from home policies.

Michael Berne, president of MJB Consulting, a real estate and retail planning consultancy based in Berkeley and New York, told the Standard that European or Asian retailers could have an advantage in negotiating with landlords.

“Maybe they are able to look at this market more objectively than Americans.” [retailers] right now,” Berne said.

“They’re not as affected by the political football and can instead focus on how this could be a golden opportunity to enter a market that they may have coveted for a long time but haven’t been able to access in the past.”