Labor Minister Bill Shorten has admitted that having wealthy parents is “more important than ever” for young Australians after a baby boomer revealed he paid just $22,000 for his first home.

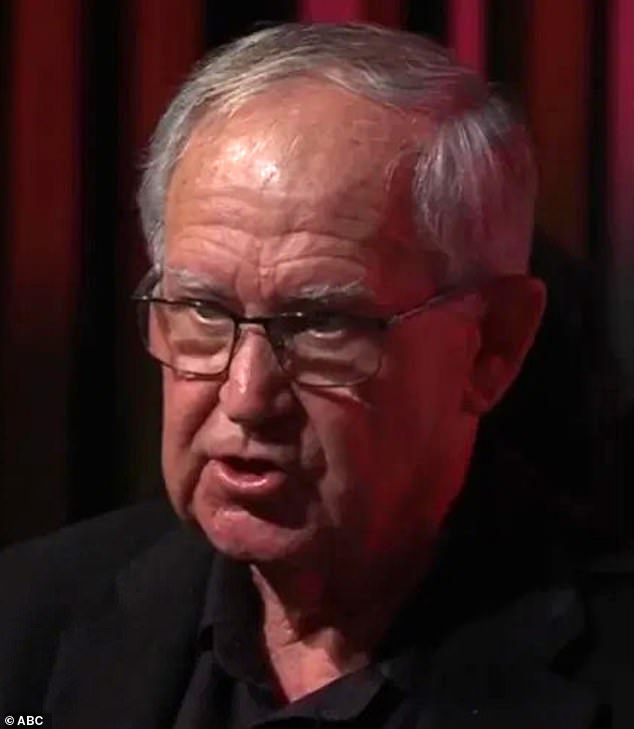

Self-funded retiree Phillip Irvine quizzed Shorten and independent senator Jacqui Lambie on how his grandchildren will be able to afford to buy a home during the ABC’s Q&A on Monday night.

Mr Irvine acknowledged that his generation had “won the lottery of life” by entering adulthood with an abundant job market and free higher education.

Mr Irvine said he was also able to buy his first property for $22,000 by “borrowing the entire land”.

“We had a good start in life. I have managed to give my children a good start in life as far as home ownership and everything else is concerned. For my grandchildren, the housing prices are unattainable,” he said.

Mr Irvine was painfully aware that his eight grandchildren were facing a very different reality from the one he had to face as a young adult.

He questioned how Mr Shorten and Ms Lambie planned to solve the “structural problems” that make home ownership impossible for many young Australians.

Australian house prices hit a new high in July, PropTrack reported, rising 6.28 percent compared to 12 months ago.

Phillip Irvine (pictured), a self-funded retiree, said he was able to buy his first property for $22,000

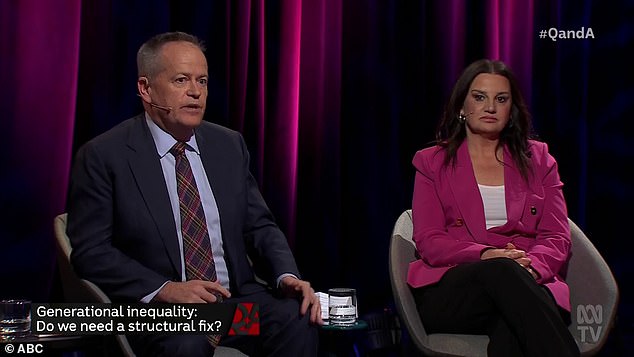

Mr Irvine quizzed NDIS Minister Bill Shorten (left) and independent Senator Jacqui Lambie (right) on how his grandchildren will ever be able to afford to buy a home.

The average house price in Sydney is now more than $1.1 million, $803,000 in Melbourne and $853,000 in Brisbane.

Shorten argued that there was no intergenerational inequality as long as young Australians had wealthy parents.

“If you have wealthy parents, if they have a big retirement account with millions of dollars and they have a couple of investment properties, then you don’t have an intergenerational gap,” he said.

‘Having wealthy parents has always been a kind of useful advantage in life, but I think it’s more important now than ever.’

He agreed that young adults are “bearing the brunt of this economy” as they suffer from slow real wage growth, a housing shortage and rising education rates.

“The way to do this is to offer free TAFE, reduce student debt, start investing in long-term jobs here in this country and get things done here,” Shorten said.

However, Lambie argued that both intergenerational and class inequality were worsening the financial situation of young Australians.

“The rich are getting richer and the poor are getting poorer,” he said.

‘You are paying more on your HECS debt than we are getting from royalties and gas from the gas cartels that you are giving back… You are paying the price instead of the people who should be paying it.’

Their solution was a temporary ban on foreign property purchases in Australia so that locals could “catch up” and “have a roof over their heads”.

Lambie also believed that the success of many Australians depended on “who mum and dad knew” rather than their grades.

Mr Irvine was concerned about how his eight grandchildren would be able to afford to buy property amid the housing shortage.

“Between getting your title and trying to buy a home, if you’re between 18 and 30, we wish you luck,” Lambie said.

‘My heart goes out to you because unless you have rich parents, you’ll never own a fucking house, let’s be honest.’

Shadow Finance Minister Senator Jane Hume, economist Joseph Stiglitz and Australian Financial Review editor-in-chief Michael Stutchbury also took part in Monday’s Q&A panel.

Hume called for “all levels of government” to find a solution to the housing shortage and improve homeownership affordability.