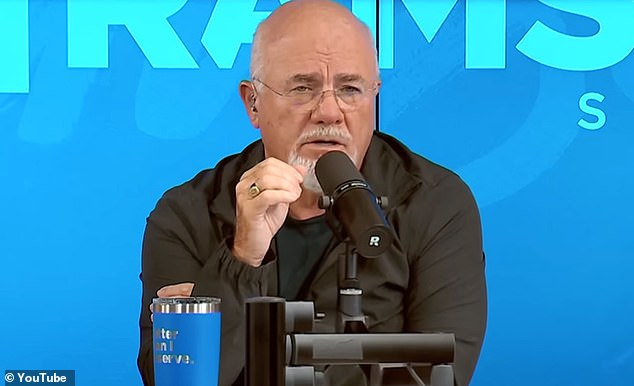

Financial guru Dave Ramsey has lashed out at a Missouri couple after the husband revealed he is $240,500 in debt but won’t give up the family car – but they are not the only Americans unwilling to make urgent changes.

John, from St. Louis, called into Ramsey’s show last month to ask for help getting his and his wife’s “massive debt” under control, but the guru had no time for his antics after telling him he refused to get rid of the family car that was weighing them down by $28,000.

“John, I don’t really care if it’s the family car,” he said. “You guys are broke, you’re starving on $150,000 a year. You can’t say it’s the family car, you can say everything’s on the table, we’re selling so much stuff that the kids think they’re next.

‘You’ve been spending like you’re in Congress for, what, 10 (years)?’

The St. Louis couple, who earn $151,600 a year, have only been married four years, which surprised Ramsey and his guest host, Jade.

Financial guru Dave Ramsey is criticizing a Missouri couple after the husband revealed he is $250,000 in debt but won’t give up the family car. “They’ve been spending like they’re in Congress,” he said. “They’ve never had a debt they didn’t like.”

“You never met a debt you didn’t like,” Ramsey said.

Ramsey laid down the law and denounced John’s excuses and the false language they used to describe his debts.

“That needs to change completely, because of your behaviours, your habits and the language you use around this issue,” Ramsey criticised. “As soon as I start talking about the car, you start saying, ‘It’s a family car’, as if it’s not a viable model.

“It’s not a useless vehicle, it’s a stupid car and your family is almost bankrupt, it’s the enemy, it’s not the family car, okay? So change your jargon around this,” he said angrily.

“It’s not the family car,” he scoffed, before telling John that he and his wife need to “go to a fucking war” to get out of debt.

Most of the couple’s debt comes from John’s $88,000 in student loans and his $46,000 HELOC, which allows borrowers to use their home as collateral for a loan.

The St. Louis couple, who earn $151,600 a year, have $240,500 in debt, much of it loans and credit card bills, and a “family car” they refuse to get rid of.

John told Ramsey that they used the home equity line of credit (HELOC) to “unfortunately” pay off a “bunch of credit cards,” to which Ramsey and Jade yelled, “No, they didn’t.”

“You are shifting the debt,” Ramsey said seriously. “And you haven’t stopped spending, you are still spending more than you earn… It’s not going to be acceptable to use plastic in your homes, you have to stop it cold turkey.”

John admitted that debt “scared” him, and Ramsey offered him free access to one of his company’s coaches and provided him with a free premium account at Financial Peace University.

The Missouri couple isn’t the only Americans struggling under the weight of massive debt, with the average household carrying around $104,000 in debt, according to Wise money.

Nearly 50 percent of Americans earning more than $100,000 said they lived paycheck to paycheck, study finds PYMNTS ReportThe figure only dropped to a third for those earning more than $200,000.