- Real estate agents accused of colluding to artificially inflate commissions on properties

- The case facing the National Association of Realtors has inspired multiple copycat lawsuits

- Homeowners who sold properties in the last seven years may be eligible

A $418 million deal that will forever change the way Americans buy and sell homes has received preliminary approval from a federal judge.

U.S. District Judge Stephen R. Bough signed a settlement involving the National Association of Realtors (NAR) after it was accused of artificially inflating commissions by allowing brokers to collude in sales.

NAR was sued in a landmark case by home sellers in Missouri that paved the way for multiple pass-through lawsuits.

Homeowners who sold properties in the last seven years may now be eligible for a payment, although they must File a claim before May 9, 2025.

While Judge Bough approved the agreement, it is still subject to final court approval on November 22. This is largely considered a formality.

Michael Ketchmark (pictured) was lead counsel in the class action lawsuit filed against NAR in Missouri.

Agents in the United States charge home sellers an average commission of between 5 and 6 percent of the sales price of their property. This is more than double the average fees charged in the UK, according to investment bank Keefe, Bruyette & Woods.

The NAR, which has 1.5 million members, will begin implementing sweeping rule changes to the way its agents operate starting September 16.

The crux of the matter centered on the commissions that NAR agents earned on home sales.

Agents in the United States charge home sellers an average commission of between 5 and 6 percent of the sales price of their property, more than double the average fees charged in the United Kingdom, for example.

That commission is paid in full by the seller, but according to the standards specified by the NAR it is split in half between the two brokers.

The NAR is the largest trade association in the U.S. and only its paying members are allowed to call themselves “real estate agents.” They are also the only people with access to their proprietary database of properties available for sale.

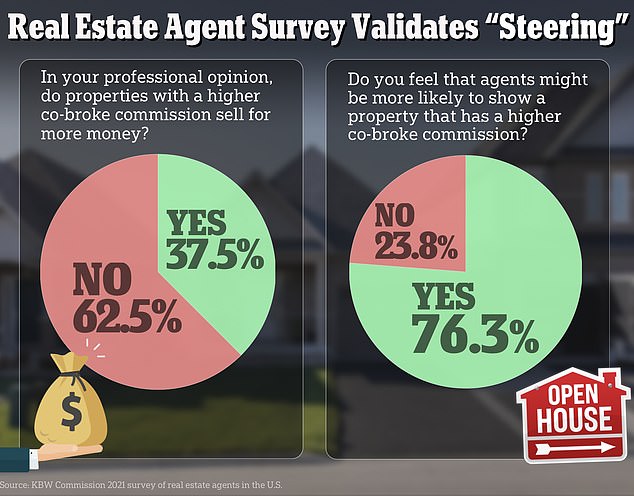

Those databases are called “multiple listing services” or MLS and require the seller’s agent to list the amount of commission their client pays. In theory, the system allows the buyer’s agent to “steer” buyers toward homes where the commission is higher so they can make more profits in the event of a sale.

According to a survey by consulting firm 1000watt, more than 76 percent of 640 real estate agents in the United States said buyers’ agents would be more likely to show a property if they knew the seller was paying a higher commission.

In turn, the seller’s agent can tell clients that if they don’t offer enough commission, buyers won’t see their home.

But under the new ruling, agents essentially won’t be able to make those commission offers.

The buyer’s agent can see which properties have the best sales commission and “guide” buyers to them. More than 76 percent of real estate agents said they would be more likely to have buyer’s agents show a property if the seller offered a higher commission.

Estate agent Desirae Wyckoff previously told DailyMail.com last year: ‘I feel like estate agents are getting an unfair reputation for this.

NAR spokesman Mantill Williams said of the preliminary approval: “It has always been NAR’s goal to resolve this litigation in a manner that preserves consumer choice and protects our members to the greatest extent possible.”

“There are strong grounds for the court to approve this settlement because it is in the best interest of all parties and class members.”

The decision was welcomed by attorney Michael Ketchmark, who represented the sellers in the lawsuit.

He said: ‘This is the first step to achieving the long-awaited change. Later this summer, NAR will begin changing the way homes are bought and sold in our country, eventually generating billions of dollars and savings for homeowners.’

Real estate agents have previously expressed concerns about how the litigation will affect their profits.

Desirae Wyckoff told DailyMail.com last year: ‘I feel like estate agents are getting an unfair reputation for this.

“I could see a lot of these people hanging up their license.”

The Justice Department also reopened its investigation into the NAR to examine broker commissions and how real estate listings are marketed.