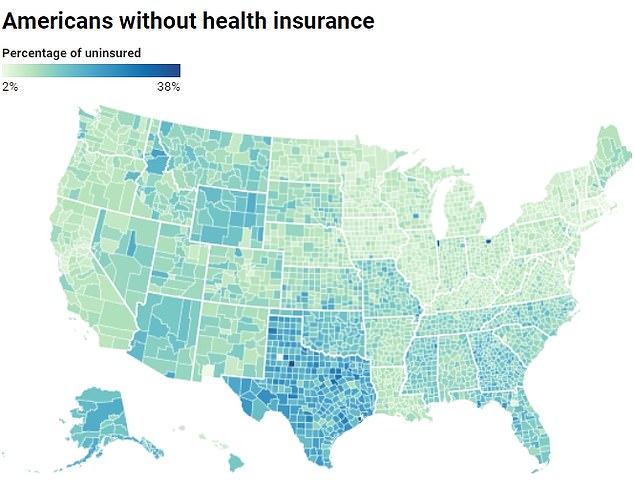

Despite a thriving local economy and an influx of new residents, Texas has the highest proportion of Americans without basic health insurance.

A startling annual report from the U.S. Census Bureau found that nearly 10 percent of Americans ages 18 to under 65 were uninsured, even though more adults were covered than the year before.

In Texas, nearly one in five lacks basic coverage, almost double the national rate of one in 10. And in some rural parts of the Lone Star State, nearly 40 percent were not covered by health insurance.

The problem could be because Texas, a major border state, has a large population of people ineligible for insurance, such as undocumented immigrants.

Data from the U.S. Census Bureau suggests that in some areas, as many as one in three Americans is uninsured.

The discovery comes at a time when Texas’ economy is booming, with the metropolitan area’s suburbs growing by more than 50 percent in just a handful of years and young people fleeing the coasts.

Meanwhile, Massachusetts had the highest number of insured residents, with just 3 percent uninsured. This could be due to the state’s requirement that all adults who can afford insurance buy it or face tax penalties, as well as its large Medicaid program, which offers free health insurance to people below a certain income.

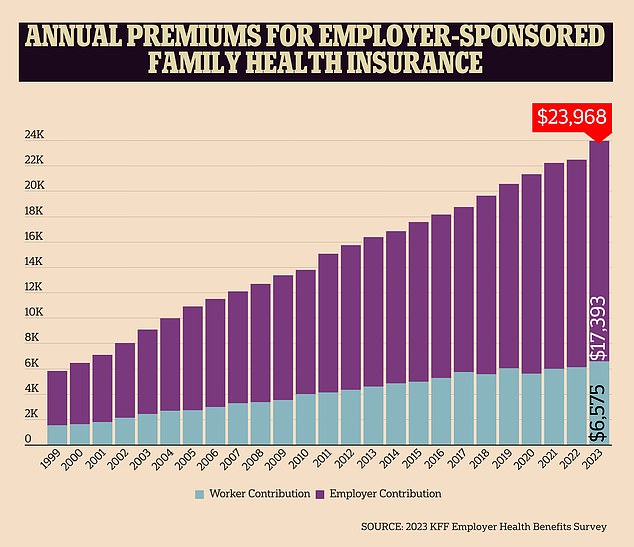

The findings come at a time when health insurance prices have hit an all-time high, rising nearly 50 percent in just 10 years.

Despite the grim results, the overall number of uninsured Americans has declined in more than 600 of the nation’s 3,100 counties, with only 23 experiencing increases.

About 45 percent of counties reduced their uninsured rates in one year to less than 10 percent, compared with 39 percent below this threshold in 2021.

According to a 2023 report from the Kaiser Family Foundation, the majority of uninsured people cite high costs as their main barrier. For example, about 64 percent of adults said coverage was too expensive in 2022.

Many adults do not have insurance through their jobs, and southern states like Alabama and Oklahoma have limited access to state insurance programs like Medicaid.

The consequences of not having health insurance can be serious, including restricted access to vaccines and the inability to afford life-saving treatments like chemotherapy.

The cost of health insurance rose this year by the most since 2011, according to an annual survey by the nonprofit health care research organization KFF.

Texas has become an economic powerhouse in recent years, thanks in large part to an influx of young people and big businesses taking over metropolitan areas.

For example, Taylor, a quiet suburb outside Austin, will become home to a $44 billion high-tech Samsung facility.

Many Americans from more urban states like California have also fled to Texas in search of cheaper rents, lower taxes and more property than they could get on the coasts.

But despite this, Kenedy County, Texas, had the highest number of uninsured adults, at 38 percent. Located just 20 miles from the U.S.-Mexico border, the small county has just 350 residents.

It is the fourth-least populous county in the United States, with roughly 100 times more livestock than people. Rural areas like Kennedy County are often more likely to have lower median incomes due to fewer job opportunities and isolation.

Additionally, according to U.S. Census data, three out of four Kenedy County residents are Hispanic or Latino, the group least likely to have health insurance.

The county’s proximity to the border suggests that many of its residents may be immigrants from Mexico who are more likely to work in jobs that don’t offer insurance or be undocumented, making them ineligible for coverage.

Overall, Texas has the second-largest number of undocumented immigrants behind California, with 1.6 million, which could contribute to gaps in insurance coverage.

According to the U.S. Census Bureau, one in five Texans lives in a rural area. These areas often have few options in the insurance markets, forcing residents to pay high premiums or go without if they can’t afford them.

And Texas does not have expanded access to Medicaid, meaning many low-income people who would qualify in other states would not be eligible for free coverage.

Further east, Holmes County, Ohio, follows closely behind, with 35 percent of people uninsured. Nearly half of its 44,000 residents are Amish, a group that largely eschews health insurance because of their religious beliefs, instead opting to have the community as a whole contribute to medical costs.

Presidio County, Texas, had the third highest number of uninsured adults, with 33 percent lacking coverage. As with Kennedy County, this could be due to the largely Hispanic/Latino population since it is a largely rural area.

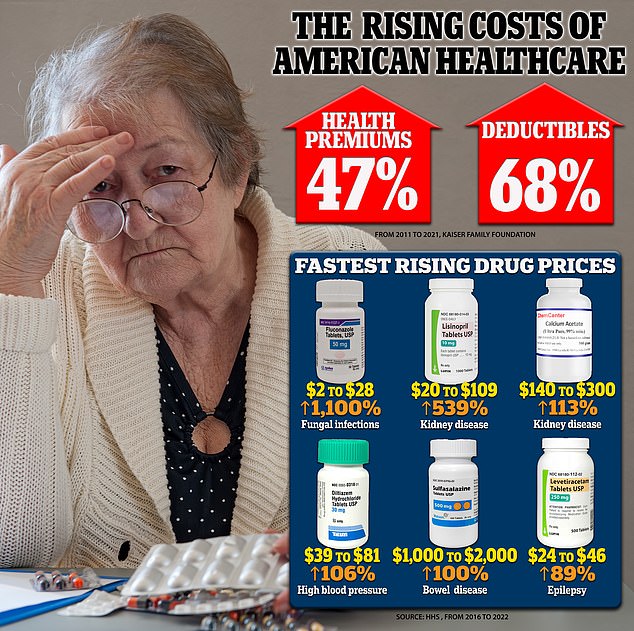

Health insurance premiums and deductibles rose sharply between 2011 and 2021, while HHS warns that many prescription drug prices increased between 2016 and 2022. The biggest offender was fluconazole, used to treat fungal infections.

In terms of state data, Oklahoma, Wyoming and Florida followed closely behind Texas, all with about 14 percent of adults uninsured.

All three states do not have expanded access to Medicaid, meaning the state insurance plan may not cover all residents who need coverage.

Los Alamos County, New Mexico, had the lowest rate of uninsured adults, at just 2.1 percent. This could be due to high household income.

A 2023 report from US News and World Report found that Los Alamos County had the highest median household income in the state, at $135,801, nearly two and a half times the state median income of $58,722.

Rounding out the top three states with the most insured residents, Middlesex County, Massachusetts, has just 2.4 percent of adults who are uninsured.

This could be due to Massachusetts’s Health Care Reform Law, which requires most residents over 18 who can afford insurance to have year-round coverage or pay a penalty on their taxes.

Massachusetts, Washington DC and Hawaii had the lowest rates of uninsured adults, ranging from three to four percent on average.

In DC’s case, this could be because many residents work for the federal government, which guarantees access to insurance. And in Hawaii, the state’s Prepaid Health Care Act requires employers to provide insurance to all employees who work at least 20 hours per week.