A leading banking analyst has predicted that US stocks could soon fall by 30 percent.

BCA Research chief global strategist Peter Berezin told clients last week that the U.S. economy could fall into a recession later this year or in early 2025.

If the U.S. falls into recession as he predicts, Berezin says the S&P 500 will fall to $3,750, a 30 percent drop from current levels.

Berezin’s concern about the economy is based on the belief that the labor market could slow substantially in the coming months.

Lower employment would weigh heavily on consumer spending, a key driver of economic growth.

Peter Berezin, chief global strategist at BCA Research, warned that stocks could fall

The S&P 500 is up more than 15 percent so far this year, while the Dow is up about 3.8 percent.

A crash would also hit Americans’ retirement accounts.

Most people have at least a portion of their 401(K) and IRA invested in the Dow Jones, S&P 500, and Nasdaq.

“The reason the US avoided a recession in 2022 and 2023 was because the economy was operating along the steep side of the Phillips curve,” he wrote in the note.

The Philips curve is an economic theory that establishes that there is an inverse relationship between unemployment and inflation: when the former rises, the latter falls.

‘When the labor supply curve is nearly vertical, weaker labor demand will primarily lead to lower wage growth and a drop in job vacancies.

“In other words, impeccable disinflation,” he added.

Berezin also told the firm’s clients that more economic problems could be on the way as a result of slowing growth in Europe and China.

Such a scenario, he argued, would weaken global growth and cause international stocks to fall.

The gloomy story comes after the Dow Jones hit an all-time high in May, surpassing 40,000 points for the first time in its history. Currently, the Dow Jones index is just below that milestone, at 39,331 points.

The S&P 500 is up more than 16 percent so far this year and the tech-heavy Nasdaq is up a whopping 22 percent so far.

The increase has also worried other analysts.

Among them is Sam Stovall, chief investment strategist at CFRA Research, who last month warned that stocks are headed for a “correction.”

“I’m increasingly concerned that we may have to endure another 5 percent or more decline before the end of the year,” Stovall told Yahoo.

In recent weeks, top bankers and even a prominent former CEO have issued chilling warnings about the U.S. economy.

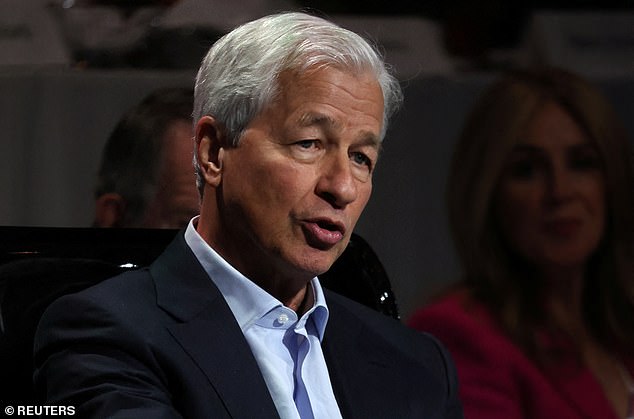

In May, Jamie Dimon, head of the world’s largest bank, JPMorgan Chase, said that The worst result for the US Economy it would be ‘stagflation’.

This is when inflation continues to rise, but unemployment is high and growth is slowing.

JPMorgan Chase CEO Jamie Dimon has said he cannot rule out a “hard landing” for the US economy.

Economists consider stagflation, last seen in the United States in the 1970s, to be worse than a recession. It would send stocks tumbling, affecting 401(k) plans and other retirement savings funds.

“I’m increasingly concerned that we may have to endure another 5 percent or more decline before the year is out,” Stovall said in June.

The upward surge has also been a cause for concern Sam Stovall, chief investment strategist at CFRA Research, warned last month that stocks are headed for a “correction.”

“I’m increasingly concerned that we may have to endure another 5 percent or more decline before the year is out,” Stovall said in June.