Florida’s condo crisis is at risk of becoming a national problem, with one major investor warning that 80 percent of condo owners in the state are at risk of losing money on their properties.

Grant Cardone, who owns 15,000 properties, told Dailymail.com that the “perfect storm” of sky-high insurance premiums, inflation and interest rates will likely fuel a national housing crisis.

Florida condo owners have been forced to cut prices by as much as 40 percent to sell their properties rather than pay huge repair costs to comply with new state laws introduced following the collapse of the Champlain Tower South in Miame-Dade County, which killed 98 people.

The laws mean that hundreds of thousands of condominium owners must now pay large sums to improve previously neglected properties.

An estimated 360,000 homeowners in South Florida alone may not be able to afford the repairs required by the new law.

Florida condo owners have reduced prices by up to 40 percent to sell (photo: Fort Lauderdale)

Real estate investor Grant Cardone believes Florida’s condo crisis will have national repercussions

Cardone predicted that because a staggering 80 percent of Florida condo owners are affected, the crisis will likely spread throughout the United States.

“This has already started and will continue to spread to the point where homeowners associations and condominiums will be penalized,” he told DailyMail.com.

Cardone said that if the federal government does not “step in,” condominium associations across the United States would be “at risk” of declaring bankruptcy.

“There is no time left to solve this problem: it is a bigger problem than global warming,” Cardone warned.

‘I have always been against investing in condos because of the endless increases in taxes, insurance, and out-of-control condo association fees and dues.’

A St. Petersburg condo owner who paid $1.2 million for a three-bedroom, two-bathroom property $715,000 to sell: a reduction of $485,000.

ISG World reported that there were a staggering 20,293 condos listed for sale in Palm Beach, Broward and Miami-Dade in the second quarter of this year, up from 8,353 in 2023.

Properties with the biggest price drops were located in St. Petersburg, Sarasota and Venice on the West Coast and Miami, Fort Lauderdale, Boca Raton and West Palm Beach on the South and East Coasts.

Cardone said that if the federal government does not “step in,” it is putting condo associations across the United States “at risk” of declaring bankruptcy (photo: Orlando)

State legislation enacted following the 2021 collapse of the Champlain Tower South in Surfside (pictured), which killed 98 people, means hundreds of thousands of condo owners must now shell out large sums for previously neglected maintenance.

The Champlain Tower disaster highlighted widespread neglect of older condominiums, with associations postponing crucial repairs to save money.

Cardone says the problem with many of those who are is that they are too familiar with cheap condo association owners, since his own, he says, “is run by a guy who has too much time on his hands.”

“It’s a great building doomed to failure by people who don’t know what they’re doing. It’s a common story among condominiums and homeowners associations across the United States,” he told DailyMail.com.

The Florida condo collapse prompted lawmakers to introduce SB 4-D in May 2022, which would require all state condos 30 years or older to undergo an inspection by the end of the year.

Condominium owners and associations must begin repairs and maintenance work noted in the report within one year of receiving it.

Nearly 90 percent of the more than 20,000 units listed for sale in Palm Beach, Broward and Miami-Dade are in buildings that are at least 30 years old.

Miami real estate agent Steven Kupchan told DailyMail.com earlier this month that people are flocking to Georgia, Texas, the Carolinas and even moving out of the country to places like Mexico or Central America.

Miami real estate agent Steven Kupchan told DailyMail.com that buyers are moving to Georgia, Texas, the Carolinas and even places like Mexico and Central America.

“With the rise of remote work, some people who had moved to Florida for work reasons are now considering moving to states with lower costs of living or more stable real estate markets,” Kupchan said.

Florida has seen a population boom during the pandemic, with more than 700,000 people moving there in 2022.

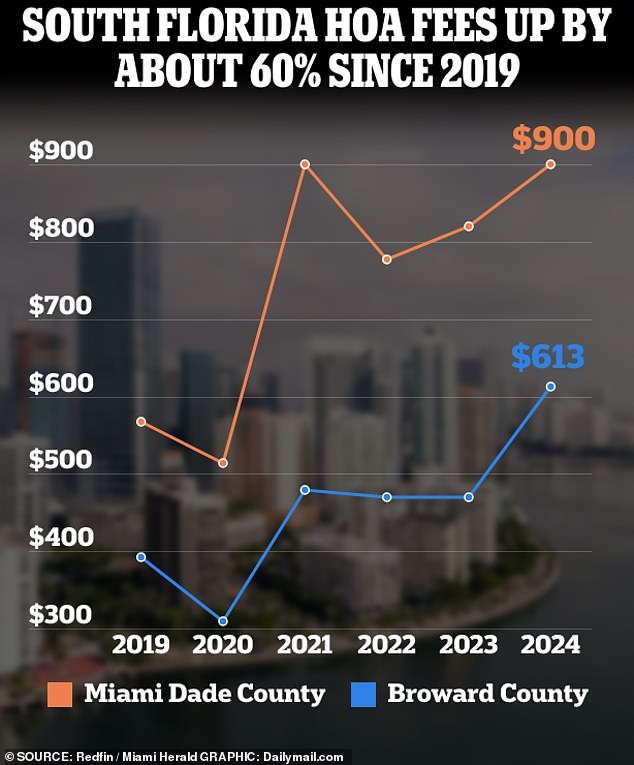

Security checks are driving up homeowners association fees, prompting many to sell

Condo sales are also declining in major Texas cities, raising fears that the state may be following in Florida’s footsteps.

Unsold homes are piling up in Fort Worth and Dallas as high insurance costs and destructive natural disasters make it difficult to sell condos, according to a new study. Redfin Data sample.

According to Redfin, the number of condos for sale in Florida rose 53 percent in the year through July, but Texas is quickly catching up: In that period, it saw a 42 percent increase.

Across the United States, the number of condos for sale is also increasing and pending sales are declining, although not as much as in Florida and Texas.

In Houston, for example, condo inventory is up 35.9 percent, sales are down 35.3 percent and prices are down 6.5 percent.

In Fort Worth, listings are up 65.4 percent and sales are down 33.3 percent.

Meanwhile, in Dallas, the number of condos for sale has increased by 61.7 percent. In San Antonio, it has increased by 58.3 percent and in Austin, by 28.6 percent.

There are several reasons why demand for condos is cooling in the Lone Star State.

Frequent and intense natural disasters in Texas, as in Florida, are a major factor in rising homeowners insurance costs. This, in turn, contributes to rising fees for condominium building homeowners associations as maintenance costs are passed on to unit owners.

Those rising costs, coupled with the danger of being caught in a natural disaster, are scaring off condo buyers and motivating owners to sell, Redfin said.