- Both Tony and his father Shad Khan appeared on Wednesday’s episode of AEW.

- It ended with a supposedly injured Tony being cared for by his billionaire father.

- DailyMail.com provides the latest international sports news.

Jaguars brass may not be at full strength for Thursday’s NFL Draft after the team’s director of football strategy fell victim to a ‘Meltzerdriver’ during Wednesday’s All Elite Wrestling show in Jacksonville.

Tony Khan, son of Jags owner Shad and owner of AEW, got his first taste of kayfabe wrestling with the help of late 90210 actor Luke Perry’s son Jack, who was returning from a recent suspension.

The scene involved Nick Jackson, one of the ‘Young Bucks’, jumping off the top rope towards a pinned Tony, who appeared to have been knocked out by the impact.

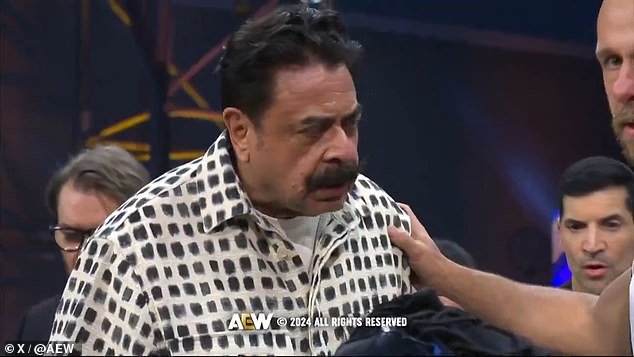

The dramatic episode ends with Shad, owner of both Fulham and the Jaguars, running to the ring to see his supposedly injured son.

Wrestling fans will have to tune in to Thursday’s NFL Draft to see if Tony is wearing a neck brace or not in the team’s war room.

Tony Khan (right) appears alongside wrestler Jack Perry, son of the late actor Luke.

Shad Khan rushes to son’s side after Tony fell victim to ‘Meltzerdriver’ on Wednesday

Is Tony Khan injured? Will he be available for Thursday’s NFL Draft? What will the Jaguars do?

For Tony, it was his first real action in the ring. But real or not, the hammer comes at a time when the team is preparing to pick 17th overall in the NFL Draft.

More specifically, Tony is being counted on to provide help to quarterback Trevor Lawrence on Thursday, and that could come in the form of a wide receiver.

The Jags have selected nine wide receivers in the first three rounds of the NFL draft in three decades of existence, and only two of those guys (DJ Chark and Allen Robinson) posted 1,000-yard seasons and only one (Marqise Lee) signed a second contract. with Jacksonville.

It’s a streak of futility that the Jags hope to end in 2024. General manager Trent Baalke and coach Doug Pederson are expected to try to turn around the franchise’s fortunes at the position during next weekend’s NFL draft.

The Jaguars have five of the first 116 picks, three of them scheduled for the first two nights of the draft.

Cornerback remains the team’s top need after releasing starter Darious Williams and opting not to re-sign nickelback Tre Herndon. Jacksonville also has fellow starter Tyson Campbell entering the final year of his rookie contract.

The Khan family and the other Jaguars executives are trying to help Trevor Lawrence.

Baalke responded by signing journeyman Ronald Darby to a two-year, $8.5 million contract in free agency, but Darby is far from a mainstay for new defensive coordinator Ryan Nielsen. Alabama’s Terrion Arnold or Toledo’s Quinyon Mitchell would make more sense with the 17th overall pick.

But no one should be surprised if Jacksonville drafts a receiver there either.

The Jaguars lost Calvin Ridley to rival Tennessee in free agency, and Zay Jones is entering the final year of his contract; He signed a three-year, $24 million contract in 2022.

Baalke landed Gabe Davis from Buffalo on a three-year, $39 million deal last month, but Davis is considered more of an upgrade on Jones than a replacement for Ridley. Drafting a receiver early appears to be a given, especially as the Jaguars continue to build around quarterback Trevor Lawrence.

LSU’s Brian Thomas Jr. and Texas’ Xavier Worthy could be options at 17 years old. Whoever it is, the Jags can only hope he turns out better than all of their other first-round receivers.

They missed R. Jay Soward in 2000 and have been chasing him ever since. His draft list of receivers includes Reggie Williams (2004), Matt Jones (2005), Mike Sims-Walker (2007), Justin Blackmon (2012), Allen Robinson (2014) and Lee (2014).

The most recent flops are Chark (2018) and Laviska Shenault (2020).