A pensioner has told how he is “scared of winter” because he cannot afford to turn on his heating, as Labour prepares to scrap winter fuel allowances for millions of people.

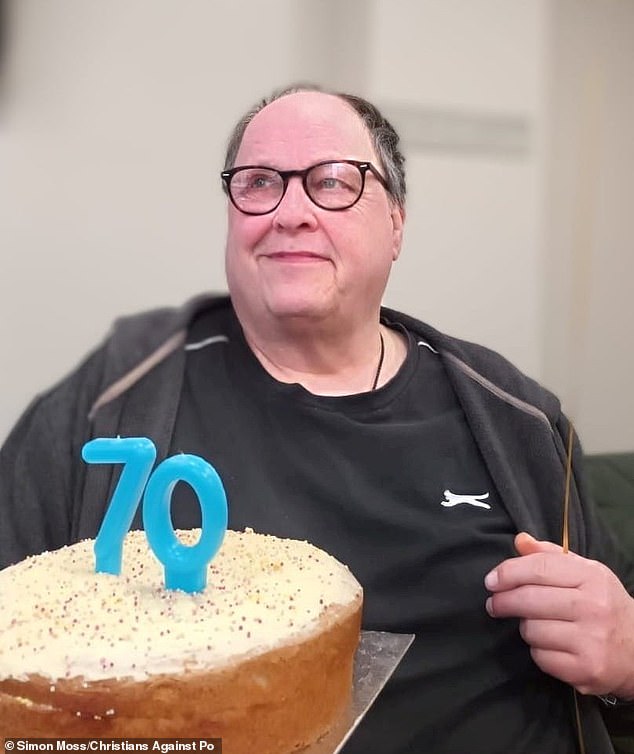

Simon Moss, a 70-year-old retired customer service assistant, faces a harsh winter in his cold bungalow in a homeowners association.

She now only goes shopping once a month, has given up smoking, drinking and holidays, as well as little luxuries like Sky TV, and has two children on Universal Credit who she tries to help as much as she can.

She is one of 11.8 million people in the UK who say they do not have enough to live on, according to a new report by Christians Against Poverty.

They say their clients are typically £273 a month short of what they need to cover basic needs such as food, energy bills and rent.

Mr Moss, from Sunderland, said: ‘Life is a struggle, I never go out and I hardly ever drink.

“I’m afraid of winter.”

Simon Moss, a 70-year-old retired customer service assistant, faces a harsh winter in his cold housing association bungalow.

She is one of 11.8 million people in the UK who say they do not have enough to live on, according to a new report by Christians Against Poverty.

Labour’s plans would see only pensioners on incomes low enough to qualify for pension credit receive winter fuel payments worth up to £300 this year, despite fears that many will be forced to choose between heating and food.

Deputy First Minister Angela Rayner said the Government would not “play fast and loose” with the country’s finances as she defended the decision to test the means available for pensioners’ winter fuel payments.

She told BBC Breakfast: ‘We need to make sure we can be fiscally responsible, so we can grow our economy, so we can pay for our public services.

“And we said this on the eve of the general election. What we didn’t realise was that the Conservatives had left the finances in complete chaos, and now we have to make difficult decisions.”

He said the government was taking steps to support pensioners, and the household support fund had been expanded to “help people who may not be entitled to pension credit, who are just above that threshold, and who may be struggling this winter”.

The triple-lock protection of state pensions, which looks set to lead to an above-inflation rise in line with average earnings, also gives “some protection”, he said.

He acknowledged that it was a “difficult choice” but it was due to the “difficult circumstances due to the previous government and what they did.”

This is of little comfort to Mr Moss, who a few years ago found himself in a difficult financial situation and sought help from Christians Against Poverty (CAP).

With the help of her CAP Debt Centre Manager, she was able to become debt free through a Debt Relief Order.

Mr Moss says his pension from various retail jobs plus his state pension only brings him close to the threshold for not receiving the winter fuel allowance.

The thought of enduring another winter like the last one but without any help from the government fills retirees with anxiety.

However, despite this relief, managing your finances remains a constant struggle.

Mr Moss says his pension from various retail jobs plus his state pension only brings him close to the threshold for not receiving the winter fuel benefit.

Her weekly income of £219 is not enough to cover all her expenses. She has had to make major changes to her previous lifestyle in order to stay afloat.

He said: ‘I’ve learned over the last few months to cancel everything I had. There’s no Sky TV, only Freeview, and I hardly ever go out or drink.

“I’ve had to quit smoking, which I think is a good thing.”

He added that he does not take vacations or indulge himself and that his existence consists of “living day to day.”

“It’s about constantly robbing Peter to pay Paul,” he said.

For Mr Moss, the thought of enduring another winter like the last one but without any help from the government fills him with anxiety.

‘Last year it was very cold. I didn’t turn on the heating unless it was absolutely necessary.

“I was barely using it and if we have a cold winter this year, I’m afraid.”

Her financial problems are compounded by the need to support her son and daughter-in-law, who are also receiving Universal Credit and not working.

Despite his limited means, he tries to help them whenever he can.

His own rent – after housing benefit – is £60 a week, and he has to be extremely careful with his food budget, shopping only once a month and sticking strictly to a shopping list.

He is particularly frustrated by the government’s withdrawal of support for pensioners, especially those on lower incomes.

He said: ‘I am not greedy, but I do think this withdrawal of support for pensioners is wrong.

“I feel like they don’t take us into account at all. They don’t care.”

To add to his stress, Mr Moss is currently embroiled in a dispute with the council over council tax payments as he has been struggling to keep up with direct debit payments.

He said: “I am one of millions of people who are ignored and forgotten every day in many local government and Westminster government decisions.”

CAP, which runs more than 200 debt centres across the UK and supports thousands of people every year, says almost 50 per cent of its clients are on a “deficit budget” – meaning their income prevents them from paying for essential items.

A spokesperson said: “We can see that chronically low incomes are devastating the lives of millions of people across the UK, damaging people’s wellbeing, affecting families and impacting health and wellbeing services.”

Christians Against Poverty chief executive Stewart McCulloch said: ‘This new report shows the brutal reality of living on a deficit budget.

‘Our expert debt counsellors, together with the local churches we partner with, continue to help thousands of people across the UK become debt free.

“It is absolutely unacceptable that 11 million people are living in hidden despair. We cannot afford the health and social care costs that this tragedy entails. We are all affected by the strains this places on our society. The time for action is now.”