A financial guru has criticised a woman for her and her partner’s spending habits despite earning a combined income of $11,500 a month.

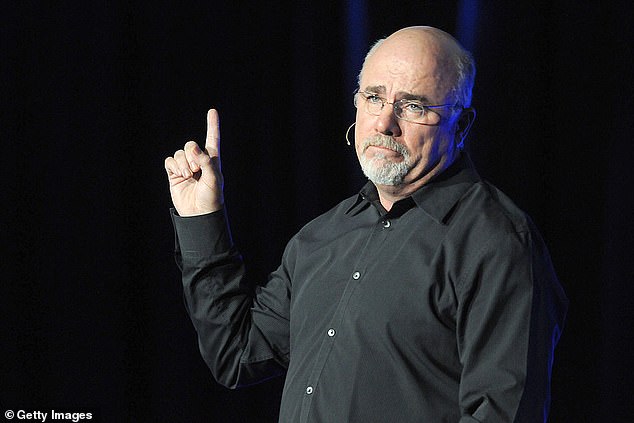

David Ramsey, an American radio personality known for his money-saving advice, spoke to a woman named Alyssa, who explained that she and her husband are not contributing to their retirement and only have $3,000 saved. They are also $138,000 in debt.

Alyssa explained on The Ramsey Show that they were living “paycheck to paycheck,” but after looking deeper into their finances, Ramsey realized that wasn’t the case.

Ramsey asked if the couple, who make about $140,000 a year together (far more than the average American), could set aside up to $5,000 each month to help pay down their shared $138,000 in debt.

Alyssa was quick to distrust his advice, as Ramsey told her, “You know what worries me? You make $130,000 a year and you’re broke. That’s what worries me.”

Financial guru David Ramsey gave a woman, Alyssa, the hard truth about her finances after she told him that she and her husband earn a combined monthly income of $11,500.

Ramsey immediately asked the woman how much debt she and her husband owed together, and Alyssa reveals that they owe $138,000.

Of that amount, about $9,000 comes from her studies to become a mental health therapist, while $40,000 comes from her husband’s time in school.

The couple also owes an additional $60,000 in car payments and a mortgage that still has $240,000 left to pay. So, in reality, the couple owes a total of $349,000.

Ramsey’s co-host George Kamel then chimed in and asked Alyssa how quickly she thinks they can pay off their debt, suggesting they start with $5,000 a month.

After hearing the hesitation in her voice, Kamel asked Alyssa what was stopping her from getting rid of her debt.

She then explained that setting aside that money would make her worry about ensuring the safety of her nine-year-old daughter.

Alyssa went on to say that she is constantly worried about “catastrophic expenses” because she is self-employed and her husband works in construction.

Ramsey reprimanded Alyssa again after hearing her response.

“You have an absolutely stupid lifestyle and that has nothing to do with a nine-year-old child,” he added.

She responded by reiterating that she wants to have money set aside in case of emergencies, but Ramsey did not accept her reasoning.

“But you’re not doing anything about it. They gave you $3,000,” he said.

Ramsey added that the money in her savings account is just a “red herring” that only “creates anxiety” for Alyssa.

Alyssa explained that she and her husband have about $3,000 in savings and are “living paycheck to paycheck,” but after digging into their finances, Ramsey quickly realized that wasn’t the case.

“You live like no one else so that you can then give and live like no one else,” he added.

To help the struggling couple, Ramsey drew up a detailed budget for them to follow that would allow them to quickly set aside $50,000 a year to cover their massive debt.

Although it will take some getting used to, Ramsey insisted it is something they have to do.

Ramsey, who started “from nothing,” had a net worth of just over $1 million when he was 26, according to his website.

He and his wife lost “everything” because of the debt they incurred. Although they didn’t tell anyone about their struggles, Ramsey said it helped them get to where they are today.

‘I paid the ‘stupid tax’ (mistakes with dollar signs at the end) so you don’t have to, and I’m here to tell you that whoever you are, wherever you come from, and however deep a mess you’re in right now, you can get out of it.

“You can take control and use the same common sense principles I used to turn your situation around,” Ramsey said on his website.

(tags to translate)dailymail