The family of a widow living with dementia claims she was allowed to withdraw more than $300,000 from a Westpac branch more than 24 months before she died.

The 89-year-old woman had been a customer at a Westpac branch in New Zealand’s North Island until her death on July 30, 2020.

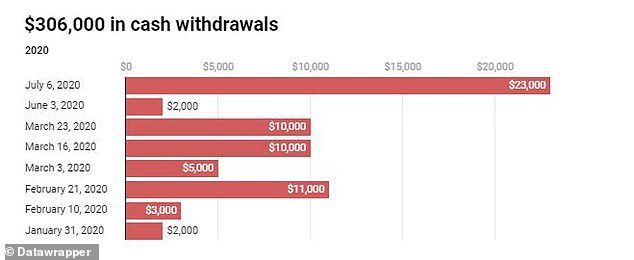

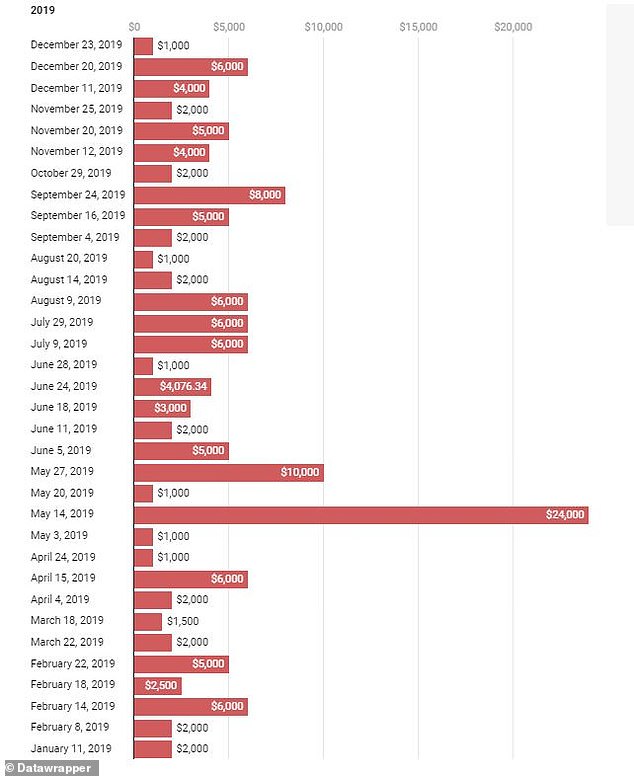

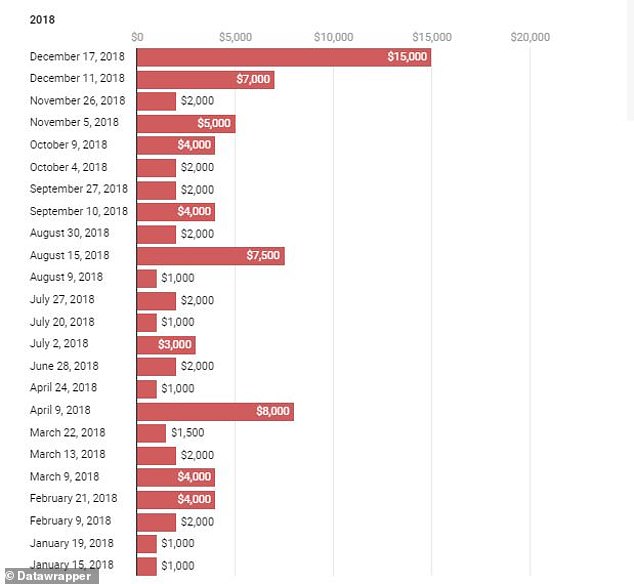

The elderly woman made more than 70 ATM-assisted cash withdrawals between September 2017 and July 2020, for a total of $305,000.

Her daughter claimed the bank had allowed the transactions despite informing them of her dementia and that she was a vulnerable customer.

An 89-year-old widow with dementia withdrew more than $300,000 in cash from her Westpac account in the 34 months before her death (file image)

Concerned about her mother’s health, the daughter contacted the Westpac branch in February 2020.

The bank added a note to his file saying he was a “vulnerable customer” and warning tellers to “be cautious with any large or unusual transactions.”

Despite the warning, the elderly woman was able to withdraw $50,000 in five separate ATM-assisted transactions in the months before her death.

The daughter explained that she was “stunned” and that the staff did not question any of the withdrawals.

He added that his mother had paid off her house and car and was not using the money for utility bills or credit card payments.

‘What the hell did they think I was spending the money on?’ the daughter told him New Zealand Herald.

The daughter said she knew “something was wrong” with her mother in the months before her death, as she was angry and commented that “people fleeced her for money.”

Relatives attempted to track down the total amount of cash the widow withdrew and believe more than $200,000 had just “disappeared.”

‘I can’t prove it, but the money is missing. And the $23,000 that she withdrew three weeks before she died was no longer in her house,” the daughter said.

The daughter, who was appointed as her mother’s attorney, checked her mother’s bank statements for suspicious transactions.

The woman’s family lodged a formal complaint with Westpac and the Banking Ombudsman, alleging the bank failed in its duty of care to protect an elderly and vulnerable customer (file image)

He was shocked to discover that his mother had withdrawn more than $200,000 in cash in the last 18 months of her life.

Account statements showed the largest cash withdrawal at the branch was $24,000 in May 2019.

The daughter said she accompanied her mother on her last trip to the bank and saw the teller hand her an envelope containing $23,000 even though her mother was not carrying a purse.

He explained that at the time he had no idea how much his mother had withdrawn, but remembered the teller telling him it was a large amount of money.

“They let her leave without a purse and with a Westpac envelope full of cash. It was probably about 8cm thick,” the daughter said.

The daughter confronted bank staff about the series of large cash withdrawals and claimed they told her they were “too scared” to ask the pensioner why he needed the money.

They allegedly claimed the mother “maybe wanted to buy a mobility scooter” with the cash.

The family contacted police suggesting the pensioner was a victim of elder abuse as she lived frugally and there was no indication she spent the money on herself.

An investigation was launched and a person of interest was questioned, but it was eventually closed because there was no evidence the person received the money and police were unable to trace the cash.

The family has since lodged a formal complaint with the Australian-owned bank, alleging it failed in its duty of care to protect an elderly and vulnerable customer.

The complaint claims Westpac tellers did not question cash withdrawals despite a vulnerable customer alert being added to their file.

The family has also filed a complaint with the Banking Ombudsman.

In a letter sent to her daughter in May, Westpac described the widowed retiree as a “highly respected” woman at the branch.

A summary of some of the transactions made by the widow before her death on July 30, 2020.

The bank said its staff did not believe the woman had “vulnerabilities” and did not suspect any of the withdrawals were suspicious.

The letter explained that it was common for the mother to withdraw money, as it was how she used her bank account and managed her finances.

The bank added that staff were of the same opinion as the daughter, who indicated that her mother was not someone who could be questioned about her funds.

Westpac said staff questioned the woman on “a number of occasions” about the reason for the cash withdrawals and that the woman was “confident and clever with money”.

“She was very secretive about her finances, which was acknowledged by her daughter… and our staff ultimately acted on her instructions when processing withdrawals,” Westpac said in a statement to the NZ Herald.

The bank added that tellers asked additional questions about cash withdrawals after February 2020, following the “extra care” code that was placed on the woman’s account at the daughter’s request.

The elderly woman made three withdrawals in March totaling $25,000 and told staff she needed the cash due to Covid-19 closures.

Staff also asked about his final withdrawal of $23,000 and were told he needed the lump sum because he didn’t know when his next visit to the branch would be.

Staff claimed they felt “comfortable” handing over the cash in an envelope as the woman was with her daughter.

In 2023, Australians aged 65 and over reported more than 72,000 scams, costing victims almost $121 million, according to the ACCC’s Scamwatch.