DailyMail.com analysis shows that IRS staff working during this year’s tax filing season sat idle for an hour each workday.

Staggering workforce waste is the fault of decades-old technology that creates a double whammy, a shocking report reveals.

Calls are routed inefficiently to staff, so they are often left “sitting around waiting for the phone to ring” during the January 29-April 15 tax season.

On top of that, outdated systems mean employees can’t help taxpayers (by reviewing paperwork or answering emails) while waiting to take a call.

Experts say this explains why only 31 percent of those who tried to contact the agency were unable to speak to a human being this year.

DailyMail.com took a hard-hitting look at the news report by the National Taxpayer Advocate, an IRS watchdog agency.

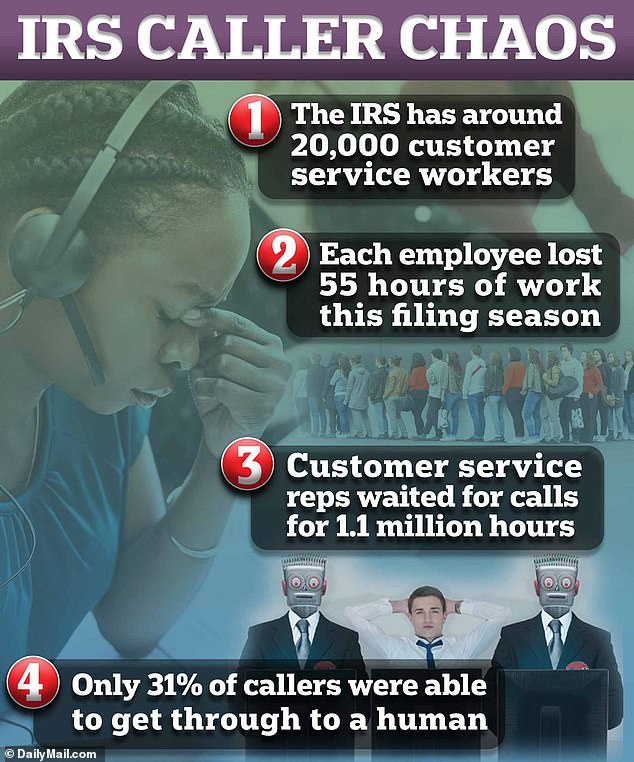

Customer service workers waited on calls for 1.1 million hours during this year’s seven-week tax season, the company revealed..

The latest figures show there are about 20,000 customer service employees at the IRS.

That means each worker lost an average of 55 hours this filing season, or just under seven eight-hour work days, according to calculations by DailyMail.com.

And the impact of these lost working hours is deeply felt by taxpayers.

The IRS has long been plagued by allegations of poor customer service.

Taxpayers attempting to contact the agency are generally limited to phone calls or postal mail.

During the Covid-19 pandemic, her reputation hit an all-time low and she became notorious for making it nearly impossible for taxpayers to reach her and get help.

The 1.1 million hours of time lost during this filing season represent “unproductive employee time that could have been spent processing taxpayer correspondence and amended returns,” the Taxpayer Advocate Service said.

Customer service representatives either answer phones or process taxpayer correspondence, but they can’t do both.

Even if call volume is low, employees are stuck working the phone lines.

This is understood to be due to outdated agency systems that make it difficult for employees to move from one task to another.

Much of the IRS’s correspondence still happens by mail, so workers have to sort through huge amounts of taxpayer documents.

The IRS has about 60 different case management systems that do not communicate with each other. Sometimes, employees have to open up to three or four systems to handle a query.

To try to achieve higher levels of telephone service, the IRS must staff its phone lines so that there are enough workers to handle calls during peak periods, the report said.

But that means that when things are quieter, reps are “sitting around waiting for the phone to ring.”

It’s not a new problem. During the 2023 tax season, employees spent 1.27 million (or 34 percent) of their time waiting to answer the phone.

While there has been a slight improvement in these figures this year, the percentage of overdue tax correspondence that was not processed within the normal time frame increased in 2024.

At the end of the 2024 filing season, 66 percent of taxpayers’ 6.8 million pieces of correspondence were overdue, compared with 61 percent the previous year.

“Going forward, the IRS must rebalance its workflow and find a way to shift employees between answering phones and processing paperwork more expeditiously,” the Taxpayer Advocate Service said.

IRS workers sat for an hour each workday, the report said.

The IRS lost 55 hours of work per customer service representative this tax season due to its “inefficient” systems, a DailyMail.com analysis reveals

This tax season, only 31 percent of people were able to reach a human when they called the agency for help.

The IRS has been criticized for its long wait times (pictured: IRS Commissioner Danny Werfel)

The IRS received 40 million calls during this year’s filing season, which ran from Jan. 29 to April 15.

But only $12.4 million were collected by an IRS employee, down from the previous year.

These calls include those facing serious problems such as eviction due to tax debt.

While the agency has hired 7,000 additional customer service employees from its pandemic-era minimums, that has done little to address clogged phone lines, the Taxpayer Advocate Service said.

The IRS said in a statement that it does not agree with all of the report’s methodology, but that telephone service had improved.