An Illinois man living in an unincorporated suburban community outside Chicago received a ruinously high tax bill that threatened to drive him out of his humble 1950s home.

Darryl Lloyd purchased the three-bedroom, one-bathroom home in 2006 and according to him, the current market value of the home is just over $180,000.

But when Cook County valued the home at $1 million, officials required him to shell out more than $30,000 in property taxes this year. fox 32 reported.

Last year, Lloyd paid $1,800, meaning the county increased its tax bill by 3,811 percent from what it was twenty years ago.

“I was literally devastated when I saw that increase,” Lloyd said of the bill he received a few days ago. “I see 960 square feet. I don’t have a second floor. I don’t have a basement.”

Pictured: Darryl Lloyd’s Chicago Heights home, a property he says is worth $180,000 — nowhere near the $1 million county tax officials assigned him. As a result, he initially had to pay a $30,000 property tax bill.

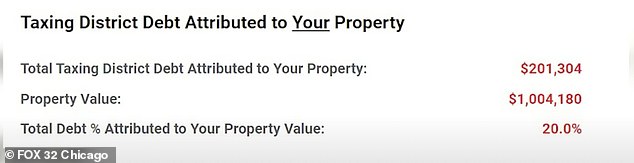

An excerpt from the tax bill Lloyd received in the mail, showing his property was valued at just over $1 million.

The houses in his neighborhood are also modest, which creates even more confusion on his part.

“There’s nothing worth more than a million dollars,” Lloyd said, adding, “I’ll have to move in with a relative or something. You know, I can’t afford it.”

But before throwing in the towel, Lloyd decided to fight, believing there had to be some kind of misunderstanding or mistake.

He made the trip to the Cook County Tax Assessment Office, an effort that proved fruitless and frustrating.

“I said, ‘Let me go to the city hall downtown, to the assessor’s office.’ And at that point I showed them my taxes and told them I had a substantial increase, and they said, ‘Everyone’s taxes are going up,'” Lloyd said.

The tax assessor’s office only admitted guilt once the local FOX affiliate in Chicago contacted them on Lloyd’s behalf.

“This property received an incorrect assessment due to a permit that was inadvertently applied to it. We will process a corrected tax bill for this property in the coming weeks, ensuring the property owner finally pays the correct amount in property taxes,” a representative from the office told FOX 32.

Lloyd is not alone: he is just one of the owners who caught the media’s attention.

This shows the dramatic increase in property taxes since 2004, before Lloyd lived at this address.

Now that he knows his tax bill was sent in error, Lloyd, pictured outside his home, said: “If it happened to me, it probably happened to other people. I would like to see immediate action.”

The Cook County Treasurer’s Office produced an analysis that concluded the county assessor miscalculated land values for more than 4,400 homes in Chicago’s south and southwest suburbs.

The overvaluations were made on properties located on larger parcels of land and the errors were discovered too late, before the tax bills were printed and mailed.

“If it happened to me, it probably happened to other people. I would like to see immediate action,” Lloyd said.

Lloyd is now awaiting a certificate of error, although the assessor’s office did not give an exact timeframe.

Lloyd’s one-story ranch-style home is shown from the side. It has three bedrooms and one bathroom.

The hidden cost of rising property taxes is forcing Americans in many states, both Republican and Democratic, to pack their bags and move.

A Florida woman was left reeling when she received a 174 percent property tax increase on her dream home this year, from $2,700 a year to $7,400.

She had to put her house back on the market after having invested most of her savings in it.

And many longtime Coloradans are selling their homes, too, as pandemic-era transplants send property values soaring — and tax bills rising just as quickly.

(tags to translate)dailymail