Table of Contents

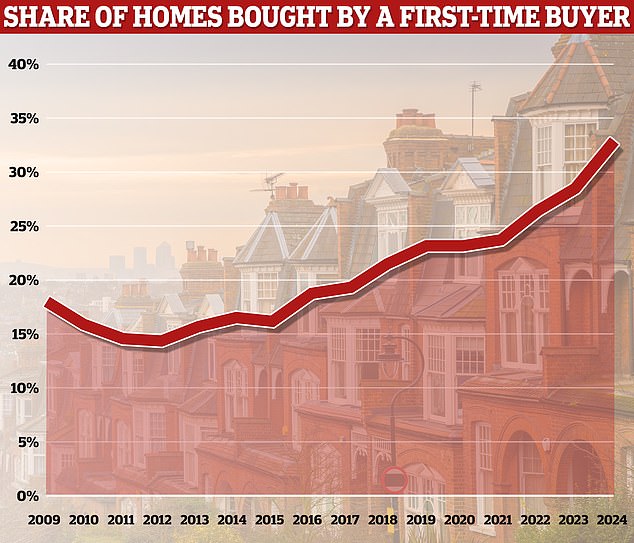

According to research from Hamptons, there are many first-time buyers this year who will buy a third of the homes sold so far in 2024.

The property company revealed that first-time buyers are responsible for 33 percent of purchases in Britain this year, a record high.

It’s a sharp increase from 29 percent in 2023 and just 17 percent in 2014.

The increase is due to starters in southern England.

For the first time, half of homes in London were bought by first-time buyers this year, compared to 41 percent in 2023 and 28 percent ten years ago.

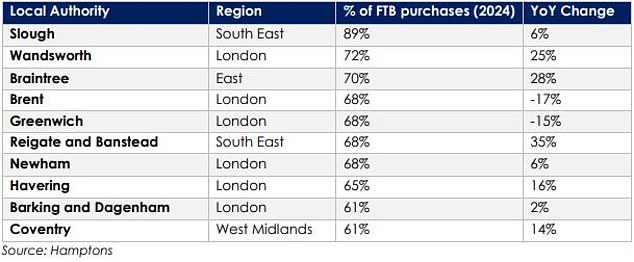

But the main target for first-time buyers appears to be Slough in Berkshire, where a whopping 89 per cent of homes are sold to them.

Market milestone: First-time buyers bought 33% of homes sold in Britain so far this year, an all-time high

Analysts at Hamptons claim that if house purchases continued at this pace, there would be 363,000 new homeowners across Britain this year – the highest number since 2009.

The research is based on sales by agents in the Countrywide network, which consists of more than 60 high street brands in the UK, of which Hamptons is one.

Why are there more starters?

Cheaper mortgages and falling inflation are thought to have helped those who couldn’t buy last year get on the ladder.

The cheapest mortgage interest rate has fallen to between 4 and 5 percent, and many people’s incomes have also risen.

> Get the best deal for you with This is Money’s mortgage finder

While the cost of living has also risen, home prices still remain slightly lower than their summer 2022 peak, making them appear more affordable.

It is also thought that rising rents will encourage some tenants who can afford to buy to do so.

Aneisha Beveridge, head of research at Hamptons, said: ‘In a bid to escape the heated rental market, first-time buyers have dominated the sales market this year, accounting for a record third of all buyers.

‘This unprecedented step comes despite a limited package of government support measures.

‘Instead, with high mortgage rates limiting their ability to borrow, most are compromising on a smaller home to get a foot on the housing ladder.

‘The market is still dominated by those who can afford to buy, rather than those who want to.

‘And the increase in the number of starters this year partly compensates for the lost moves in 2023.’

‘Over the longer term, in a similar way to post-2008 when the abolition of high loan-to-value lending made it out of reach for many, unless interest rates fall significantly, homeownership will be limited to the most affluent households, turning the decade around. -long increase in purchases by new buyers.’

Why are there so many starters in London?

Considering London is home to some of Britain’s most expensive properties, this may come as a surprise to many.

That said, London has seen some of the biggest rent increases in recent years, perhaps encouraging more renters to become homeowners.

House prices in London have also underperformed Britain’s for much of the past decade. The average price of a flat in London has barely changed since 2016.

First-time buyers in London also appear willing to make compromises on space and location, as higher mortgage rates limit the amount of money they can borrow.

This is suggested in the data by the fact that they are buying cheaper houses than before.

This year, the typical London first-time buyer spent £108,710 less on their property than in 2020, when mortgage rates were more affordable.

London calls: starters bought a record 50% of all homes sold in the capital this year

The best town for first time buyers is… Slough

In total, there were 19 local authorities in Britain where more than half of all first-time buyers came to the market this year.

Fifteen of these were in the south of England and seven in London.

Ten years ago, Slough was the only local authority where more than half of homes were bought by first-time buyers.

But now it includes London boroughs such as Wandsworth, Brent and Greenwich, as well as Reigate and Banstead in Surrey, Braintree in Essex and Coventry.

Hotspots: These are the areas where the largest share of homes goes to starters

First place: Slough has recorded the highest percentage of first-time buyer purchases, according to Hamptons

The South East, the second most expensive region in the country, also saw a 9 per cent year-on-year increase in the share of homes bought by first-time buyers.

They bought 34 percent of the homes sold in the region this year, more than double the share in 2014.

Wales and the North East were the only regions where the share of first-time buyer purchases fell since last year.

These are some of the most affordable areas in Britain to buy a home, so improving affordability conditions has had a smaller impact.

First-time buyers are buying increasingly smaller homes

In an effort to escape the expensive rental market, first-time buyers are buying smaller homes, the Hamptons analysis shows.

For the first time since 2011, more than half of starters bought a home with one or two bedrooms.

Last year, 49 percent purchased a home with two bedrooms or smaller, while the majority of new homeowners purchased a larger home.

Similarly, 28 percent of first-time buyers bought an apartment this year, up from a recent low of 24 percent in 2022, when the post-Covid race for space was in full swing.

Hamptons estimates that first-time buyers will spend £3 billion less on their first home this year than in 2021, while they will pay £796 million more in mortgage repayments during their first year of ownership due to higher rates.

A typical first-time buyer with a 10 per cent mortgage, taken out over 30 years, will pay £13,977 in the first year of 2024.

That’s £1,524 more than they would have paid for a larger house in 2021.

This first-year mortgage payment calculation assumes they are purchasing a mortgage with a 10% down payment over a 30-year term. Source: Bank of England & Hamptons

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.